Irs Audit Letter Envelope

An IRS audit letter will come to you by certified mail. What To Do When You Get An IRS Audit Letter Written by Barry Fowler Posted in Audit IRS A thick white envelope with a logo that looks like a yeti is scratching the top of a scale while a leaf floats through the scene arrives in your mailbox and frankly youre scared.

Received A Notice From The Irs Or Department Of Revenue Here S What You Need To Do Sacco Tax

Received A Notice From The Irs Or Department Of Revenue Here S What You Need To Do Sacco Tax

If we dont hear from you by the deadline provided in your Letter 566 within 30 days or if we.

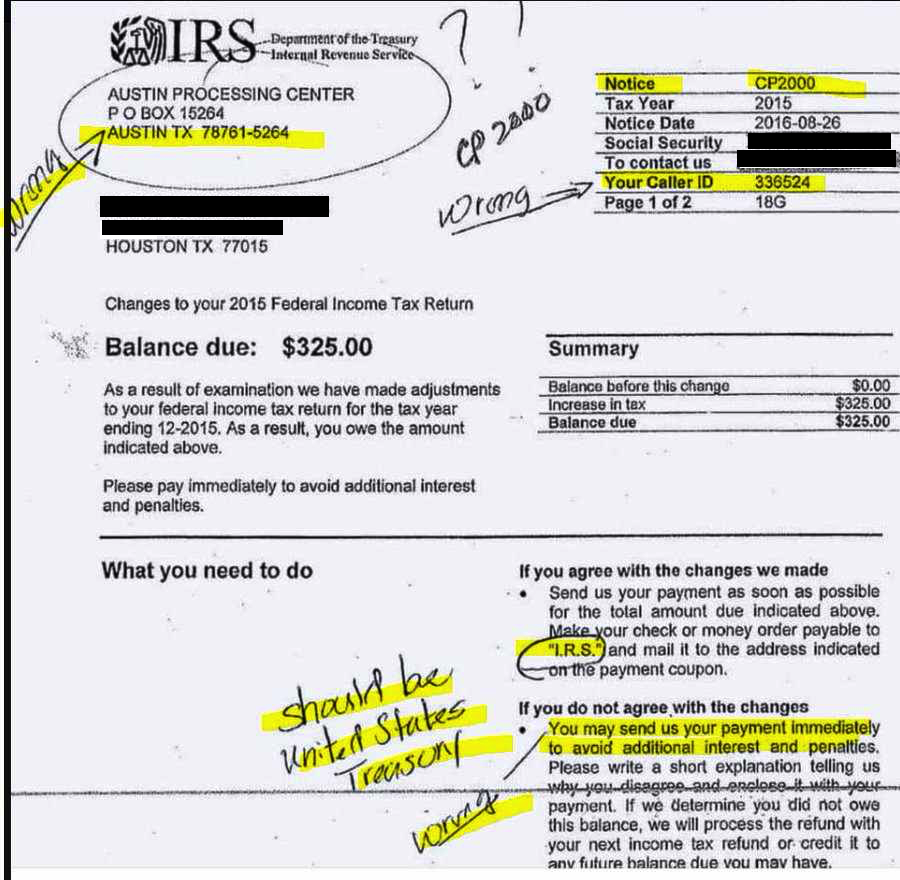

Irs audit letter envelope. S which is dead wrong. If the IRS decides to audit you youll usually get a letter that says your return has been selected for examination This means that your most recent tax forms are being subject to further review. When you open it up it will identify your name taxpayer ID form number employee ID number and contact information.

Should you decide on the latter you must file a tax court. Nine love letters from the i r s tpl beware fake irs letters are making the the tax man cometh times of israel irs audit letter envelope page 1 Nine Love Letters From The I R S Tpl Beware Fake Irs Letters Are Making The Rounds This Summer The Tax Man Cometh Times Continue reading What Does An Irs Audit Letter Envelope Look Like. 135 Zeilen Audit Letter 2205.

In fact in 2016 the IRS made a change to the return in 89 of all mail audits. The IRS does 70 of audits by mail. Basically this letter informs you of a tax deficit.

The first type of correspondence is a simple letter sent to you by the IRS to claim you owe the government money. They might ask for additional documentation or they might simply recalculate your taxes for you. The first line of text within your letter from the IRS may state something along the lines of Your state or federal income tax return for the year shown above has been selected for examination.

