Bond Ladder Strategy

Instead of buying bonds that are scheduled to mature during the same year you purchase CDs or bonds that mature at staggered future dates. Laddering also increases portfolio.

How To Build A Bond Ladder Fidelity

How To Build A Bond Ladder Fidelity

If one of them goes bad it could take a mean slice out of your portfolio.

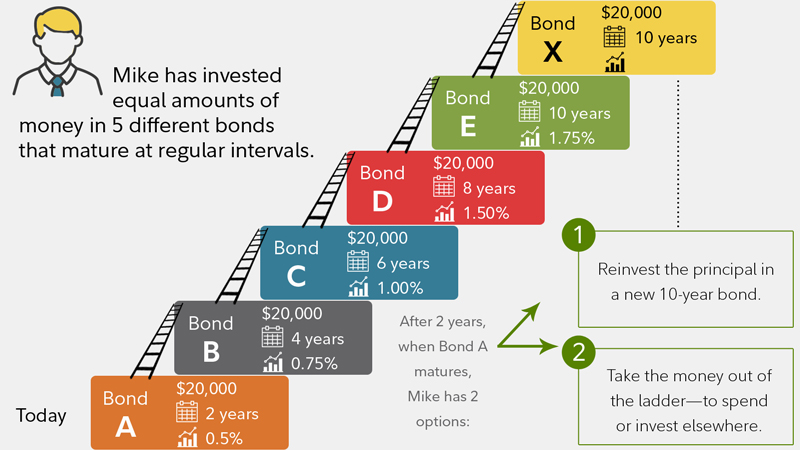

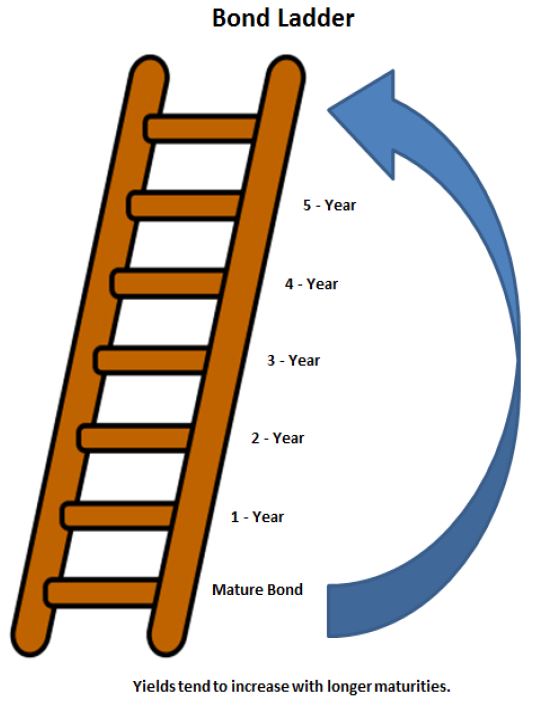

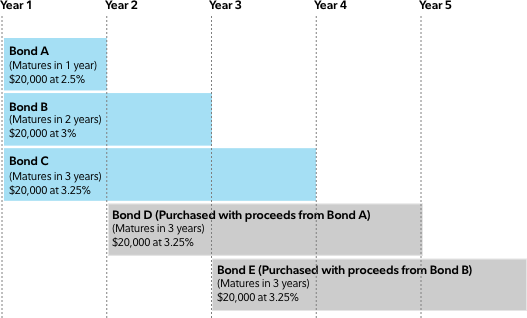

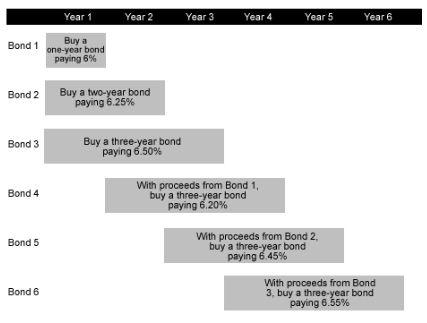

