When Can You Roll Over 401k To Ira

IRA account holders who retire and take withdrawals before age 59½ are subject to a federal penalty tax of 10 and possibly state early withdrawal penalty taxes as. You cant roll a Roth 401k into a traditional IRA.

What S A 401 K Rollover And How Does It Work Ellevest

What S A 401 K Rollover And How Does It Work Ellevest

Rule of 55.

When can you roll over 401k to ira. Most people roll the money over to an IRA because they gain access to more investment options and have more control over the account. Some 401 k plans have only a half. Generally you cannot roll over funds from your active 401k but there are some exceptions.

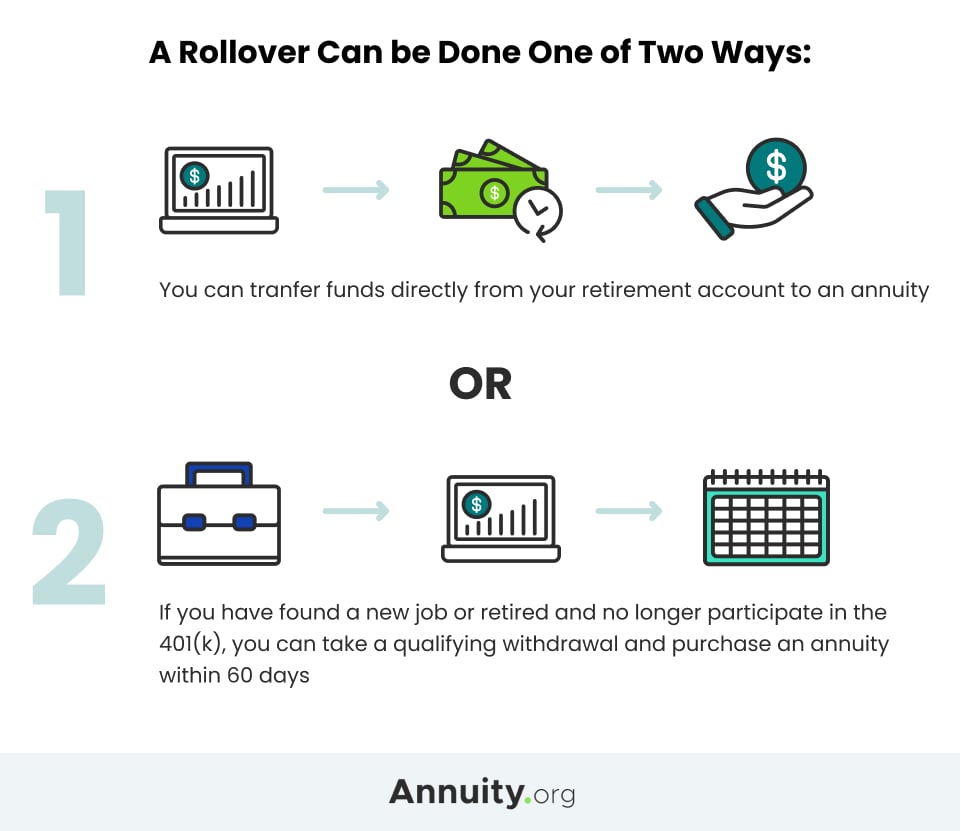

You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. Before leaving your company consult with your 401 k plan manager to determine how retirement account transfers are conducted. But it is possible to do.

If someone wants to move money to an IRA maybe the investment options are greater or the costs are lower and is in that 55-to-59½ age range one option may be to do a partial rollover if your. Taxes will be withheld from a distribution from a retirement plan see below so youll have to use other funds to roll over the full amount of the distribution. But it takes a few steps.

Because contributions to a traditional IRA are also paid pre-tax it is possible to roll over your 401 k to a traditional IRA without incurring taxes provided you follow the appropriate procedures. Thus if you retire between 55 and 595 you might want to roll over part of your 401k to your IRA to take advantage of the investment opportunities there while keeping part of the money in your 401k so you can withdraw it without penalty to pay for living expenses in the meantime. Yes Its Called an In-Service Rollover.

