Is 3.5 A Good Mortgage Rate

Well for starters the FHA 35 down payment requirement is higher than the 3 requirement for the conventional. I said that todays roughly 35 mortgage rates are going to look silly someday so not all of the low interest rate policies have hurt savers that can take advantage.

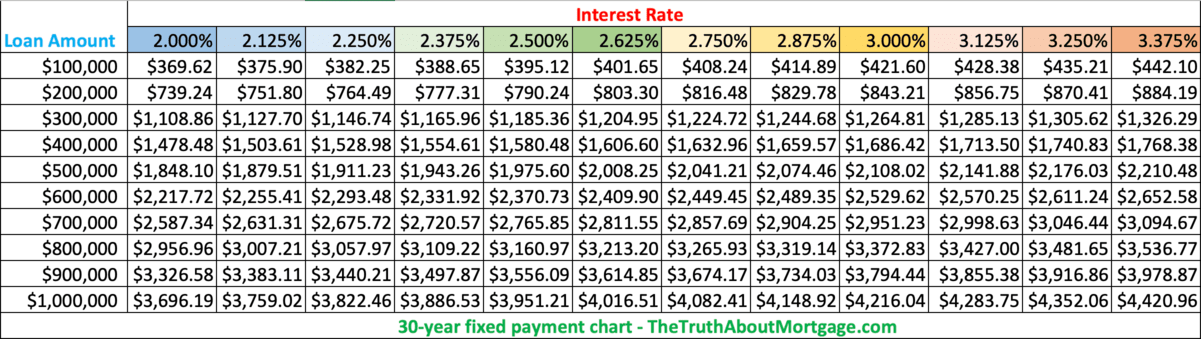

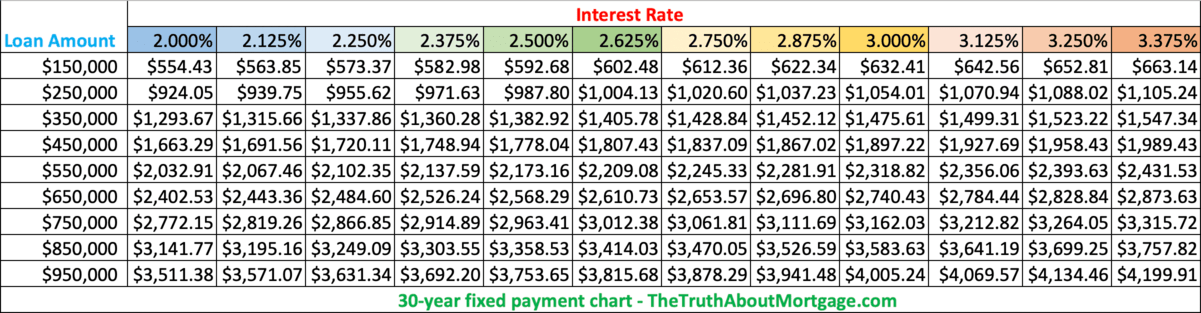

Use These Mortgage Charts To Easily Compare Rates The Truth About Mortgage

Use These Mortgage Charts To Easily Compare Rates The Truth About Mortgage

The answer is yes if you willing to invest discount points to purchase your interest rate down so long as your financial profile is completely flawless.

Is 3.5 a good mortgage rate. The conventional 3 down requirement means youll need to put 6000 down on a. One is a 35 15 year My other 30 year loan is 48 last year rate Im able to refi into 375 so your 33 is actually a crazy rate. Otherwise for the 999 us 30 year mortgages are trailing between 35 to 425.

Once we got real loan estimates we compared mortgage rates they started at 3625 and ranged down to 3 and closing costs. 35 for 300000 - 30 Years Fixed Mortgage - 134713. If youre taking out a 30-year mortgage for 200000 with 4000 in closing costs you might be able to choose between a rate of say 35 with closing costs or 3875 with no closing costs.

