Irs Sole Proprietorship Ein

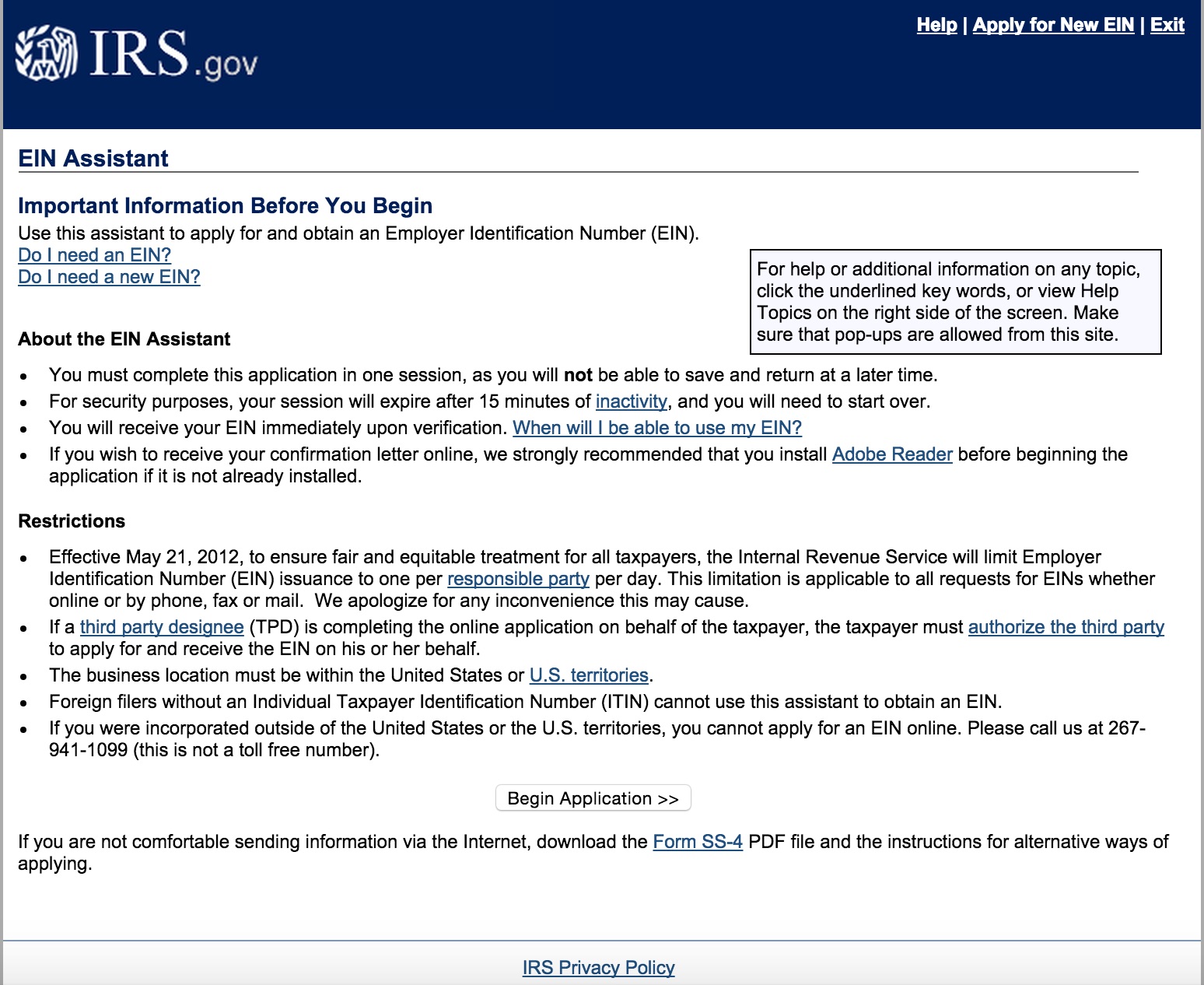

STEP 2 - COMPLETE THE FORM. Sole Proprietorships and Individuals starting your own business click here to file your online SS4 application for your federal IRS EIN TAX-ID number.

Ein Comprehensive Guide Freshbooks

Ein Comprehensive Guide Freshbooks

Many professionals and entrepreneurs run sole proprietorships such as independent bookkeepers and accountants.

