Can You Claim A New Car On Your Taxes

If you moved more than 50 miles to take your first job you can deduct the cost to get you and your stuff to your new location. So during the lease term youre essentially paying the cost of that depreciation plus charges fees and yes taxes.

/car-salesman-and-female-customer-in-driver-s-seat-of-new-car-in-car-dealership-showroom-922707694-f707b8227b334aaaa0ac55e90d4ec89f.jpg) The Personal Property Tax Deduction And What Can Be Claimed

The Personal Property Tax Deduction And What Can Be Claimed

Whether you have good credit bad credit or no credit if you have equity in your house you can turn the interest you pay on your car loan into a tax-deductible expense.

Can you claim a new car on your taxes. While the deductibility of sales. With the large cash outlay that you make in buying a new vehicle do not overlook the potential for the purchase to save you money on your federal income taxes. You would claim the writeoff for that portion of your cars license or registration fee on line 7 of the Schedule A form according to the IRS 2013 tax year instructions for that form.

You can use your actual expenses which include parking fees and tolls vehicle registration fees personal property tax on the vehicle lease and rental expenses insurance fuel and gasoline repairs including oil changes tires and other routine maintenance and depreciation. You can claim the credit right on your Form 1040 the main tax form but you also need to complete Schedule EIC if you. If youre self-employed and purchase a vehicle exclusively for business reasons you may be able to write off some of the costs.

A partnermember who has unreimbursed auto expenses as a requirement of the partnershipLLC agreement can typically claim the deduction on Schedule E of Form 1040 rather than on Schedule A. You can deduct sales tax on a vehicle purchase but only the state and local sales tax. To claim sales taxes on a vehicle or boat you need to meet two criteria.

While your personal car isnt eligible to be a tax-deductible expense there is a way to claim the interest on your car loan as a tax-deductible expense. The deduction is based on the portion of mileage used for business. Its name could vary depending on where you live but if you pay a tax that is tied to your cars market value you can usually deduct it if you itemize deductions.

You cant claim the whole 175. Some employees may still deduct unreimbursed travel expenses though. You can deduct the cost of damage or loss to a car resulting from the event.

You have to select one option because you cant take both. There are two methods for figuring car expenses. However not every property loss resulting from an accident is tax deductible.

An employee cant claim a car-related deduction even if their employer does not reimburse costs tied to the use of their car for work. Also only vehicle sales taxes of. You can deduct sales tax on a new or used purchased or leased vehicle or boat but if you live in a state with a state income tax it probably isnt to your advantage to do so.

Taxpayers must become familiar with the deductions requirements before preparing a tax return. Only the portion of the registration fee thats based on the value of your vehicle is deductible for federal tax purposes. This rule applies if youre a sole proprietor and use your car for business and personal reasons.

If you finance a car or buy one you cannot deduct your monthly expenses on your taxes. For 2020 taxes the EITC ranges from a maximum of 538 for taxpayers with no children to a maximum of 6660 for taxpayers with three or more children. There is a general sales tax deduction available if you itemize your deductions.

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. Do not forget however that there may be an advantage to claiming sales taxes in the current year rather than income taxes. The rules are the same as an S Corporation with one exception.

And you get this tax break even if you claim the standard deductionas most taxpayers dorather than itemizing deductions on your tax return. New cars are generally depreciating assets so the leasing company that owns the car can reasonably expect the vehicle will be worth less at the end of your lease than it was when you started. You will have to choose between taking a deduction for sales tax or for your state and local income tax.

You can write off sales taxes paid on the new car or the income taxes paid for the year with a Schedule A form an income tax form that you use to report your tax-deductible expenses. These include military reservists certain entertainers and some state and local government officials. So if the total of your state and local taxes exceeds 10000 without the sales taxes on your new vehicle then there will be no benefit to you from the deduction even though you may be entitled to claim it.

Taxpayers who acquired a brand new vehicle for personal use may qualify for a tax deduction if they purchased any of the following. Your total registration fee might be 175 but your actual tax deduction is limited to 60 if that includes 2 for each 1000 of value and your car is worth 30000 or 2 times 30. You have two options for deducting car and truck expenses.

The write-offs include 165 cents per mile for driving your own car and any parking fees or tolls. If a taxpayer uses the car for both business and personal purposes the expenses must be split. The Schedule A form also has other write-offs for your tag registration property tax.

