Traditional Savings Account Is It Fdic Insured

Compare different terms and conditions including yield rates to find an online bank that meets your savings account. Contents of safe deposit boxes.

What Is Fdic Insurance The Simple Dollar

What Is Fdic Insurance The Simple Dollar

Insured accounts include negotiable orders of withdrawal NOW money market deposit accounts MMDA checking and savings accounts.

Traditional savings account is it fdic insured. The FDIC is a federally backed deposit insurance agency where. No FDIC deposit insurance coverage depends on whether your chosen financial product is a deposit product. NOT Insured by FDIC.

Certificates of deposit CDs Annuities. You are probably familiar with the traditional types of bank accounts - checking savings and certificates of deposit CDs - that are insured by the FDIC. Banks have traditionally offered consumers deposit products such as checking savings and money market deposit accounts and certificates of deposit CDs for which each depositor is insured by the FDIC up to at least 250000.

To learn more refer to httpswwwfdicgovconsumersconsumernewsseptember2018pdf. Because linking accounts is simple to do an easy way to maximize both insurance amounts is to hold cash deposits in a CD or savings account with Bank of America while keeping securities in a Merrill Edge account. Even if your bank is FDIC insured be sure to take your own steps to protect your accounts.

Online banks are FDIC insured and so your money is as safe in those banks as they would be in a traditional bank. Money market accounts MMAs Bonds. Even when it is insured take proactive measures to safeguard your financial information.

Coverage is automatic whenever a deposit account is opened at an FDIC-insured bank or financial institution. Negotiable orders of withdrawal NOW Treasury or municipal securities. The FDIC does not insure all accounts.

Savings accounts in general require the owner of the account to manually deposit or withdraw funds from the account. Merrills membership in the SIPC provides a total insurance protection of 500000 per account. A traditional bank savings account is a great place to put money aside for special occasions as they allow you to withdraw funds easily and earn some interest.

FDIC insurance is the standard deposit insurance offered at most traditional banks for things like checking and savings accounts If your bank has FDIC insurance the standard insurance amount is 250000 per depositor per insured bank for each account ownership category. The Federal Deposit Insurance Corporation FDIC is. Insured by FDIC.

Additionally If you are interested be sure to check out our list of bank bonuses saving rates and CD rates. The FDIC covers the traditional types of bank deposit accounts including checking and savings accounts money market deposit accounts MMDAs and certificates of deposit CDs. Most online savings accounts are FDIC insured but it always helps to make sure.

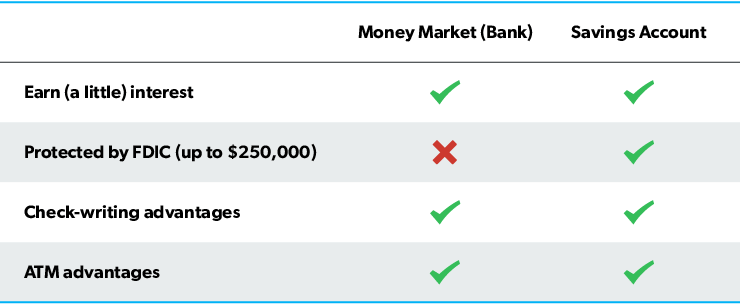

September 9 2020 FDIC insurance covers traditional deposit accounts and depositors do not need to apply for FDIC insurance. The Risks of Money Market vs Savings When you deposit money into your savings account you are guaranteed to be able to withdraw the amount you deposited plus interest earned on your principal at any time. Banks also may offer what is called a money market deposit account which earns interest at a rate set by the bank and usually limits the customer to a certain number of transactions within a stated time period.

An FDIC insured account is a bank account at an institution where deposits are federally protected against bank failure or theft. Your funds are protected up to 250000 by the FDIC. Insurance coverage is instead determined based on ownership with each person typically being allowed to have 250000 USD worth of coverage across all individual accounts at one bank regardless of whether they are savings checking or otherwise.

All self-directed retirement funds owned by the same person in the same FDIC-insured bank are combined and insured up to 250000. As far as the FDIC is concerned a checking account and a savings account are functionally identical. When you open a deposit account such as a savings or checking account you may see a notice stating the account is FDIC-insured.

Most online savings accounts are FDIC insured but always confirm before you open an account. Online savings accounts can provide several advantages over traditional savings accounts. If the bank fails the FDIC will get you your money back.

Money Market Accounts Vs Savings Accounts Ally

Money Market Accounts Vs Savings Accounts Ally

Find Out What A Health Savings Account Can

Find Out What A Health Savings Account Can

Compare Checking Savings And Money Market Accounts Ally

Compare Checking Savings And Money Market Accounts Ally

Money Market Vs Savings Which Account Is Right For You Investinganswers

Money Market Vs Savings Which Account Is Right For You Investinganswers

Online Savings Account How Do High Yield Savings Accounts Work How Information Center

3 Types Of Savings Accounts And How They Work Padsplit Blog

3 Types Of Savings Accounts And How They Work Padsplit Blog

This Crypto Startup Is Offering 8 6 Interest On Savings Accounts 123 Times The National Average Pressboltnews

Money Market Vs Savings Which Account Should I Choose Ramseysolutions Com

Money Market Vs Savings Which Account Should I Choose Ramseysolutions Com

Four Reasons To Open A Savings Account Discover

Four Reasons To Open A Savings Account Discover

Are Online Savings Accounts Fdic Insured

Are Online Savings Accounts Fdic Insured

Money Market Vs Savings Account Which One Should You Use

Money Market Vs Savings Account Which One Should You Use

This Crypto Startup Is Offering 8 6 Interest On Savings Accounts 123 Times The National Average Pressboltnews

:max_bytes(150000):strip_icc()/savings-accounts-4073268-FINAL-a1e0d68405b1455887d18059c7a14400.png)

Comments

Post a Comment