Irs sole proprietorship ein. Sole Proprietor Individual A sole proprietor is one individual who owns a company that is not incorporated or. It is not necessary to obtain an EIN for. With little government regulation they are the simplest business to set up or take apart making them popular among individual self contractors or business owners.

We recommend employers download these publications from IRSgov. WHEN IS AN EIN REQUIRED FOR A SOLE PROPRIETORSHIP. Please complete the form on the left.

Sole Proprietor EIN Tax ID Application. Receive an Electronic Tax ID. We cannot process your application online if the responsible party is an entity with an EIN previously obtained through the Internet.

Please use one of our other methods to apply. You dont have to file paperwork in order to get it set up. Enter information for the Sole Proprietor Owner.

In this instance the sole proprietor uses his or her social security number instead of an EIN as the taxpayer identification number. This entity type is affordable and relatively easy to establish. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity.

A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN but can get one. Having access to a federal tax ID number is one of the most important parts of starting a new business. EIN assigned by IRS to sole proprietorship.

A Sole Proprietorshipis an unincorporated business with one owner who pays personal income tax on profits from the business. We are not affiliated with the Internal Revenue Service or any other federal or state organizations. However there are some times when a separate number is necessary.

A single-member LLC that is a disregarded entity thatdoes not have employees and does not have an excise tax liability does not need an EIN. You need to work to determine whether or not you require a sole proprietorship Tax ID EIN number and act accordingly based on the outcome of your choice. Apply for a Sole Proprietor Tax ID EIN Steps to Applying for a Sole Proprietorship Tax ID.

9 Zeilen A sole proprietor is someone who owns an unincorporated business by himself or. As you work through the form this box will assist you by describing the current field you are filling out. In a sole proprietorship one person is going to own and run the business and the income and expenses of that business will flow through the individual.

For income tax purposes an LLC with only one. Any tax consequences for the business will be the individuals own tax consequences. We do not provide legal financial or other professional advice.

It should use the name and TIN of the single member owner for federal tax purposes. In the vast majority of cases though a sole proprietorship will need a Tax iD EIN number. A sole proprietorship is a company that has a sole owner not registered with the state as a corporation or limited liability company.

In most cases a sole proprietor does not need to get an EIN. Read on to get a rundown of when having. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.

Please enter first name. However at any time the sole proprietor hires an employee or needs to file an excise or pension plan tax return the sole proprietor. We are not a law or an accountancy firm nor are we affiliated.

Its a very simple type of small business. Copies can be requested online search Forms and Publications or by calling 1-800-TAX-FORM. Sole Proprietors may or may not have employees.

SOLE PROPRIETOR TAX ID EIN APPLICATION. A Sole Proprietor is one individual who owns a company that is not incorporated or registered with the state as a Limited Liability Company LLC. Do I Need an EIN for a Sole Proprietorship.

In fact in some instances having a separate EIN for ones business may even be preferable. Yes if you have an existing Sole Proprietorship with an EIN with or without a DBA and you want to change your Sole Proprietorship to an LLC you will need a new EIN from the IRS. A Sole Proprietorship is the simplest and most common business type in existence today.

When you let us assist you with the process we can email this sensitive information. Per the IRS A sole proprietor without employees and who doesnt file any excise or pension plan tax returns doesnt need an EIN Once you hire employees or file excise or pension. Usually it is totally acceptable for a sole proprietor to use his or her social security number in the place of any other tax identification number.

When a designation has been confirmed business owners in need of a sole proprietorship tax ID can benefit from the simplified filing process we offer at IRS EIN Tax ID Filing Service.