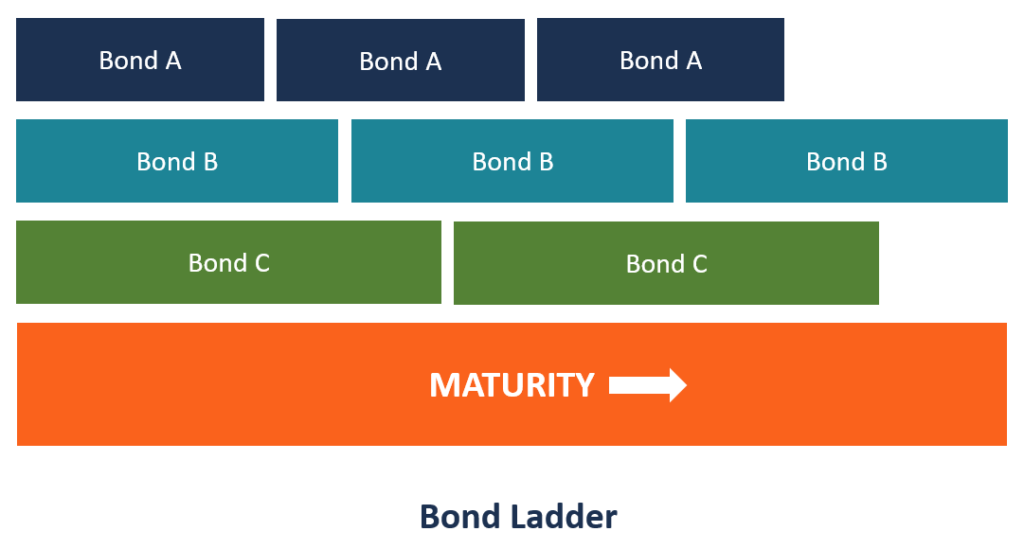

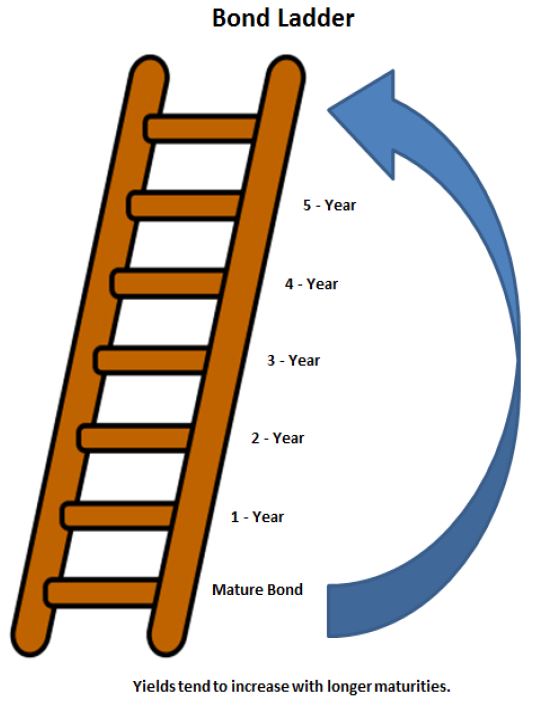

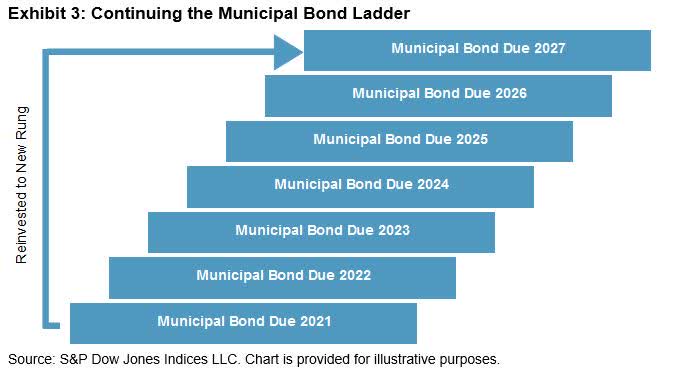

Bond ladder strategy. An investor builds a bond ladder by investing an equal amount of capital into bonds that will mature on different dates. Bond laddering strategy can offer higher average yields because generally the bonds with higher maturity offer higher yields. By staggering maturity dates you wont be locked into one bond for a long duration.

