Strategies To Improve Your Credit Score

Paying your bills in a timely manner can greatly affect your credit in the long term. There are nonetheless methods that will help you strengthen your credit score rating over time.

How To Improve Your Credit Score Tips For Fico Repair

How To Improve Your Credit Score Tips For Fico Repair

Its possible to improve your credit scores by following a few simple steps including.

Strategies to improve your credit score. Closing accounts might sound like a great short-term strategy to raise your score but its not if you are carrying revolving credit card debt. Opening accounts that report to the credit bureaus maintaining low balances and paying your bills on time. Credit score scores are equally tough to rebuild.

Do these two things and then toss in one or more of the sneaky ways above to give your score a kickstart. Reduce Your Credit Utilization Ratio. The catch is which you cant max out your card as soon as your restrict has been elevated.

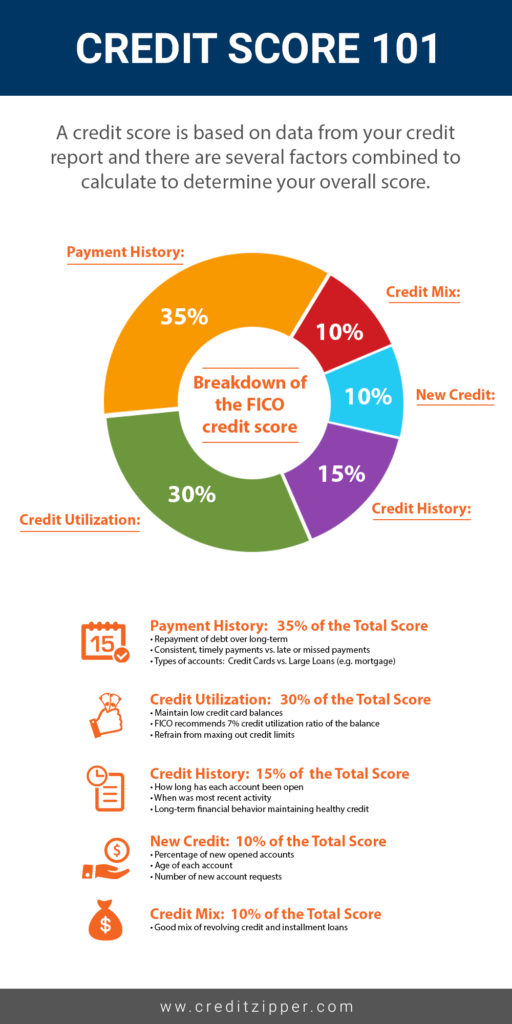

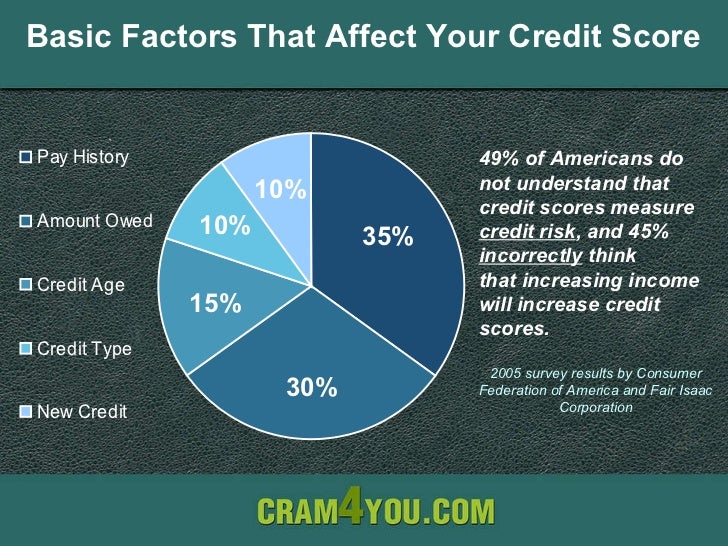

One of the fastest and easiest ways to quickly give your credit scores a boost is to carefully review all. As you can see payment history has the biggest impact on your credit score. 10 Clever Ways To Improve Your Credit Score Fast 1.

In fact payment history is one of the primary categories reviewed by the credit card bureaus when determining your credit score. Review Your Credit Reports. Your credit utilization ratio is.