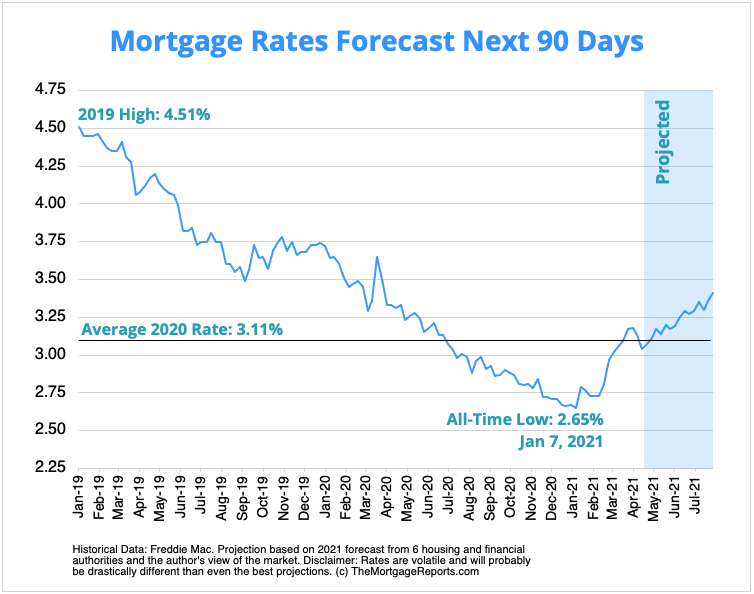

If you have a truly ideal credit profile and loan scenario a few of the more aggressive lenders are quoting conforming 30yr fixed mortgage rates at 35 today. If youre able to lock in low interest rates you can also lock in future savings for many years to come. Not bad I just refied at 325.

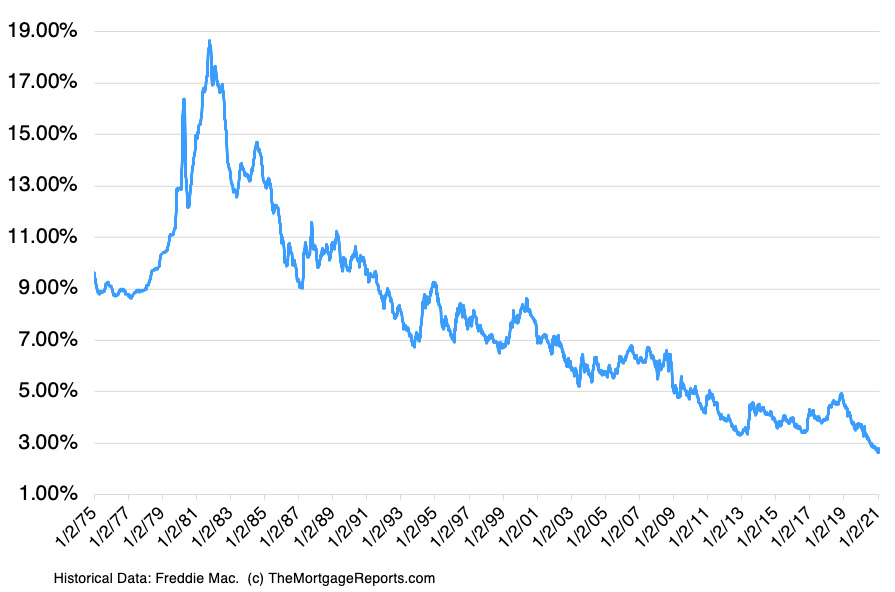

Well that depends on how you look at. We are at or near all-time low mortgage rates right now. Again using the 30-year mortgage rates chart the payment on a 400000 loan amount at.

Is it worth paying approximately 4000 to save an additional 69 per month in this example. The answer is yes if you willing to invest discount points to purchase your interest rate down so long as your financial profile is completely flawless. Youd pay 898 per month in principal and interest and more than 123000 in interest over the life of the.

On a 30-year fixed-rate loan of 150000 at 35 percent APR your monthly payment is 674. 35 for 200000 - 30 Years Fixed Mortgage - 889809. Heres an example of how that works.

15 year fixed rates are better and arent but 30 higher payment. 35 for 400000 - 30 Years Fixed Mortgage - 179618. Drop the rate to 3 percent your payment drops to 632.

For example lets say you borrow 200000 at 35 percent on a 30-year fixed-rate loan. Mortgage Rates Back to 35 for Some. These fees are for registering the deed attorney fee appraisal fee bank fees title insurance loan origination fee.

I would highly advise first time home buyers togo with the shortest term loan they can afford. Additionally higher mortgage rates can be more damaging than larger loan amounts. Based on actual lender rate sheets as of this morning the average lender was pricing out 35 30yr fixed rates at almost the exact same cost as last.

Otherwise for the 999 us 30 year. UWM is offering rates in the 2s for both purchase and refinance loans. It is now lower than it was a month ago.

