Credit One Closed My Account

My records indicate that my current balance is 000--being the. If they close an account for other reasons such as an adverse credit report they must notify the cardholder within.

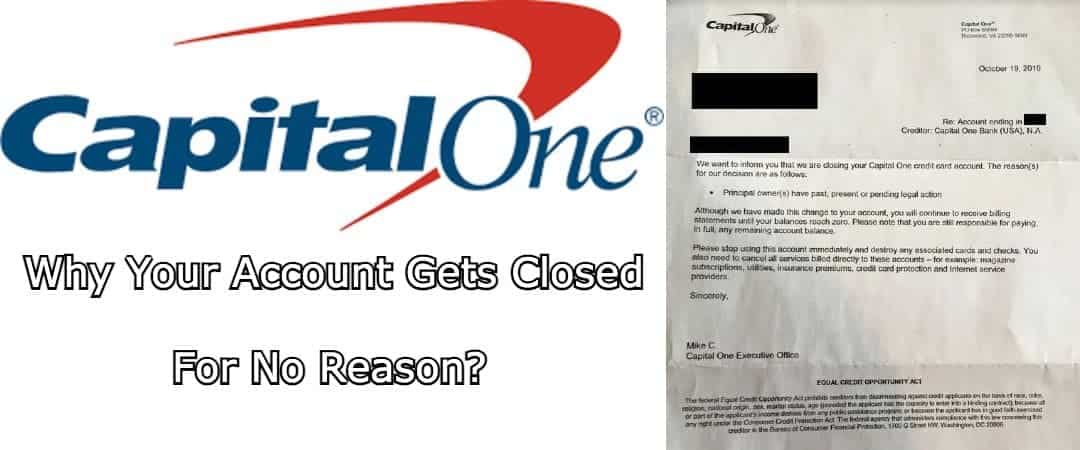

Why Has Capital One Closed My Checking Account For No Reason Almvest

Why Has Capital One Closed My Checking Account For No Reason Almvest

There are a few reasons an account could show up as closed on your credit reports including that you asked to cancel or close the account a creditor closed it because of inactivity or several missed payments or the credit bureau made a mistake and your account is actually still open.

Credit one closed my account. If you click the Continue button you will be directed to a third-party website unaffiliated with Credit One Bank which may offer a different privacy policy and level of security. In fact according to the Equal Credit Opportunity Act creditors can close an account for delinquency inactivity or default with no notice whatsoever. The account has been closed.

If you click the Continue button you will be directed to a third-party website unaffiliated with Credit One Bank which may offer a different privacy policy and level of security. If it was closed in error you may be able to dispute the record on your credit report and repair your credit. Make sure to check that your credit score didnt go down because your account was closed.

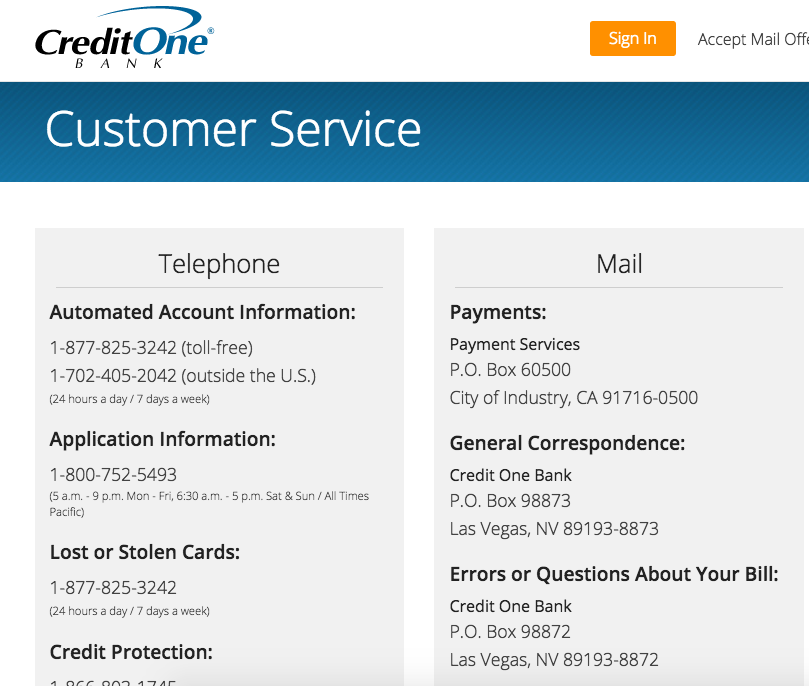

Therefore I wish to close my credit card account with Credit One Bank. To cancel a Credit One card call customer service 247 at 877 825-3242. If your bank closed your account you might be panicking but try to stay calm and call your banks customer service number to find out whats going on.