Some brokerage firms sweeten the. By using the 401 k strategically high earners can do those Roth conversions tax-free. For example some plans allow for in service withdrawals at age 59½.

If your 401 k is a Roth 401 k you can roll it over directly into a Roth IRA without intermediate steps or tax implications. Likewise if you had a Roth 401k you could roll the money into a Roth IRA completely tax-free. For example if in the past you rolled money directly from an old 401k into your current plan you may be able to move that money out of your plan into an IRA.

This is called a catch-up contribution. With a traditional IRA you defer paying taxes on the money in your retirement account until. Now the type of rollover IRA you transfer your money into depends on what type of 401k youre rolling over.

You dont have that advantage when you roll your 401 k to an IRA though you. When should I roll over. It may not have dawned on you that you can roll over some of your 401k to an IRA while youre still working for the employer that sponsors the 401k.

You can cash it out leave it where it is transfer it into your new employers 401k plan if one exists or roll it over into an individual retirement account IRA. I want the option to be able to transfer 401K funds to the IRA account whenever I want such as that similar to a checking and savings account. To do a rollover from a traditional 401 k to a Roth IRA is a two-step process.

If you had a traditional 401k you can transfer the money into a traditional IRA without having to pay any taxes on it youll pay taxes later when you take the money out in retirement though. Of all the support articles Ive read Its all about former employers 401K roll over and nothing on current employer. First you roll over the money to an IRA then you convert it to a Roth IRA.

If you have 10000 in your 401k or 100000 you can roll over the entire balance to an IRA. Beyond the type of IRA you want to open youll need choose a financial institution to invest with. There are two types of IRA.

If you are under age 59½ or if your plan does not have that withdrawal provision you may be able to withdraw or roll over specific types of contributions. Once youve completed the rollover youre subject to the annual contribution limits going forward. You should check how to handle any employer matching contributions.

Learn when it makes sense to roll some of your 401k into an IRA while still employed along with the advantages. However you can exceed this limit if you complete a direct rollover from 401K accounts and other employer-sponsored plans. With a 401 k you can actually start withdrawing funds at age 55 penalty-free if you leave your job.

Once you reach the age of 50 or older you can deposit an additional 1000 per year. The traditional IRA and the Roth IRA. Can I roll over a part of the 401K to a new IRA under Fidelity so I have more control over what I invest in.

Some basic investigation into the types of investment options available at various institutions should. Please advise if this. You would have to roll all your deductible IRA contributions into the 401 k.