Keep Your Credit Card Balances Low. Each credit card company will. Strategies To Improve Your Credit Score - If you are looking for a way to improve your rating then our convenient online service can help.

Periodically request an increase to your credit limit. It accounts for 35 percent. Ask your bank card firm to extend your restrict.

If your credit score isnt currently where you would like it to be there are some things that you can do to improve it - and by implementing these strategies you can end up reaping some nice benefits such as lower interest rates on loans and the ability to secure higher credit card limits. First keep your credit card balances low. This can help even if you are paying the same total amount each month.

Get a Handle on Bill Payments. To improve your credit it helps to know what might be working in your favor or against. Correct inaccuracies on your credit reports and make sure old information is removed.

Request Credit Limit Increases. Whether youre building your credit from scratch or rebuilding after your scores have taken a hit its important to learn how your scores are calculated and. Depending on what those are you can choose from the strategies below to help improve your score.

Reduce what you owe. A simple yet effective approach to improving your credit utilization is to make payments more frequently especially if you are near maxing out your available credit. Remember 35 of your.

8 strategies that will get you a better credit score 1. Companies giving out loans will look at your previous payments as a reflection of how you might handle any future payments. One of the best ways that you can improve your credit score is by paying your bills on time.

There are two basic strategies for lowering your credit utilization ratio and in turn improving your credit score. It tells lenders at a glance how responsibly you use credit. At the very least before you close an account ensure that it wont negatively affect your credit.

If youve accessed your credit score and got a bit of a nasty shock dont worry too much there are some remedial actions you can take to help improve matters. Your creditscore is one of the most important measures of your financial health. Tips to improve credit score credit score tips and secrets how to raise credit score fast boost my credit score instantly how to raise your credit score.

When you want to boost your credit score there are two basic rules you have to follow. They could deny you but when they do not it is a method to enhance your credit score rating over time. Several factors determine your credit score.

Make multiple payments each month. Having a detailed look of your credit report will help you assess where the weak points are in your finances. Strategies To Improve Your Credit Score Apr 2021.

A good credit score therefore is an important tool that will help your chances for success. Reducing your balances will reduce your utilization rate and can help with your scores. Second pay your bills on time and in full.

Your credit score is an important indicator that lenders use to gauge reliability and risk when assessing a loan application. The fact that you have credit cards impacts your credit score. This may also reduce the.

Pay Your Bills on Time. Likewise your payment history on. Pay Your Credit Card Bills and Loans on Time.

Its rare that closing a credit card will improve your credit score. You might be tempted to close credit card accounts that have become delinquent past due but the outstanding amount due will still up on your credit report until you pay it off. However it can be difficult to know where to start.

Improving My Credit Score Credit Zipper

Improving My Credit Score Credit Zipper

How To Improve Your Credit Score Credit Carrots

How To Improve Your Credit Score Credit Carrots

Simple Ways To Improve Your Credit Score Youtube

Simple Ways To Improve Your Credit Score Youtube

7 Quick Ways To Improve Your Credit Score Credit Repair Improve Your Credit Score Improve Credit Score

7 Quick Ways To Improve Your Credit Score Credit Repair Improve Your Credit Score Improve Credit Score

5 Sneaky Ways To Improve Your Credit Score Clark Howard

5 Sneaky Ways To Improve Your Credit Score Clark Howard

Simple Ways To Improve Your Credit Score

Simple Ways To Improve Your Credit Score

5 Ways To Improve Your Credit Score Accel Capital

5 Ways To Improve Your Credit Score Accel Capital

/things-that-boost-credit-score-8ee7c4392e764cceb0deae74b741e000.gif) How To Boost Your Credit Score

How To Boost Your Credit Score

8 Ways To Build Credit Fast Nerdwallet

8 Ways To Build Credit Fast Nerdwallet

What Credit Score Is Needed To Buy A House In 2020 Lexington Law

What Credit Score Is Needed To Buy A House In 2020 Lexington Law

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score By 100 Points In 30 Days

How To Improve Your Credit Score By 100 Points In 30 Days

Simple Ways To Improve Your Credit Score

Simple Ways To Improve Your Credit Score

Understanding Your Credit Score And Why It Matters Envision Financial

Understanding Your Credit Score And Why It Matters Envision Financial

Comments

Post a Comment