Usually accounts are closed. A closed account may increase your utilization rate by lowering the total amount of credit you have available. The lady was really nice bad english but managed to close it.

However before you take out the scissors to cut up your plastic make sure you understand how closing a credit card account may impact your score. This infographic by Credit One Bank provides reasons to consider in making a decision to cancel a credit card. Saying that since my balance was 0 I was not going to get charged for any fees.

How to Avoid Having Your Bank Close Your Account. To close my credit card or not to close. They closed 2 of my accounts a total ofalmost 50k worth in credit they took me of a credit card I was an additional on with a credit line of approx 55 000 I tried to tlk to a super viser but he saaid it was due to hi risk and he cant give more details as he does not know The irony though is that I had on card 0 balance on the other card I was uosing less the 25 and I have more money in.

You may want to use up any points youve accumulated before closing your account. Its also worth checking your credit report to make sure that everythings in order. These late payments will remain on your credit report for seven years but they will hurt your credit score less as time passes and as you add positive information to your credit report.

Whether cancelling your account is right depends on your spending habits and how well you are able to stay on top of your payments. With a credit card closing an account causes you to lose the available balance on that card says Rod Griffin director of public education at Experian. The best way to avoid having your account closed is to avoid a negative balance.

Credit One Bank is not responsible or liable for and does not endorse or guarantee any products services information or recommendations that are offered or expressed on other websites. Credit One Bank is not responsible or liable for and does not endorse or guarantee any products services information or recommendations that are offered or expressed on other websites. That is the question many people ask every day in deciding whether or not to keep a rarely used credit card open.

If the credit card issuer closed your account because of late payment or serious delinquency those delinquencies will impact your credit score. For accounts closed with a balance the creditor continues updating account details with the credit bureaus each month. When prompted enter your card number.

Lower the average age of accounts The length of your credit history is another factor that affects your credit scores. Stated even with her 780 credit score and always paying most of her bill off each month that she was a poor credit. Youll need to stop any monthly automatic payments or preauthorized charges on your account Make at least the Minimum monthly Payment until the account balance reaches zero In most cases youll lose your Rewards once you close your account.

It was so weird because I could still access the account. After the account is closed the account status on your credit report gets updated to show that the account has been closed. Even if your account offers overdraft services you will be paying a lot in overdraft fees and you may become trapped in an overdraft cycle where more and more of your paycheck goes towards the overdraft fees.

If keeping the account open is going to tempt you to make purchases you wont be able to pay off andor to make late payments it may be better to close it. Synchrony closed all my mother-in-laws accounts 2 days before her 78th birthday. It may be in your best interest to keep your account open.

1-877-825-3242 toll-free 1-702-405-2042 outside the US 24 hours a day 7 days a week. In addition to the refund of my secured deposit in the amount of 50000 I am requesting that my credit reports reflect that this account was Closed at the Consumers Request I am further requesting written confirmation of the accounts closure. The impact that a closed account has on your credit depends largely on the type of account involved and whether you still owe a balance.

If the closed account was open for a long time that could lower the average age of your accounts. The easiest way to get rid of a credit card without getting any comment back is saying that you are moving out of the united states and you need to close all your credit cards. Once connected to a customer service representative state that you want to cancel the card and close your account.

A closed credit account could hurt your credit score.

I Just Closed My Creditone Account Myfico Forums 5215018

I Just Closed My Creditone Account Myfico Forums 5215018

Credit Card Faqs Credit One Bank

Credit Card Faqs Credit One Bank

Why Did Credit One Close My Account Reasons Next Steps

Why Did Credit One Close My Account Reasons Next Steps

Why Has Capital One Closed My Checking Account For No Reason Almvest

Why Has Capital One Closed My Checking Account For No Reason Almvest

Credit One Customer Service Complaints Department Hissingkitty Com

Credit One Customer Service Complaints Department Hissingkitty Com

I Just Closed My Creditone Account Myfico Forums 5215018

I Just Closed My Creditone Account Myfico Forums 5215018

Credit One Bank On Twitter Due To Covid 19 We Have Been Experiencing Heavy Call Volume And Significantly Increased Wait Times We Encourage Card Members To Access Their Accounts Online Or On Our

Credit One Bank On Twitter Due To Covid 19 We Have Been Experiencing Heavy Call Volume And Significantly Increased Wait Times We Encourage Card Members To Access Their Accounts Online Or On Our

