How To Get Things Removed From Credit Report

If youve already paid the account however you dont have much-negotiating power. With pay for delete you can use money as the bargaining chip for getting negative information removed from your credit report.

:max_bytes(150000):strip_icc()/tactics-for-paying-off-debt-collections-960596-v3-5b8814c0c9e77c0025a6f156.png) Tactics For Paying Off Debt Collections

Tactics For Paying Off Debt Collections

Disputing can be done by phone online or by mail.

:max_bytes(150000):strip_icc()/how-can-i-remove-a-closed-account-from-my-credit-report-960399-FINAL-5b88130146e0fb0050feded0.png)

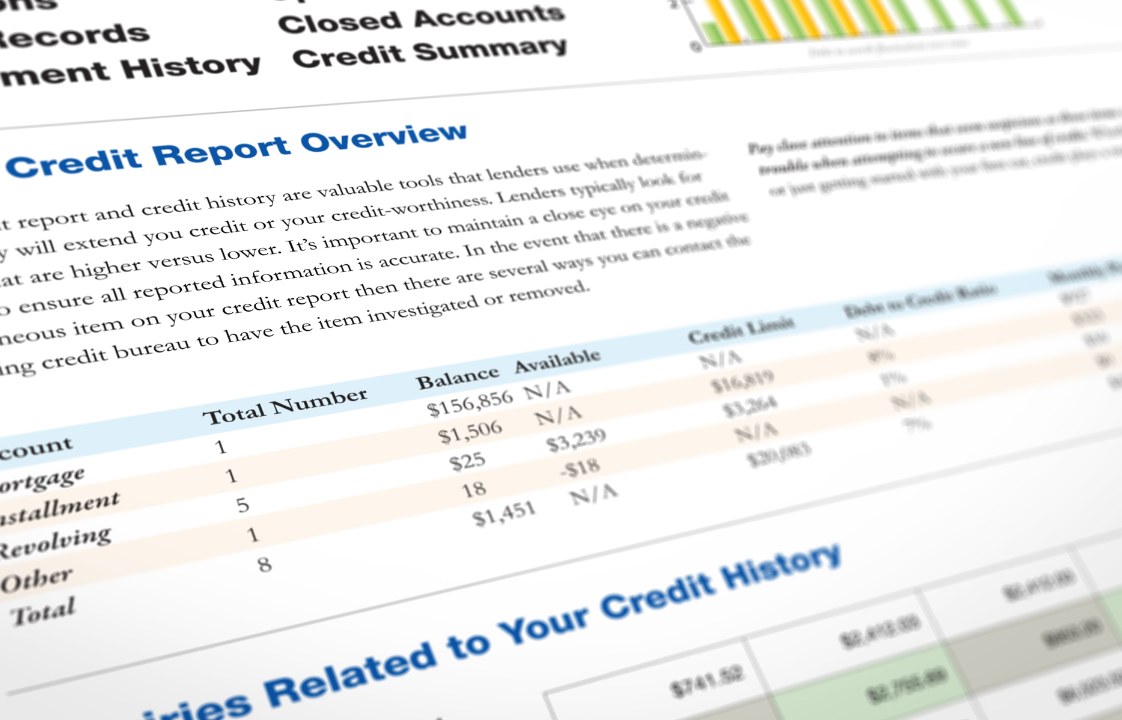

How to get things removed from credit report. 13 rijen Ways to Get Something Removed From Your Credit Report. Consider paying any unpaid collection accounts. A brief explanation of the financial hardship that led to your late payment.

Generally they have 30 days to investigate and get. If they cant verify their entries with the proper documentation when a dispute is filed which is not uncommon the negative item must be removed from your credit report. A request to remove the negative mark from your credit report.

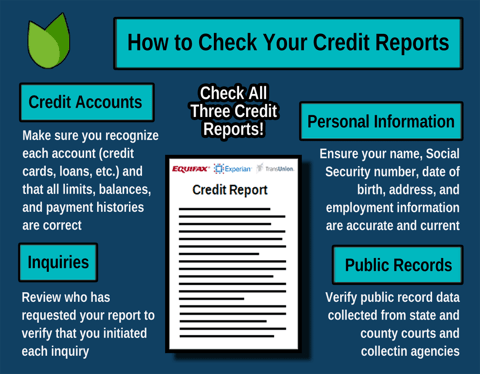

Make a goodwill deletion request. There are a few different strategies you can try to get the information removed though. Once you have your credit reports in hand or on-screen find the negative item youd like removed and check it out closely.

