What Is The Current Income Tax Rate

Income tax rates are the percentages of tax that you must pay. Money from renting out property.

How Do Marginal Income Tax Rates Work And What If We Increased Them

How Do Marginal Income Tax Rates Work And What If We Increased Them

Then there is a 42 step tax for income between 254500kr and 639750kr.

What is the current income tax rate. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 518400 and higher for single filers and 622050 and higher for married couples filing jointly. The rates are either 8 or 9 depending on the federal state where the individual resides. Interest from a bank account or investment.

Your income could include. 7 8 The TCJA more or less doubled the estate tax exemption in 2018. As of 2020 only estates valued at more than 1158 million are subject to the estate tax up from 114 million in 2019 1118 million in 2018 and 549 million in 2017.

This is a progressive tax rate based on four levels as follows. The rates are based on your total income for the tax year. 29467 plus 37c for each 1 over 120000.

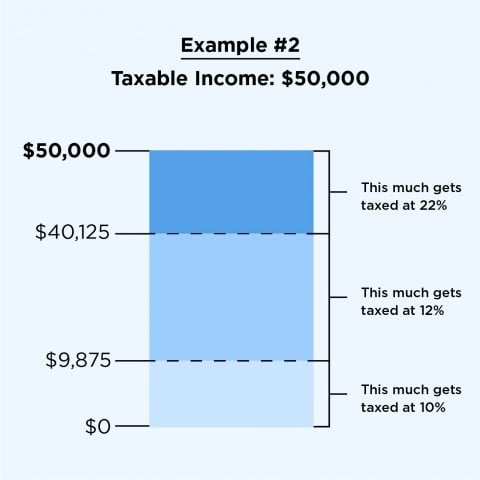

Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37. The basic rate payable in England Wales and Northern Ireland is 20 on taxable income up to 50000. Effective July 1 2017.

495 percent of net income. The tax rate increases very progressively rapidly at 13 keyear from 25 to 48 and at 29 keyear to 55 and eventually reaches 67 at 83 keyear while little decreases at 127 keyear to 65. 19 step tax is owed on your personal income between 180000kr and 254500kr.

51667 plus 45c for each 1 over 180000. The total Finnish income tax includes the income tax dependable on the net salary employee unemployment payment and employer unemployment payment. That means you could pay up to 37 income tax depending on your federal income tax bracket.

Tax Types Current Tax Rates Prior Year Rates. In 2020 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. For the first 180800kr of your personal income you will not pay any step tax.

Federal Income Tax Brackets for 2020. Prior to the Tax Cuts. IIT prior year rates.

Trumps tax overhaul in 2017. Effective July 1 2017. A Work and Income benefit.

Corporations 7 percent of net income. 19c for each 1 over 18200. Federal tax rates for 2021 15 on the first 49020 of taxable income plus 205 on the next 49020 of taxable income on the portion of taxable income over 49020 up to 98040 plus 26 on the next 53939 of taxable income on the portion of taxable income over 98040 up to 151978 plus.

52 Zeilen Currently the federal corporate tax rate is set at 21. Personal Property Replacement Tax. Trusts and estates 495 percent of net income.

BIT prior year rates. Income thresholds Rate Tax payable on this income. Biden will also propose raising the top marginal income tax rate to 396 percent from 37 percent the level it was cut to by President Donald J.

5092 plus 325c for each 1 over 45000.

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

Why A Roth Ira Or 401k Might Not Be A Good Idea If Tax Rates Increase Cbs News

Current Income Tax Rates For Fy 2019 20 Ay 2020 21 Sag Infotech

Current Income Tax Rates For Fy 2019 20 Ay 2020 21 Sag Infotech

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

Current Flat Taxes Rates In Percent 1 Personal Income Tax Rates Download Table

Current Flat Taxes Rates In Percent 1 Personal Income Tax Rates Download Table

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

The Tax Burden Across Varying Income Percentiles Mercatus Center

The Tax Burden Across Varying Income Percentiles Mercatus Center

How To Evaluate Your Current Vs Future Marginal Tax Rate

How To Evaluate Your Current Vs Future Marginal Tax Rate

How Federal Income Tax Rates Work Full Report Tax Policy Center

How Federal Income Tax Rates Work Full Report Tax Policy Center

Current Income Tax Rate Page 1 Line 17qq Com

Current Income Tax Rate Page 1 Line 17qq Com

Comments

Post a Comment