Betting Against A Stock

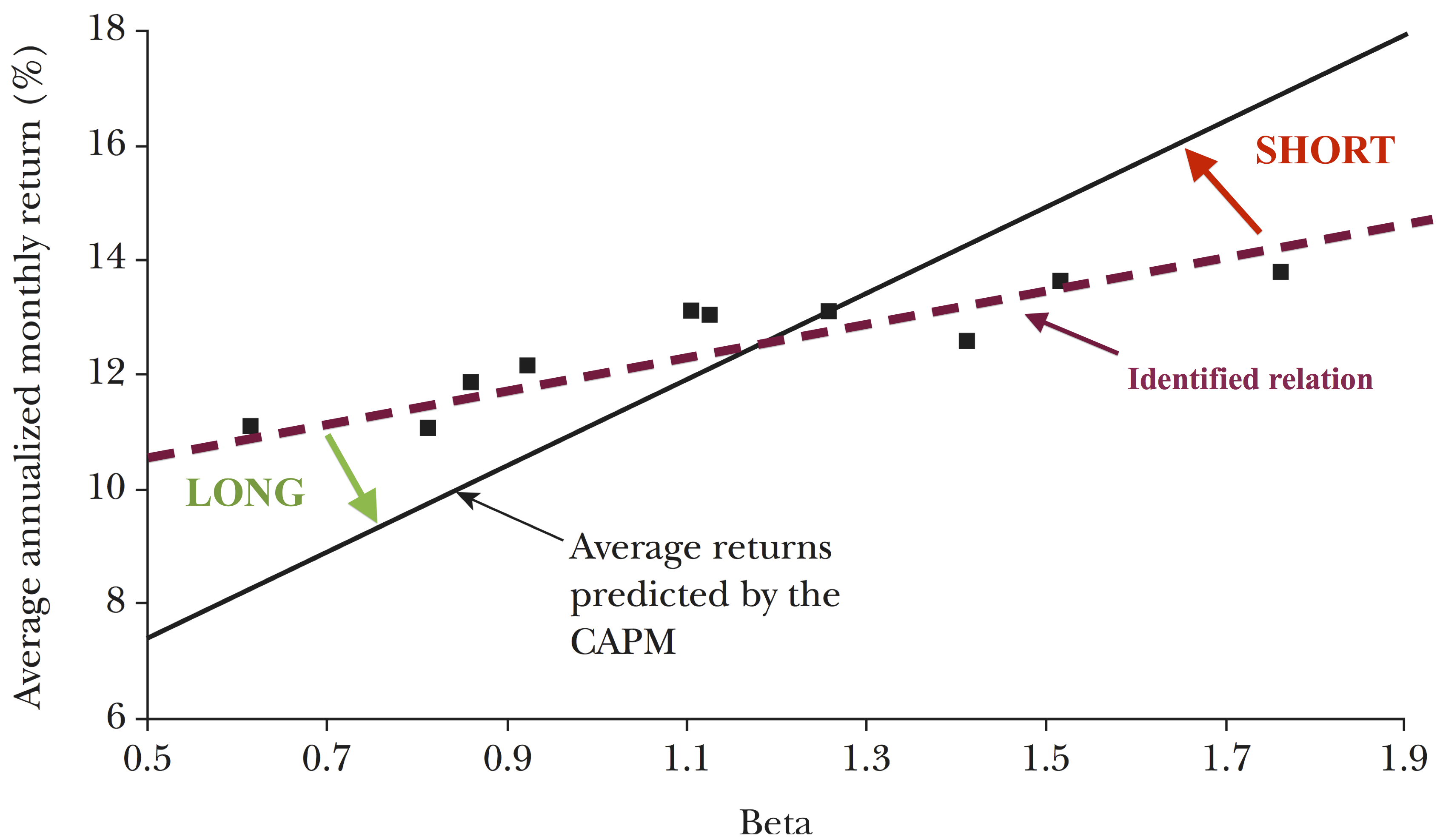

2 A betting against beta BAB factor which is long leveraged low-beta assets and short high-beta assets produces significant positive risk-adjusted returns. When you sell calls you sell the stock on a predetermined fixed price irrespective of the price action.

How Does Short Selling A Stock Work Money Badger

How Does Short Selling A Stock Work Money Badger

Instead youre borrowing shares to sell them.

