Income Based Student Loan Repayment

How Student Loan Income-Based Repayment Is Calculated Income-driven plans can calculate payments based on your spouses income and debt as well as how much you earn. Income-Based Repayment IBR.

Student Loans Making Them More Affordable Cbs News

The term income-driven repayment describes a collection of plans that calculate a borrowers monthly student loan payment based on their income.

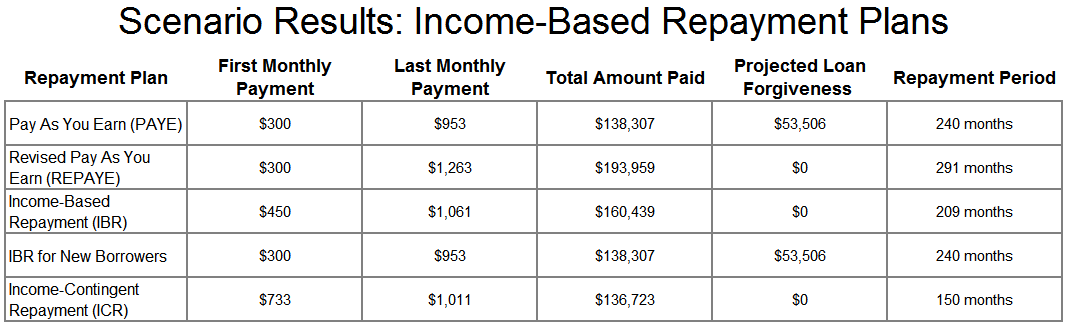

Income based student loan repayment. Available income-based repayment plans include the Revised Pay as You Earn Repayment plan the Pay as You Earn Repayment plan the Income-Based Repayment plan and the Income-Contingent Repayment plan. If your payments are unaffordable due to a high student loan balance compared to your current income an IBR plan can provide much-needed relief. For borrowers who obtained their first loan after July 1 2014 payments are capped at 10 of discretionary income and cant exceed the payment amount for the standard repayment plan.

Income-Based Repayment IBR is one of four Income-Driven Repayment IDR plans. The correct term for these plans is actually Income-Driven Repayment IDR. IDR plans include Revised Pay As You Earn REPAYE Pay As You Earn PAYE Income-Based Repayment IBR and Income-Contingent Repayment ICR Plans.

Sometimes Income-Based Repayment IBR is incorrectly used as an umbrella term to describe all student loan repayment options determined by your income. Almost all borrowers qualify for this program including Subsidized Unsubsidized PLUS and consolidated loans. Its based on the idea that how much you pay each month should be based on your ability to pay not how much you owe.

Essentially if too much of your income is going toward student loan payments qualifying for an income-based repayment plan might make your monthly payments more manageable. As a result similar to the Standard. When applying for IBR the government looks at your income family size and state of residence to calculate your monthly payments.

You can work in a job you love or for the public good in a low-paying position. Income-Based Repayment is only allowed with conventional loans FHA VA USDA does not allow Income-Based Repayment. Income-driven repayment plans can help lower your monthly student loan payment.

Income-Based Repayment IBR is a repayment plan available to federal student loan borrowers. Federal Student Aid. IBR is a type of income-driven repayment IDR plan and can lower your monthly student loan payments.

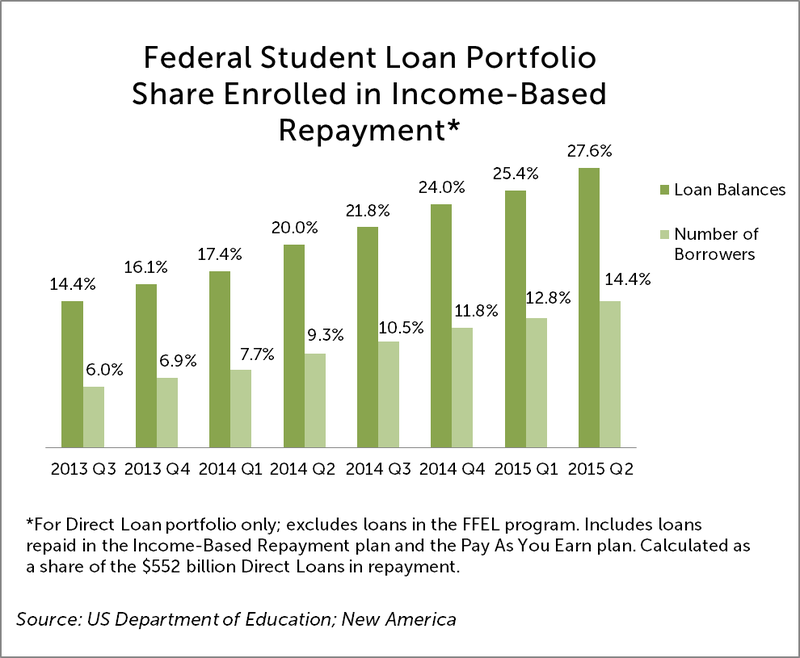

As the number of student loans in the United States has increased the number of students paying back loans using income-based repayment plans has also increased. You could pay nothing as your monthly payment if your income is low enough or. There are many benefits of the income-based repayment plan for student loans.

As you may already know income-based repayment IBR plans are offered on federal subsidized and unsubsidized student loans in an attempt to make them more manageable for people to pay off. Ryan Lane Dec 14 2020 Many or. Income-Based Repayment Student Loan Mortgage Guidelines On Loan Programs Income-Based Repayment is often referred to as IBR Payments.

These plans include Income-Based Repayment IBR. An income-driven repayment plan adjusts monthly student loan payments based on your discretionary income family size and state. For people who borrowed earlier than that date payments are capped at 15 of discretionary income but still cant exceed the amount due under the standard plan.

Federal student loan borrowers get a fixed repayment through this plan to pay out the debt in 10 years. A graduated plan involves paying less during the first two years and getting higher payments in subsequent years. Under these plans your monthly payment is based on your income and family size.

You can pay less each month so you can focus on living expenses.

Income Based Repayment White Coat Investor

Income Based Repayment White Coat Investor

Ibrinfo What Are These Programs

What Is The Best Income Driven Repayment Plan Student Loan Hero

What Is The Best Income Driven Repayment Plan Student Loan Hero

Student Loan Max Payments Under Us Federal Ibr Table Frugal

Which Income Driven Repayment Plan Is Right For You Ed Gov Blog

Which Income Driven Repayment Plan Is Right For You Ed Gov Blog

Student Loan Income Based Repayment

Best Student Loan Planning Software For Financial Advisors

Best Student Loan Planning Software For Financial Advisors

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Pros And Cons Of Income Driven Repayment Plans For Student Loans

Take Control Of Your Student Loans 2 Repayment Plans Remote Financial Planner

Take Control Of Your Student Loans 2 Repayment Plans Remote Financial Planner

How To Decide Which Income Driven Repayment Plan To Choose Ed Gov Blog

How To Decide Which Income Driven Repayment Plan To Choose Ed Gov Blog

Income Driven Repayment Options

What Does Income Based Repayment For Student Loans Cost

What Does Income Based Repayment For Student Loans Cost

A Better Way To Provide Relief To Student Loan Borrowers

A Better Way To Provide Relief To Student Loan Borrowers

Your Discretionary Income Student Loans How One Impacts The Other Student Loan Hero

Your Discretionary Income Student Loans How One Impacts The Other Student Loan Hero

Comments

Post a Comment