The steps to removing negative items from your credit report is simple. Ask the Collection Agency to Validate the Debt The Consumer Financial Protection Bureau CFPB regulates collection agencies and requires them to produce consumer requests to validate the debt be provided within 30 days. Below are working phone numbers to connect you to a live person with all three Credit Bureaus.

Once you have your credit report write down the accounts that you need to remove disputes from. In general the only details that can be removed from your credit report are those that are incorrect or erroneous. A pay for delete letter should include.

This is especially true if you have proof of the start of. How to Request Pay for Delete To ask for pay for delete youll need to send a written letter to the creditor or debt collection agency. Send a pay for delete letter.

But you can take steps immediately to start rebuilding your credit and reversing the damage those collections have done to your credit score. For this to work be prepared to negotiate with the creditor or collection agency over the phone. You will now need to call each Credit Bureau that lists dispute comments on your report.

6 Ways to Remove Collection Accounts from Your Credit Report 1. If a collector keeps a debt on your credit report longer than seven years you can dispute the debt and request it be removed. Tell them you need to remove dispute comments from all of the accounts on your report.

After this they are removed from your history. Before you get started note that if your. Your name and address.

You cant remove a legitimate enquiry from your credit report. Simply send them a letter with proof of delivery using the contact information found on your credit report. TransUnion Experian and Equifax provide you with a free credit report once a year.

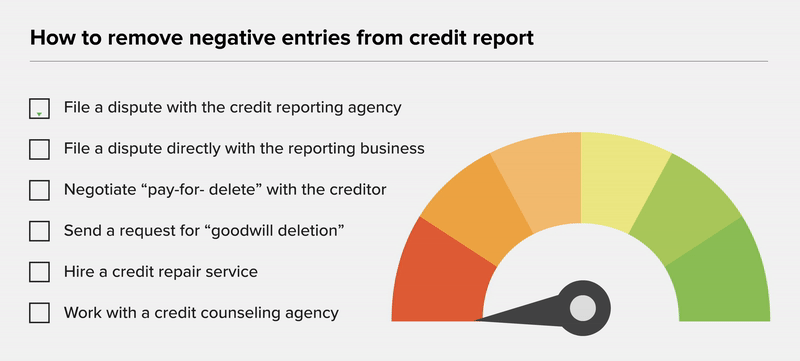

Ask the credit bureau to remove it from your credit report using a dispute letter. Youll want to contact the creditor directly either with a phone call or a letter. How To Remove Negative Items From Credit Report Yourself 1.

For this you will need a current copy of your credit report. If you have legitimate collection accounts on your credit reports theres nothing you can do to get them removed before their expiration dates. Dispute the Information With The Credit Bureau Initiate a claim directly with the credit bureau by writing a dispute letter.

If you have collection accounts or charge offs that you have not paid off you should try a pay-for-delete agreement to have the negative item removed from your credit report. In most cases you will have to wait until the five years has passed. When submitting your dispute you should give a clear and concise explanation of why you feel the information is incorrect so that Experian can communicate the issue effectively with the company reporting the account.

Get your free credit report from all 3 credit rating agencies Find the negative items you want to be removed Write a letter that includes the items you need removed. You can try requesting that a creditor remove negative reporting in return for full payment. Either way your request should include.

At this point you can ask for mercy by requesting a goodwill deletion. A brief rundown of your history with the creditor. Creditors are mandated by federal law the Fair Credit Reporting Act FCRA to report accurate information about each account.

