What Is A Tin Number For A Business

This is a tax ID for individuals. To have a TIN number is necessary for many business purposes and you have asked for it even when you wish to make a money transaction from some money transfer account like PayPal etc.

A copy of your ID free and can be gotten online from the comfort of your home.

What is a tin number for a business. Income Tax Return for Estates and Trusts. The purpose is to assign a number to each taxpayer whether thats an individual or a business. Today lets talk about how to verify TIN numbers and also how to check if a business has been duly registered in Ghana.

If youre wondering about the differences between a TIN and an EIN SSNs and ITINs are tax IDs for individuals while EINs are used for businesses. When does the TIN come into Play in Business Once you have a TIN number if your company engages to work with other companies online you will provide your tax identification number for tax identification reasons sometimes in an online form and sometimes you will be asked to submit a W-9 download copy of W9 form from IRS. TIN is an umbrella term that may refer to any of the five primary types of taxpayer identification numbers.

An ITIN has nine digits always begins with the number 9 and has a 7 or an 8 as the fourth digit eg 9XX-7X-XXXX. The format is a unique set of 10 numerals allocated automatically by HMRC for individuals who have to submit a tax. How to get a ITIN number for business.

Some do not automatically issue TINs to all taxpayers. An Individual Taxpayer Identification Number ITIN is a specific tax processing number that is distributed by the Internal Revenue Service IRS. The numbers for the program ID and account number will change based on which of the four its referring to.

That will be discussed in a subsequent article. Some have other identifiers which for legal or other reasons cannot be treated as TINs. Understanding the Tax Identification Number TIN A tax identification number is a unique set of numbers that identifies individuals corporations and other entities such as nonprofit.

To sum up there are a few different types of TIN depending on your status. The nine-digit tax ID number Business Number is the same across program accounts. You can apply for the number through The Canada Revenue.

Social Security number SSN Employer identification number EIN Individual taxpayer identification number ITIN Adoption taxpayer identification number ATIN Preparer tax identification. Refer to Employer ID Numbers for more information. The first two characters of the TIN represent the state code and the rest nine digits vary from state to state.

A tax identification number or TIN is an ID number the IRS uses to administer tax laws. Social Security Number SSN individual taxpayer identification number ITIN and an employer identification number EIN. It is also used by estates and trusts which have income which is required to be reported on Form 1041 US.

Getting a TIN is actually easy all you need is your details and other requirements eg. The technical construction of the number specifies that the first digit must always be either 8 or 9 with a modulus 11 check digit at the end. This is a tax ID for businesses.

Your TIN is most likely the business entitys Employer Identification Number EIN. An online check module which allows checking the TIN syntax ie. There is no TIN at EU level and not all EU countries have TINs.

According the Central Coordination Registers website the weighting factors are 3 2 7 6 5 4 3 and 2 calculated from the first digit. If you need a TIN number for yourself you can easily register for it following these easy steps-How to Apply for TIN Number for Business 1. Your TIN is the same as your social security number.

The TIN full form is Tax Identification Number TIN which is an eleven digit number assigned to every business registered under VAT. It stands for Taxpayer Identification Number and it is basically the same thing as an EIN. TIN registration is mandatory for the enterprises registering for VAT such as manufacturers exporters dealers and traders of goods and services.

A Tax Identification Number or TIN is assigned by the state government to the businesses. Usually TINs are assigned to businesses that have employees. There are three different types of numbers the IRS uses for tax purposes.

The most recent quasi TIN is the unique taxpayer reference UTR. Algorithm or if not available the TIN structure. As an individual without a SSN.

A TIN is required both for the sales and purchase of the goods and services within a state or intra-state. The organisation number TIN is a nine digit number. An Employer Identification Number EIN is also known as a federal tax identification number and is used to identify a business entity.

How To Get Tax Identification Number In Nigeria Online Gallery Wallpaper

How To Get Tax Identification Number In Nigeria Online Gallery Wallpaper

Offshore Company Formation International Business Company Bank Account

Offshore Company Formation International Business Company Bank Account

Business Tax Id Number Example Page 1 Line 17qq Com

Business Tax Id Number Example Page 1 Line 17qq Com

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Taxpayer Identification Number Guyana Revenue Authority

Taxpayer Identification Number Guyana Revenue Authority

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg) Differences Among A Tax Id Employer Id And Itin

Differences Among A Tax Id Employer Id And Itin

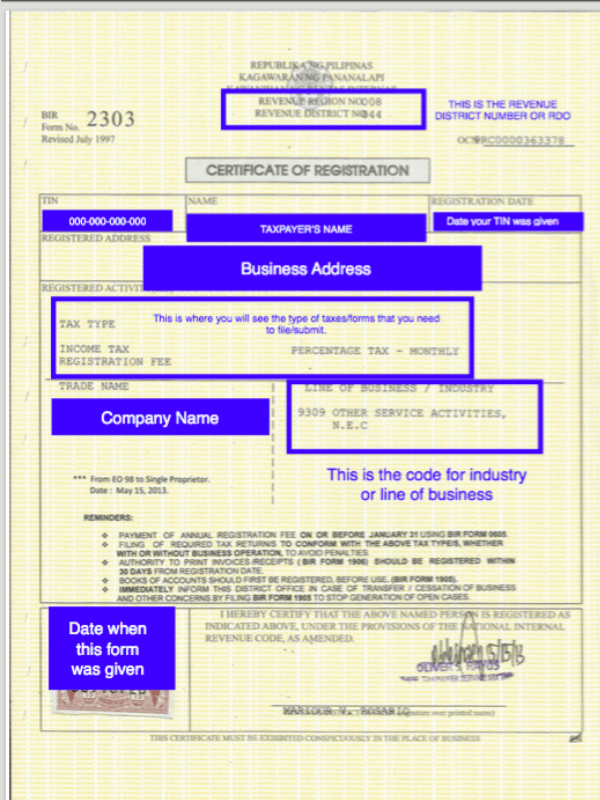

Bir Registration The Top Reasons Why It Is Important To Register Your Business

Bir Registration The Top Reasons Why It Is Important To Register Your Business

/application-form-w-9--request-for-taxpayer-identification-number-tin-and-certification-close-up-shot-867665546-af6d55c962a24fe38165f2a1aa45f726.jpg) Tax Identification Number Tin Definition

Tax Identification Number Tin Definition

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

Proof Of Tin Number Page 1 Line 17qq Com

Proof Of Tin Number Page 1 Line 17qq Com

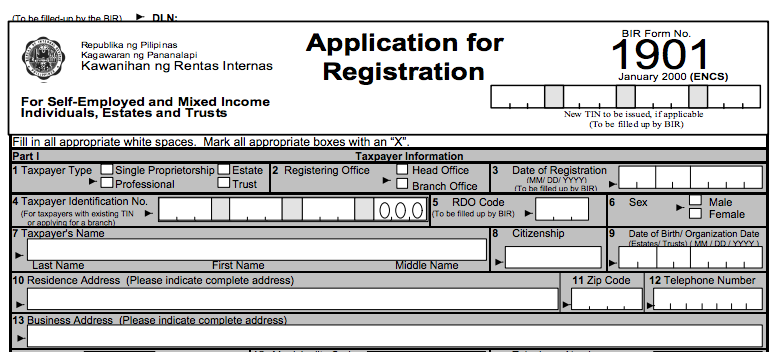

Different Types Of Taxpayers You Should Know Fullsuite

Different Types Of Taxpayers You Should Know Fullsuite

How To Get Tax Identification Number Tin In Nigeria Current School News

How To Get Tax Identification Number Tin In Nigeria Current School News

Comments

Post a Comment