Use the envelope enclosed with your letter to send the information back to us. If you are unable to submit the request by fax mail your request to the address shown on the IRS letter. IRS Letter 531 includes the specifics of the tax deficit such as the years from which you owe and the additional amount you need to pay the IRS.

However if you received a Notice of. Here you have two options. We will contact you if we are unable to grant your extension request.

The biggest single red flag on the letter is that payment is requested payable to I. That logo only means one thing. This is called Notice of Deficiency.

If you want the process to go smoother response with an IRS audit response letter even if they dont ask anything from you in return with proper documentation. You can get any of the forms or publications mentioned in this letter by calling 1-800-TAX-FORM 1-800-829-3676 or visiting our website at wwwirsgovformspubs. If theres no notice number or letter its likely that the letter is fraudulent.

For most tax return errors the IRS has a three year window in which an audit can be initiated. It can be scary to receive a letter from the IRS saying your tax return has been selected for an audit. For audits conducted by mail - fax your written request to the number shown on the IRS letter you received.

You can either pay the tax deficit or refute the new computation. We can ordinarily grant you a one-time automatic 30-day extension. The text of the letter will tell you if the audit is correspondence by fax or letter or in person at either your location or the nearest IRS office.

After youve collected the requested information attach photocopies of your documents to the audit letter you received. Take action and respond by the deadline within 30 days or arrange for additional time. But just because you get an IRS audit letter instead of an IRS agent at your door the outcome may not be much different than a face-to-face audit with an IRS agent.

However if your documents dont fit in the envelope. If you prefer you can write to us at the office we provided in this letter. Send us the information by using the address on the envelope.

If you received a Letter 566 please dont ignore this letter. The IRS manages audits either by mail or through an in. The letter will contain details of the error as well as information on how to make things right.

If youd rather not deal with this on your own you can. However you may only have to conduct your audit by mail in which case you wont ever have to submit to an in-office review or a home visit from an agent. Getting any letter from the IRS in your mailbox is enough to send your blood pressure skyrocketing.

Sometimes the IRS will submit an audit letter to let you know that an audit will be taking place on you at a selected date. A letter from the IRS. 1 While this missive is not technically an audit the failure to resolve it may.

A correspondence audit is simply a letter from the IRS notifying you of a possible error on your return. It will also tell you which forms or items are under review and an outline of what the auditor wants to see. Real IRS letters have either a notice number CP or letter number LTR on either the top or bottom right-hand corner of the letter.

Hi Im Patrick and I work for the IRS. Weve been conditioned to fear the IRS and the prospect of an audit. When you write include this letter and provide in the spaces.

Its recommended you call the IRS at 800-829-1040. All 100 of your payments are made to the United States Treasury for federal income tax purposes never to the IRS or I.

Irs Notice Cp518 Tax Return Filing Reminder H R Block

Irs Notice Cp518 Tax Return Filing Reminder H R Block

Irs Audit Letter Cp2501 Sample 1

How To Respond To An Irs Notice Very Carefully

How To Respond To An Irs Notice Very Carefully

Irs Audit Letter Cp3219a Sample 1

Irs Audit Letter 324c Sample 1

What Do You Do When An Irs Audit Letter Arrives

What Do You Do When An Irs Audit Letter Arrives

Beware Fake Irs Letter Scam The Big Picture

Beware Fake Irs Letter Scam The Big Picture

The Dreaded Irs Audit How To Get The Best Results Varnum Llp

The Dreaded Irs Audit How To Get The Best Results Varnum Llp

Irs Scam To Be Aware Of In 2020 Verdant

Irs Scam To Be Aware Of In 2020 Verdant

Beware Fake Irs Letters Are Making The Rounds This Summer

Beware Fake Irs Letters Are Making The Rounds This Summer

Irs Audit Letter And Envelope Page 1 Line 17qq Com

Irs Audit Letter And Envelope Page 1 Line 17qq Com

The Tax Man Cometh The Times Of Israel

The Tax Man Cometh The Times Of Israel

Nine Love Letters From The I R S Tpl

Nine Love Letters From The I R S Tpl

Fake Irs Letters Being Sent To Taxpayers Irs Problem Solvers

Fake Irs Letters Being Sent To Taxpayers Irs Problem Solvers

Comments

Post a Comment