Betting against a stock. Unloved companies could deliver higher returns like sin stock portfolios. Put options are a little different than stocks and options trading is the next skill to. You can trade blue-chip stocks like Microsoft and Starbucks or you can bet on penny stocks to profit from their volatility.

In this video you will learn about three ways that you can bet on a stock going down in value. Before you open a trade know when you are going to close it. How to Bet Against the Stock Market Going Down Buy A Put Option on SPY or DIA.

It is a riskier version of buying puts. This is actually possible by betting against stocks. Inverse ETFs are the best.

Spread betting is a derivative strategy in which participants do not own the underlying asset they bet on such as a stock or commodity. 4 Increased funding liquidity risk compresses betas toward one. The three common ways to bet against stocks are to short a stock buy puts and sell a covered call if you already own 100 shares of the stock.

That process is known as shorting stock and is a way to bet against a companys stock. What is the best ETF to short the market. Stocks Betting on stocks is the easiest and best-known way to get in on the action of the markets.

Though please not that these techniques are highly risky. However selling cuts doesnt give. Since the stock you sold is borrowed you promise to buy the stock later to in order to repay your debt.

Rather spread bettors simply. Robin Wigglesworth Add to myFT. Typically mirroring the markets short interest buying the stocks that others like and betting against the ones they dislike generates extra return the researchers found.

Short selling is a risky investment strategy but its proven profitable for those with the appetite. If you sell during a bear market you will gain. To review buying a put option gives you the right to sell a given stock at a certain price by a.

To bet against Alphabet stock for example you would short Alphabet at. Short-selling is the easiest way to make a negative bet on a stock. Let me put it to you this way The simplest way to bet against a stock is to buy put options.

Betting against the market thus means hoping for a drop thats likely to be temporary. Keep at it for a year experiementing with shorting stock and eventually options. Selling calls is another great way to bet against the stock market and profit during a price decline.

Time works against you and holding onto a short position as. If the stock went down you may have sold it for 20 and bought it back for 15. Betting against the stock market means taking advantage of the fall in the value of the stocks which is very common due to the high volatility of the share market.

Its the logical opposite of buying low and selling high in the traditional order. The phrase bet against beta was coined from a few economics papers written by the. But trade with discipline.

Khan Academy probably has the best video tutorial on shorting stock. 3 When funding constraints tighten the return of the BAB factor is low. Beta is a statistical measure of the risk of an individual stock or portfolio against the market as a whole.

If you sell during a bull market might lose. ESG rush opens opportunities for betting against the angels. You can also bet on stock indices like the Dow Jones Industrial Average or the NASDAQ.

Betting Against the Market by Selling Calls.

How To Bet Against A Stock Short Selling Explained

How To Bet Against A Stock Short Selling Explained

How To Bet Against A Stock Short Selling Explained

How To Bet Against A Stock Short Selling Explained

How To Bet Against A Stock Short Selling Explained

How To Bet Against A Stock Short Selling Explained

Betting Against Beta Factor In Stocks Quantpedia

Betting Against Beta Factor In Stocks Quantpedia

Beware Betting Against Short Sellers Wsj

Beware Betting Against Short Sellers Wsj

Buying Puts How To Bet Against The Market

Buying Puts How To Bet Against The Market

Should You Bet Against A Stock At Some Point By Marc Guberti The Capital Medium

Should You Bet Against A Stock At Some Point By Marc Guberti The Capital Medium

Betting Against This Stock Market Bounce Is A Fool S Errand For Now

Betting Against This Stock Market Bounce Is A Fool S Errand For Now

Betting Against Beta Seeking Alpha

Betting Against Beta Seeking Alpha

How To Bet Against A Stock Short Selling Explained

How To Bet Against A Stock Short Selling Explained

When Many Traders Are Betting Against A Stock It Could Be Time To Buy Morgan Stanley Says

When Many Traders Are Betting Against A Stock It Could Be Time To Buy Morgan Stanley Says

How To Bet Against A Stock Short Selling Explained

How To Bet Against A Stock Short Selling Explained

Buying Puts How To Bet Against The Market

Buying Puts How To Bet Against The Market

How To Bet Against The Crashing Stock Market Coinnewsspan

How To Bet Against The Crashing Stock Market Coinnewsspan

Comments

Post a Comment