Because bond ladders by definition hold different maturities this strategy may help. This strategy is designed to provide current income while minimizing exposure to interest rate fluctuations. The ladder strategy also increases liquidity of bond investments because at least one bond is relatively close to maturity.

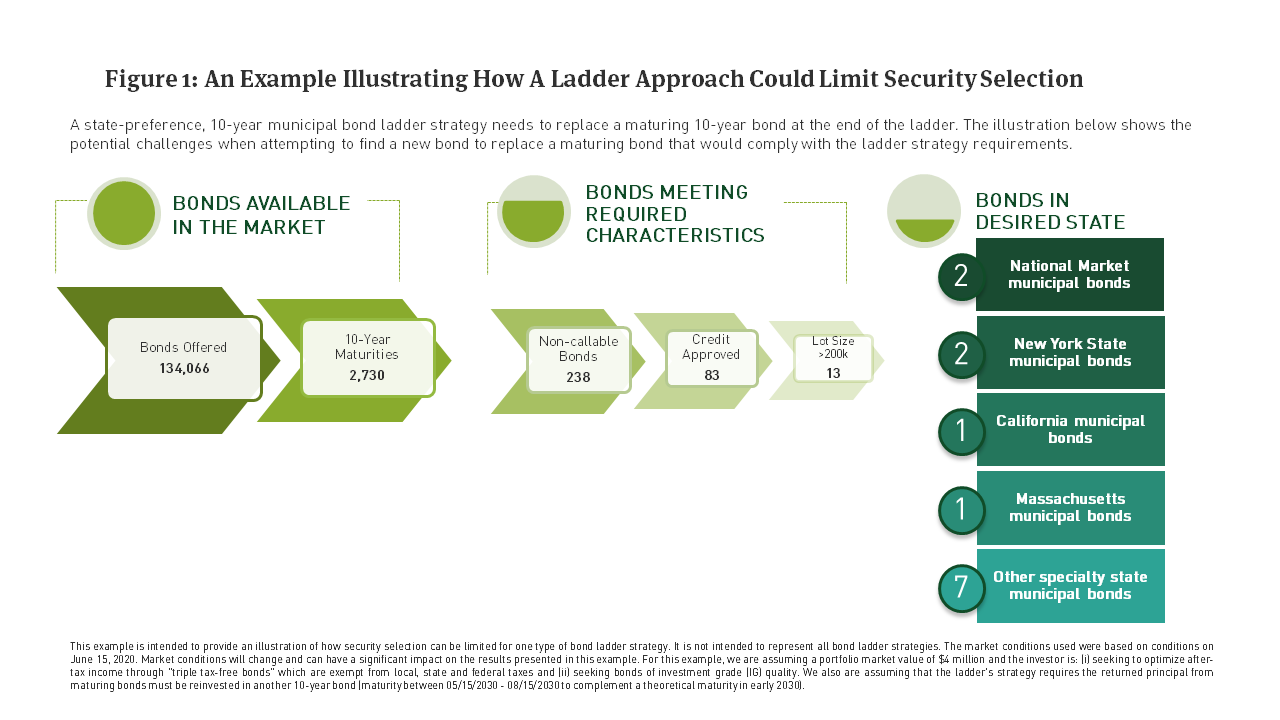

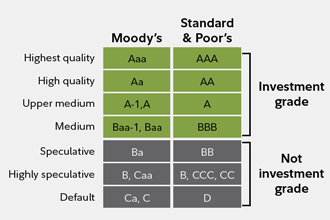

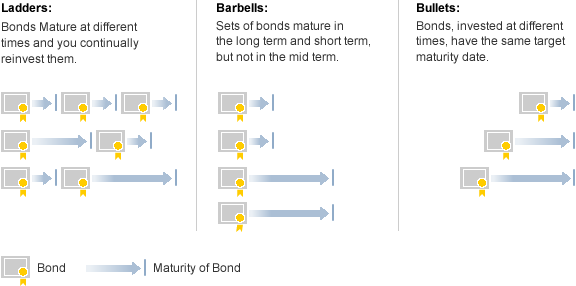

Callable bonds can be redeemed by the issuer before the maturity date exposing you to interest rate risk. Climbing the ladder exercising with barbells more. We believe a bond ladder strategy is a complacent investing approach where the bond ladder owner effectively sets it and forgets it and puts his head in the sand.