Retirement Plan 7 Reasons To Roll Your 401 K Into An Ira Cbs News

How To Do A 401k To Ira Rollover

How To Do A 401k To Ira Rollover

Should I Roll Over My 401k Into An Ira How To Decide My Money Blog

Should I Roll Over My 401k Into An Ira How To Decide My Money Blog

What To Do With An Old 401 K 4 Choices To Consider Ticker Tape

What To Do With An Old 401 K 4 Choices To Consider Ticker Tape

The Complete 401k Rollover To Ira Guide Good Financial Cents

The Complete 401k Rollover Guide Retire

The Complete 401k Rollover Guide Retire

Roll Over Ira Or 401 K Into An Annuity Rollover Strategies

Roll Over Ira Or 401 K Into An Annuity Rollover Strategies

The Complete 401k Rollover To Ira Guide Good Financial Cents

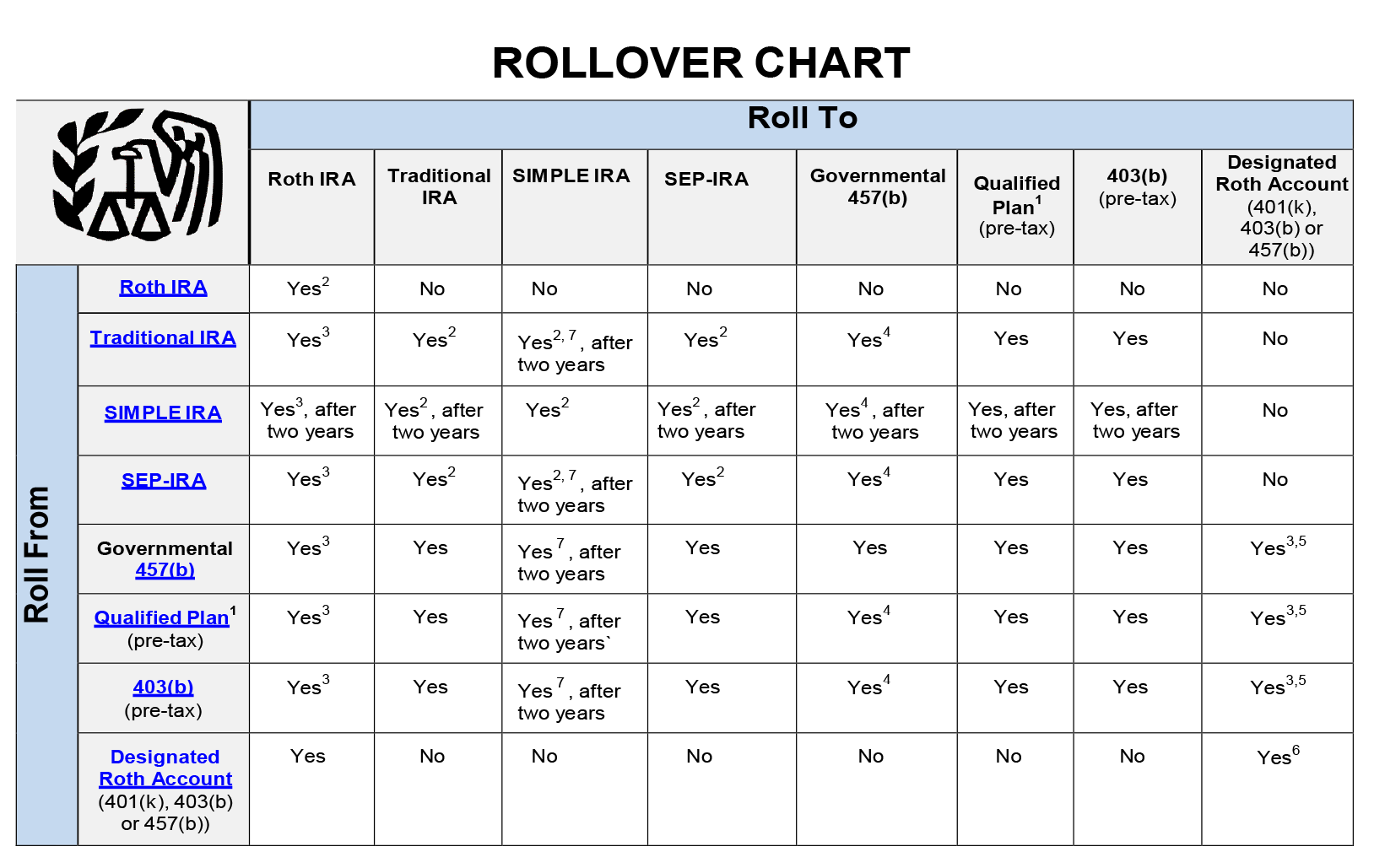

Rolling Over Funds From One Retirement Account To Another National Benefit Services

Rolling Over Funds From One Retirement Account To Another National Benefit Services

Learn The Rules Of Ira Rollover Transfer Of Funds

What Is A Rollover Ira And Should I Do It

What Is A Rollover Ira And Should I Do It

Roll Over Ira Or 401 K Into An Annuity Rollover Strategies

Roll Over Ira Or 401 K Into An Annuity Rollover Strategies

Should You Always Rollover Your 401 K Account To An Ira When You Leave An Employer Engage Advising

Comments

Post a Comment