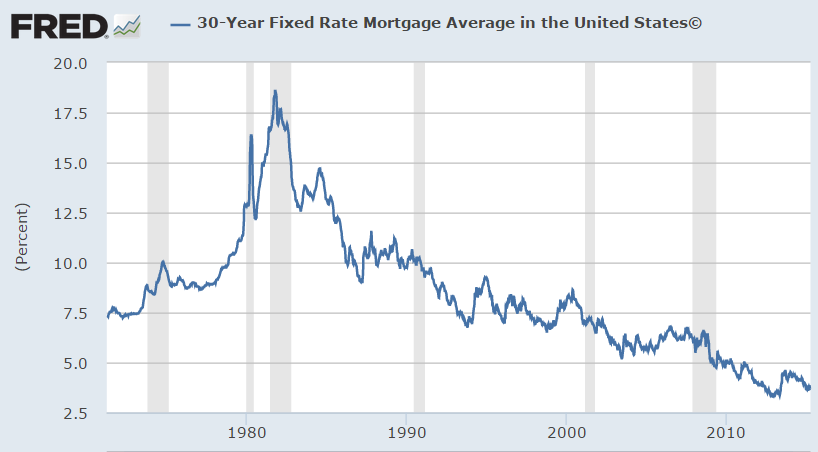

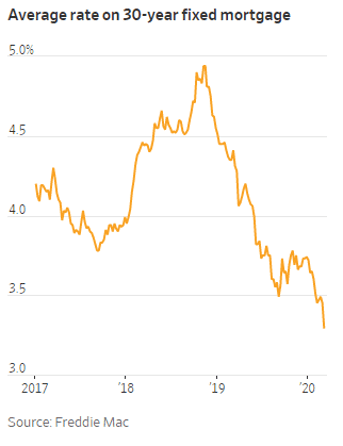

Todays average rate for a 30-year fixed-rate mortgage dropped below 35. Throuwho if you dont mind I am in the highest tier and I cant seem to get anything below 4 for a refi. Historically under 6 is low under 5 is very low under 4 is incredibly low.

The downward trend in rates is good news for anyone interested in buying a home or refinancing a mortgage. With good credit a rate of around 35 to 395 is the current mortgage loan rate. Not bad but not earth-shattering.

A 30-year 250000 mortgage at 35 has a monthly payment of 1122 and lifetime interest costs of about 154000. Get new amortization chart and monthly payment amount. Even so it seems the push for widespread lower mortgage rates.

The lender doesnt publish DTI requirements but youll generally need a. That saves you 41 a month on your monthly payment. They ranged from 6461 to 10227.

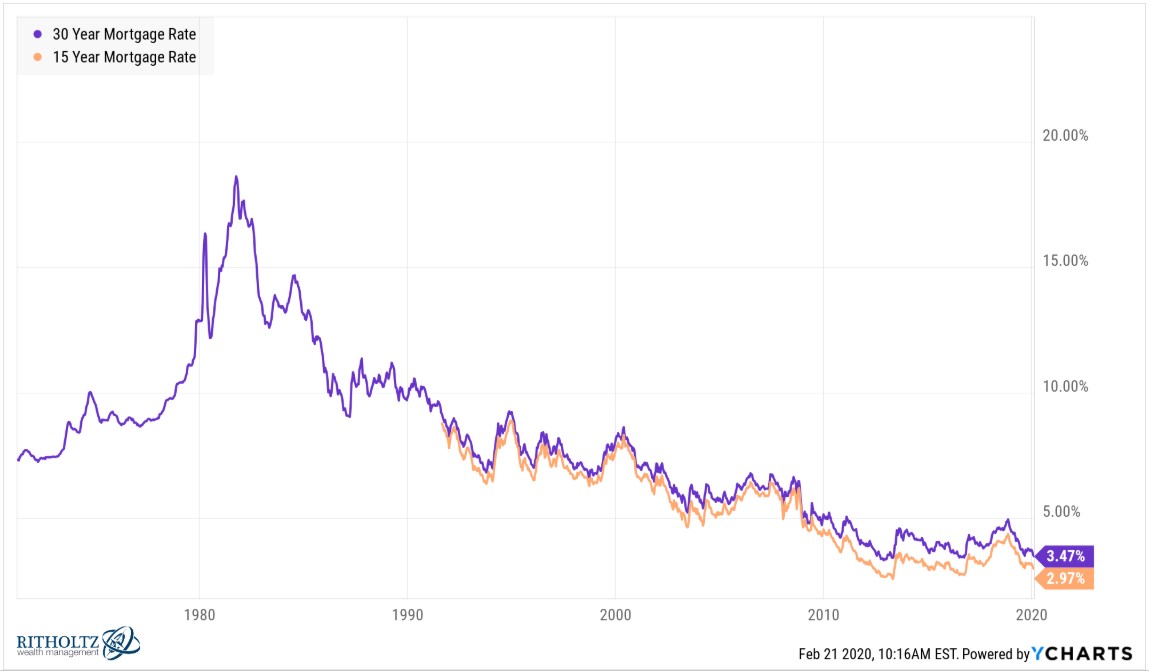

Refinance rates were between 35 and 4. This chart led to a discussion about the pros and cons of a 30 year fixed rate mortgage since many countries do things much differently than. Mortgage rates have had a great week.