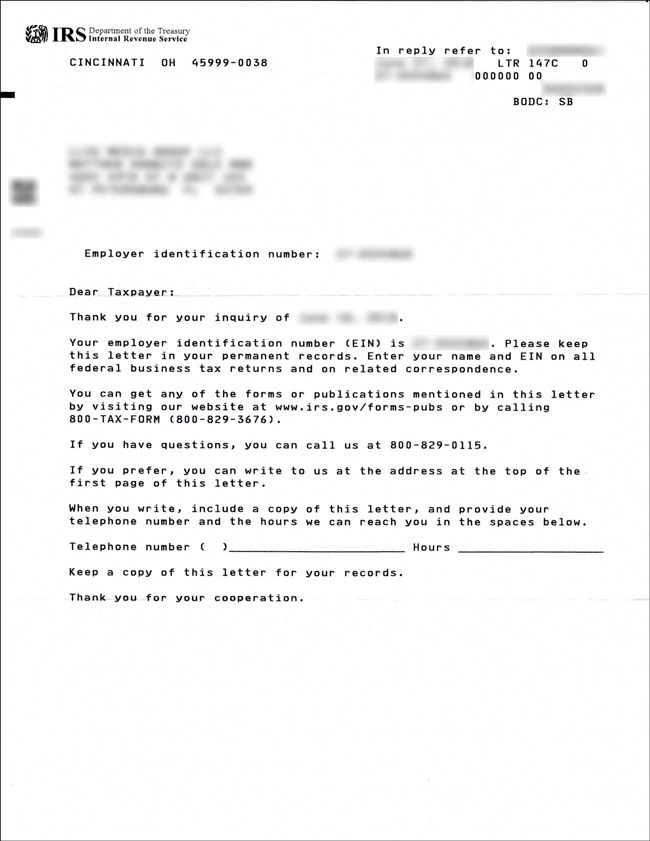

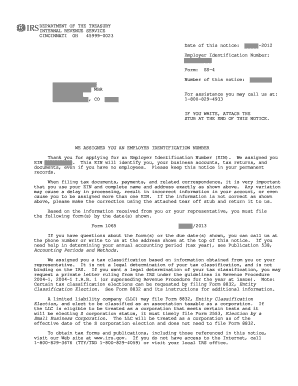

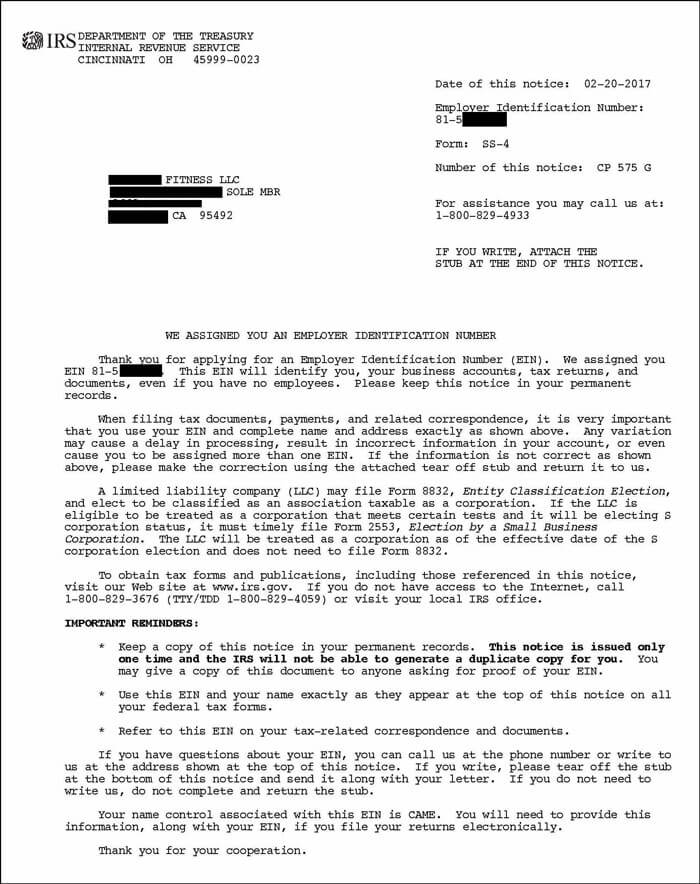

How To Get Copy Of Ein Verification Letter 147c From The Irs

How To Get Copy Of Ein Verification Letter 147c From The Irs

How To Get Copy Of Ein Verification Letter 147c From The Irs

How To Get Copy Of Ein Verification Letter 147c From The Irs

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Comprehensive Guide Freshbooks

Ein Comprehensive Guide Freshbooks

How To Fill Out A W9 As A Single Member Llc Should You Use Ein Or Ssn Your Freelancer Friend