This is why you should build a bond ladder with. A bond ladder is a portfolio of individual CDs or bonds that mature on different dates. Buy one bond that matures in two years another that matures in five and a third that matures in ten and presto.

This helps create diversification both in the portfolio and the potential for income. Quick Summary of Points A bond ladder is an investment strategy that involves constructing a portfolio in which bonds mature continuously at. You have just constructed a bond ladder.

For one the success of the bond ladder strategy is contingent on the bonds supplying your cash flows not defaulting--and this is no minor risk. Why not simply buy one big fat bond that. Bond ladders carry more default risk.

Ladders barbells and swaps are some of the trading strategies you can use for buying and selling bonds. Since the strategy helps you invest in both long-term and short-term bonds you benefit from higher yields of long-term bonds and liquidity of short-term bonds. The strategy is then to invest one-fifth of the capital into bonds of each maturity.

This can be a risky approach to bond investing as events will happen over time that impact a bonds. Bond ladders by definition hold a number of different issues. For example an investor may want to create a ladder of bonds maturing in one two three four and five years.

The bond ladder strategy involves building up a portfolio of multiple bonds that fit with your investment needs. Risk is bond ladders. To set up the initial bond ladder.

This investment strategy can be used to retain liquidity while also taking advantage of generally higher yield. A bond ladder can be an incredibly valuable tool in your investing arsenal once you reach the point of taking money out of your portfolio. Then as each security matures you reinvest the proceeds in a new security at the top of ladder which becomes your new longest-dated security.

When investors refer to a bond ladder strategy they are referring to a way of creating your own adjustable-rate income stream by buying a series of bonds or bond funds with staggered maturity dates. You can structure a bond ladder as per your financial. Key Takeaways A bond ladder is a multi-maturity investment strategy that diversifies bond holdings within a portfolio.

Individual investors might hold no more than 10 or 20 bonds. Bond laddering is a fancy term for diversifying your bond portfolio by maturity. Bond laddering is an investing strategy that involves buying bonds that mature at various dates so that the investor can take advantage of upswings in interest rates.

Bond ladders allow investors to adjust cash. How bond ladders work.

What S A Bond Ladder Learn More

What S A Bond Ladder Learn More

Bond Ladder Tool From Fidelity

Bond Ladder Tool From Fidelity

Signet Financial Management Llc Signet Financial Management Llc Laddering Bonds For Rising Rates

Signet Financial Management Llc Signet Financial Management Llc Laddering Bonds For Rising Rates

Bond Ladder Definition Example Investinganswers

Bond Ladder Definition Example Investinganswers

Laddered Bond Portfolio Overview Features How It Works

Laddered Bond Portfolio Overview Features How It Works

Bond Investment Ladder Reduces Interest Rate Risk While Providing Income

Bond Investment Ladder Reduces Interest Rate Risk While Providing Income

Taking The Measure Of Bond Ladders Breckinridge Capital Advisors

Taking The Measure Of Bond Ladders Breckinridge Capital Advisors

Wa Corporate Bond Ladders 1 5 Years Legg Mason

Wa Corporate Bond Ladders 1 5 Years Legg Mason

Why Rising Rates Don T Have To Be Alarming For Income Investors Invesco Canada Blog

Bond Ladder Strategy Disadvantages Bondsavvy

Bond Ladder Strategy Disadvantages Bondsavvy

How To Build A Bond Ladder Fidelity

How To Build A Bond Ladder Fidelity

Why Reach For Yield When You Can Use A Ladder Seeking Alpha

Why Reach For Yield When You Can Use A Ladder Seeking Alpha

Comments

Post a Comment