Kelly explains In the case of the 35 the lender is giving the borrower a credit for the closing costs. FHA programs through Goodmortgage require a 530 credit score or better and a down payment of at least 35 percent. Other rates are mixed again with interest on all fixed-rate loan types decreasing and all adjustable-rate loans increasing.

But over 30 years youll save 14817 in interest. If you look at the 30-year mortgage rate chart the monthly payment difference on a 500000 loan amount between a rate of 35 and 375 is 7036 compared to a difference of 7793 for a rate of 525 vs. However there are several fees involved that you pay called closing fees.

What Your Mortgage Interest Rate Really Means Money Under 30

What Your Mortgage Interest Rate Really Means Money Under 30

Mortgage Rates Drop To 3 Year Low Locations

Mortgage Rates Drop To 3 Year Low Locations

Average Mortgage Rates Fall But Purchasers Are Staying Away National Mortgage News

Average Mortgage Rates Fall But Purchasers Are Staying Away National Mortgage News

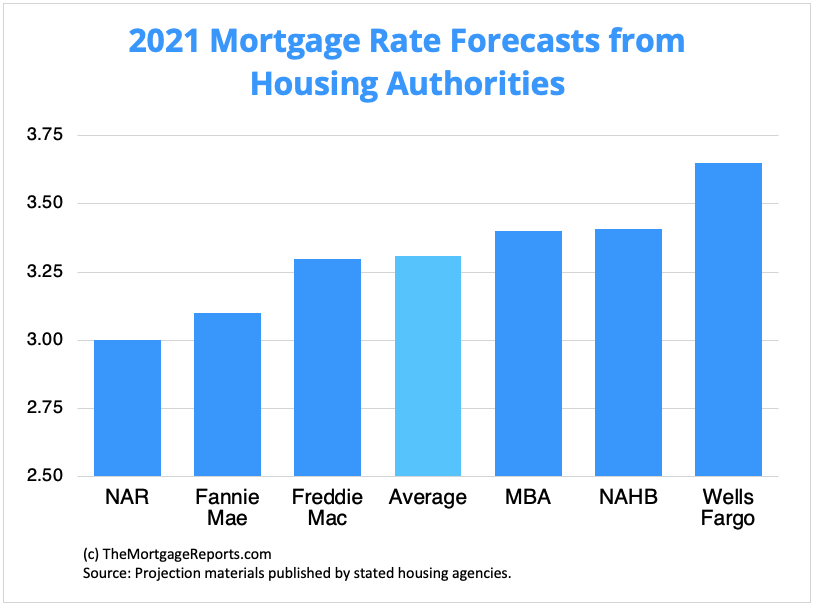

Mortgage Interest Rates Forecast Will Rates Go Down In May

Mortgage Interest Rates Forecast Will Rates Go Down In May

Pros Cons Of A 30 Year Fixed Rate Mortgage

Pros Cons Of A 30 Year Fixed Rate Mortgage

How Much Does A 1 Difference In Your Mortgage Rate Matter

How Much Does A 1 Difference In Your Mortgage Rate Matter

Should You Pay Off Your Mortgage Early With Rates So Low

Should You Pay Off Your Mortgage Early With Rates So Low

Long Term Mortgage Rates Fall Below 3 5 Reishman Group

Long Term Mortgage Rates Fall Below 3 5 Reishman Group

Mortgage Rates Are At A Three Year Low Financial Advisors Halbert Hargrove

Mortgage Rates Are At A Three Year Low Financial Advisors Halbert Hargrove

30 Year Mortgage Rates Chart Historical And Current Rates

30 Year Mortgage Rates Chart Historical And Current Rates

Use These Mortgage Charts To Easily Compare Rates The Truth About Mortgage

Use These Mortgage Charts To Easily Compare Rates The Truth About Mortgage

Mortgage Rates Remain Near Historic Lows

Mortgage Rates Remain Near Historic Lows

Mortgage Interest Rates Forecast Will Rates Go Down In May

Mortgage Interest Rates Forecast Will Rates Go Down In May

Comments

Post a Comment