How To Fill Out A W9 As A Single Member Llc Should You Use Ein Or Ssn Your Freelancer Friend

Ein Employer Identification Numbe Tax Usa Inc

Ein Employer Identification Numbe Tax Usa Inc

How To Get An Ein For A Pennsylvania Llc Step By Step Llc University

How To Get An Ein For A Pennsylvania Llc Step By Step Llc University

How To Apply For An Employer Tax Identification Number Ein Start Your Small Business Today

How To Apply For An Employer Tax Identification Number Ein Start Your Small Business Today

Get An Irs Ein Number The Definitive Step By Step Guide

Get An Irs Ein Number The Definitive Step By Step Guide

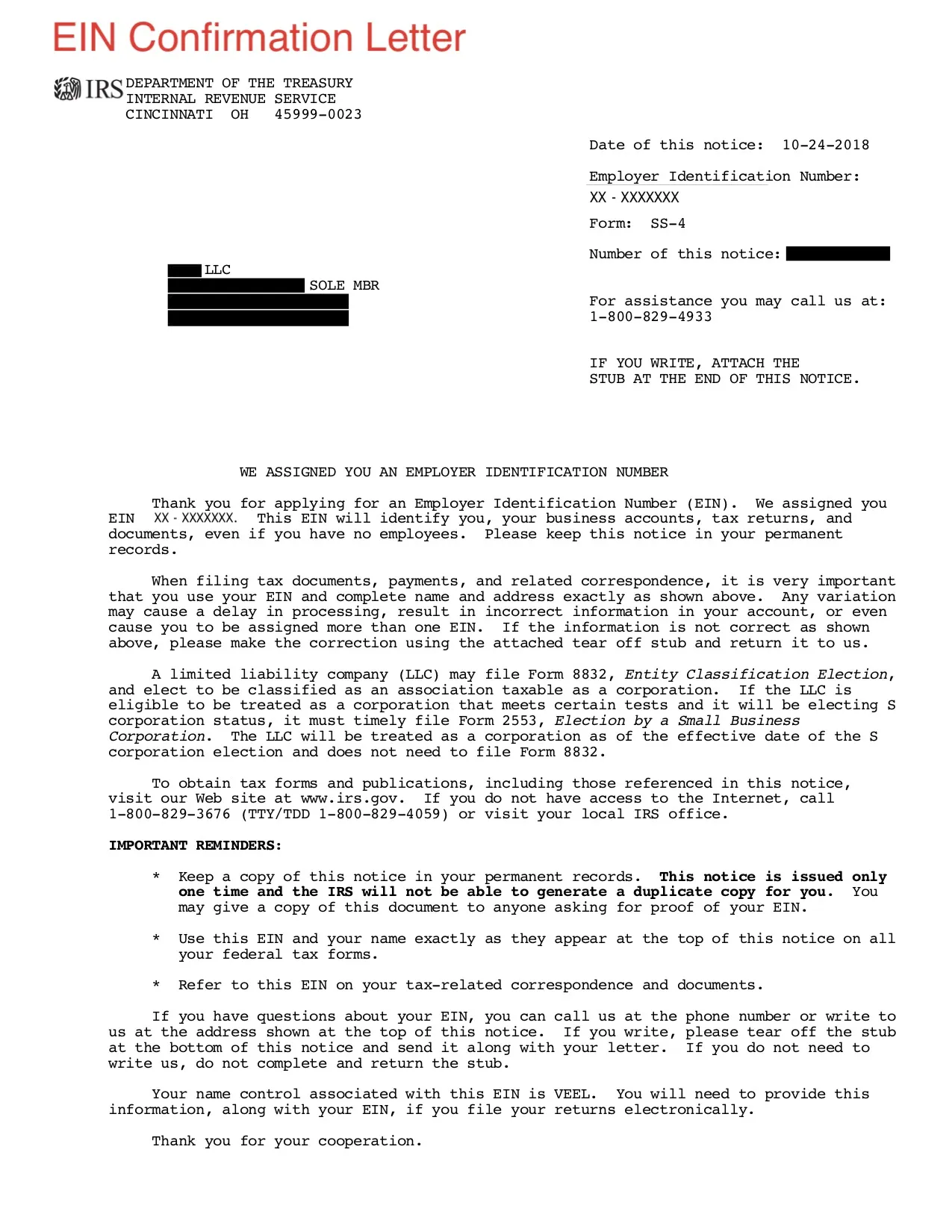