/remove-negative-credit-report-960734_final-a6f5398d4fbf4f48a5b2fb8d6c1041eb.png) Strategies To Remove Negative Credit Report Entries

Strategies To Remove Negative Credit Report Entries

How To Remove Items From Your Credit Report Money

How To Remove Items From Your Credit Report Money

5 Ways To Legally Remove Items From Your Credit Report 2021 Badcredit Org

5 Ways To Legally Remove Items From Your Credit Report 2021 Badcredit Org

How To Remove Late Payments From Your Credit Report

How To Remove Late Payments From Your Credit Report

Removing Closed Accounts From Credit Report Bankrate

Removing Closed Accounts From Credit Report Bankrate

How To Improve Your Credit Score By 100 Points In 30 Days

How To Improve Your Credit Score By 100 Points In 30 Days

Stop Paid Tax Liens And Remove Expired Tax Liens From Your Personal C

Stop Paid Tax Liens And Remove Expired Tax Liens From Your Personal C

/remove-debt-collections-from-your-credit-report-960376_FINAL-5ae6517517024613885ec46df1e58ecd.png) Remove Debt Collections From Your Credit Report

Remove Debt Collections From Your Credit Report

:max_bytes(150000):strip_icc()/how-can-i-remove-a-closed-account-from-my-credit-report-960399-FINAL-5b88130146e0fb0050feded0.png) How To Get A Closed Account Off Your Credit Report

How To Get A Closed Account Off Your Credit Report

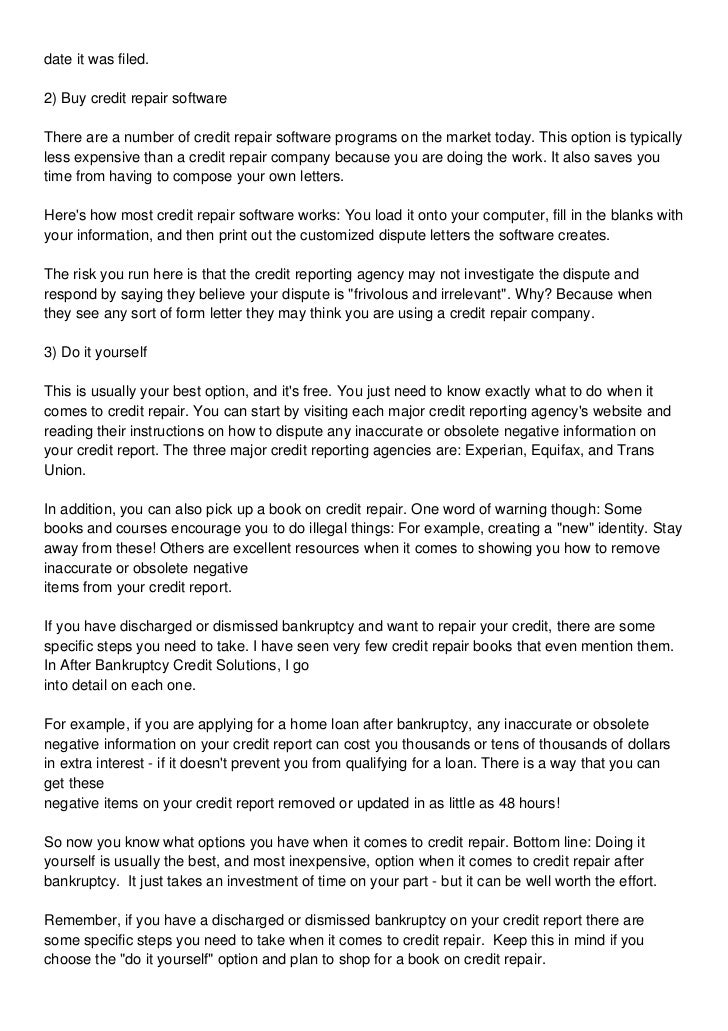

Credit Repair After Bankruptcy Your Options

Credit Repair After Bankruptcy Your Options

:max_bytes(150000):strip_icc()/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif) Strategies To Remove Negative Credit Report Entries

Strategies To Remove Negative Credit Report Entries

/sample-pay-for-delete-letter-f4e2fcf6c7064969b31571000058315a.png) Sample Pay For Delete Letter For Credit Report Cleanup

Sample Pay For Delete Letter For Credit Report Cleanup

How To Remove Negative Items From Your Credit Report Before 7 Years Badcredit Org

How To Remove Negative Items From Your Credit Report Before 7 Years Badcredit Org

How To Remove Negative Items On Your Credit Report

How To Remove Negative Items On Your Credit Report

Comments

Post a Comment