You can deduct the sales tax you pay on a new vehicle if you buy it between February 17 and December 31 2009. A passenger car light truck or motorcycle as long as it weighs 8500 pounds or less. Deducting Your Actual Expenses.

You can take this write off even when you dont itemize.

/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png) The Rules For Claiming A Property Tax Deduction

The Rules For Claiming A Property Tax Deduction

How To Get A Tax Benefit For Buying A New Car Axis Bank

How To Get A Tax Benefit For Buying A New Car Axis Bank

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

What Are Tax Deductible Car Expenses Gofar

What Are Tax Deductible Car Expenses Gofar

Can I Deduct Sales Tax On A Car Purchase

Can I Deduct Sales Tax On A Car Purchase

Is Buying A Car Tax Deductible 2020

Is Buying A Car Tax Deductible 2020

Vehicle Sales Tax Deduction H R Block

Vehicle Sales Tax Deduction H R Block

_(1).jpg) Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

Everything You Need To Know About Claiming A Mileage Tax Deduction Taxes Us News

Everything You Need To Know About Claiming A Mileage Tax Deduction Taxes Us News

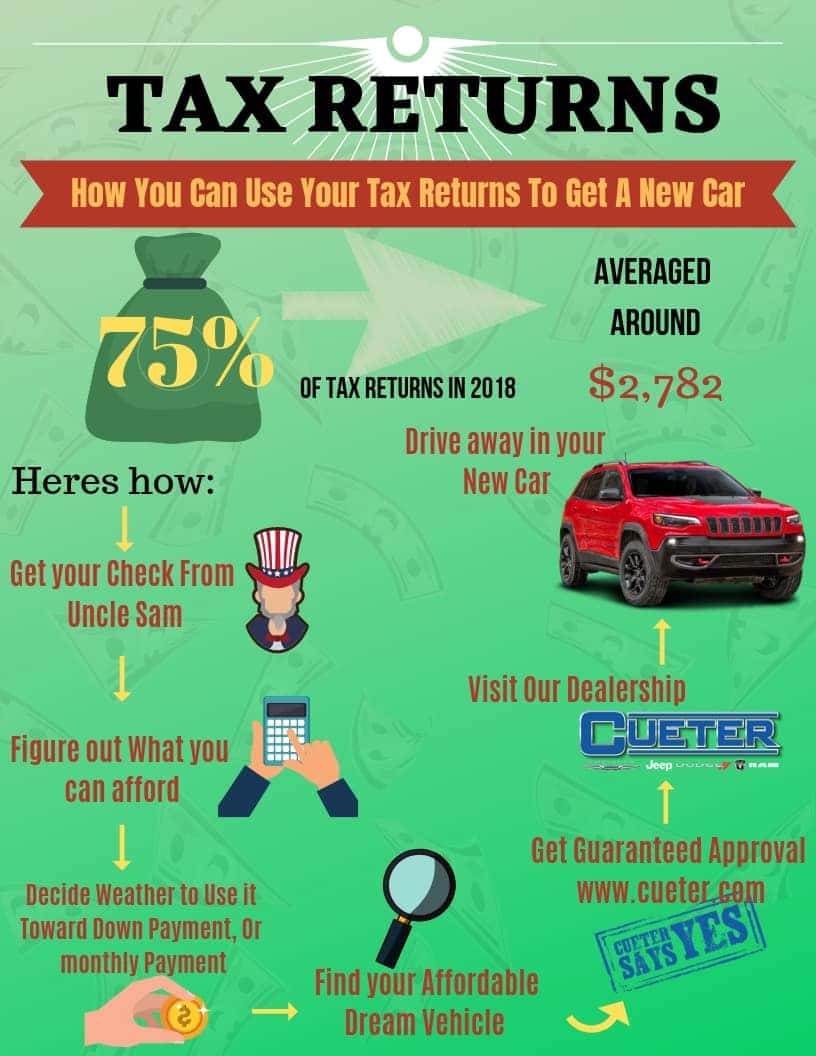

Use Your Tax Return To Buy A New Car Regardless Of Credit

Use Your Tax Return To Buy A New Car Regardless Of Credit

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Comments

Post a Comment