Ein Letter Sample Fill Out And Sign Printable Pdf Template Signnow

Ein Letter Sample Fill Out And Sign Printable Pdf Template Signnow

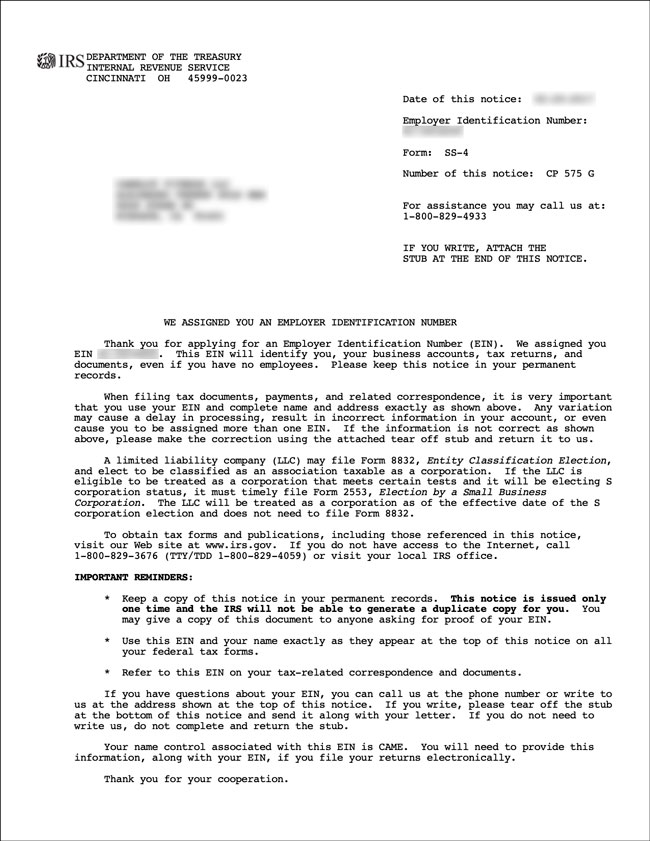

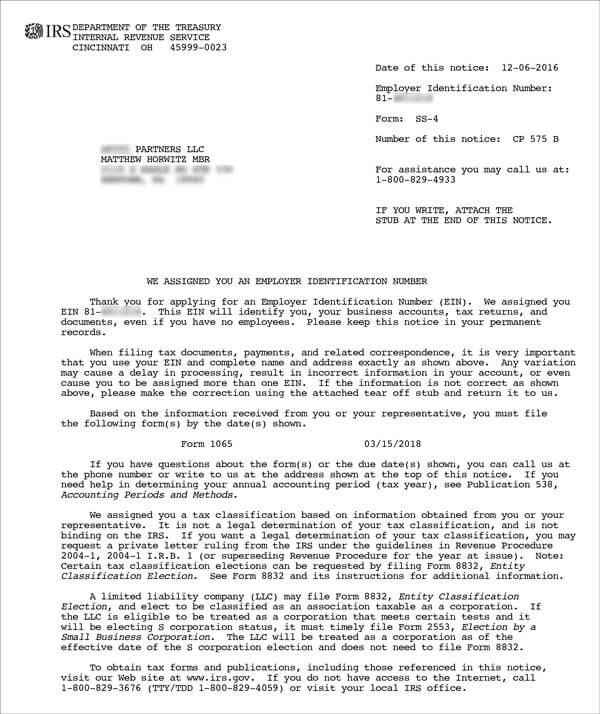

Ss4 Ein Registration Letter Asap Help Center

Ss4 Ein Registration Letter Asap Help Center

Ein Comprehensive Guide Freshbooks

Ein Comprehensive Guide Freshbooks

How To Apply For An Ein For Your Llc Online Step By Step Llc University

How To Apply For An Ein For Your Llc Online Step By Step Llc University

:max_bytes(150000):strip_icc()/Screenshot62-e3afffa8797d42978c248dc79434215c.png)

Comments

Post a Comment