Closed Credit One Bank Card Myfico Forums 4978488

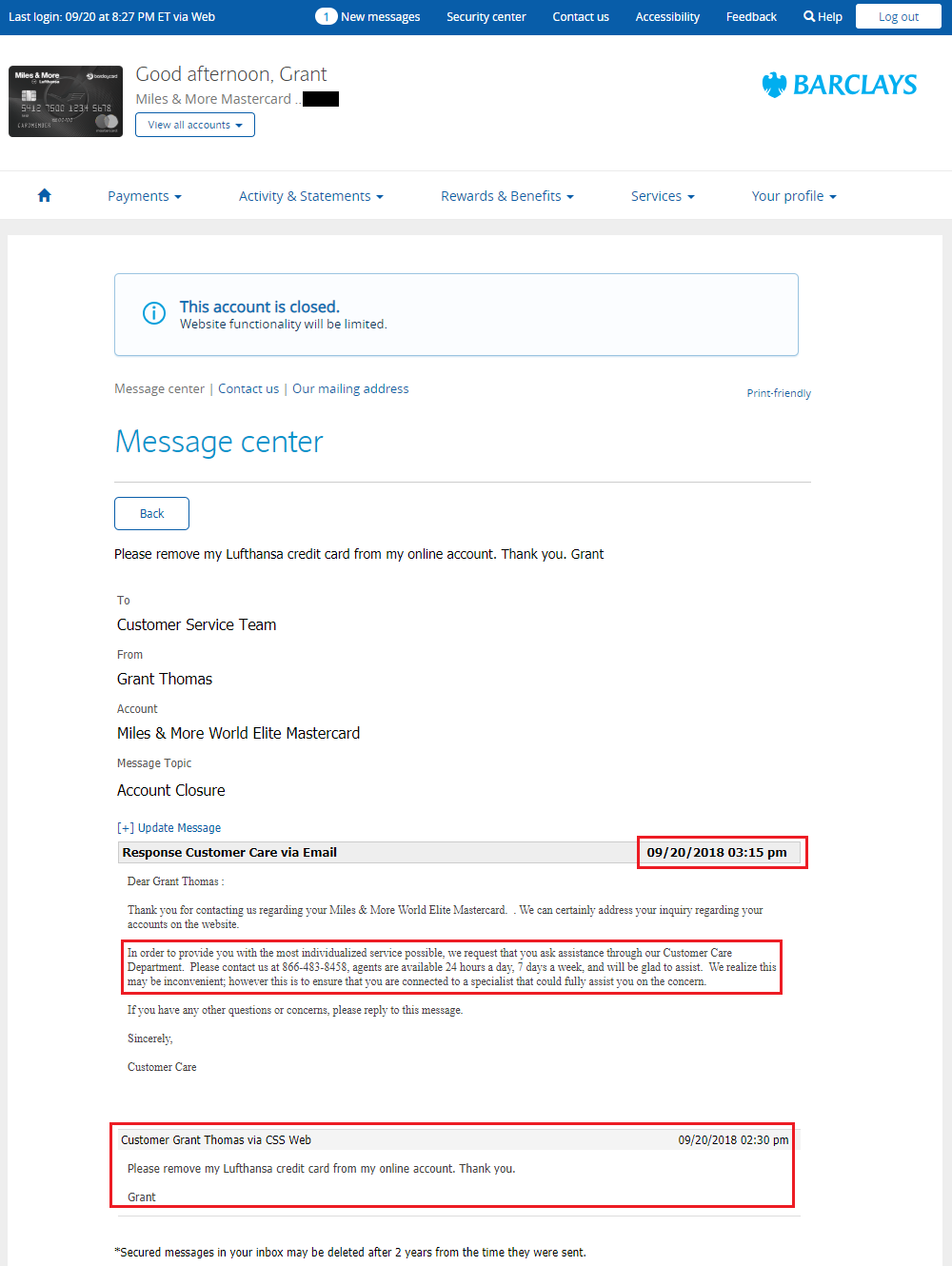

Why Can T I Remove Closed Barclays Credit Card From My Online Account

Why Can T I Remove Closed Barclays Credit Card From My Online Account

Why Has Capital One Closed My Checking Account For No Reason Almvest

Why Has Capital One Closed My Checking Account For No Reason Almvest

Credit One Customer Service Complaints Department Hissingkitty Com

Credit One Customer Service Complaints Department Hissingkitty Com

Chase Ink Business Preferred Invitation Luxury Chase Closed My Credit Card Account S Archived 2013 Mid Luxury Invitation Credit Card Account Accounting

Chase Ink Business Preferred Invitation Luxury Chase Closed My Credit Card Account S Archived 2013 Mid Luxury Invitation Credit Card Account Accounting

Comments

Post a Comment