At What Age Do You Stop Paying Income Tax

There is no age when you can stop filing taxes. If youre 65 years old and your Social Security benefits are your sole income source you can stop paying taxes on them.

Workers The Losers As Consumption Taxes Shrink Intheblack

Workers The Losers As Consumption Taxes Shrink Intheblack

However if you had over 400 in self-employment income or interest income you must file a tax return.

At what age do you stop paying income tax. We all have a personal tax-free allowance representing the amount of income you can receive before paying tax. Age is only helpful because it can increase your standard deduction. Even if you must file a tax return there are ways you can reduce the amount of tax you have to pay on your taxable income.

Wish it were different. This tax-free amount starts to reduce if your income exceeds 100000. Maybe not income but estate taxes and income from continuing holdings.

If you are married and both are over 65-years-old your combined income cannot exceed 23100 if you plan to stop filing taxes. There isnt an age limitation on paying taxes. If you are over the age of 65 and live alone without any dependents on an income of more than 11 850 you must file an income tax return.

If your spouse is younger. Theres also the option of a Roth 401 k which is not tax-deductible so youll have already paid the taxes when you put the money into the account. At age 65 or older you are eligible to exclude up to 65000 of retirement income and up to 4000 of earned income on the state tax return.

Have you used TurboTax or some other means to file your state tax return. You may or may not be free from paying income tax after age 70 depending on your circumstances. Federal income tax is incurred whenever you earn taxable income.

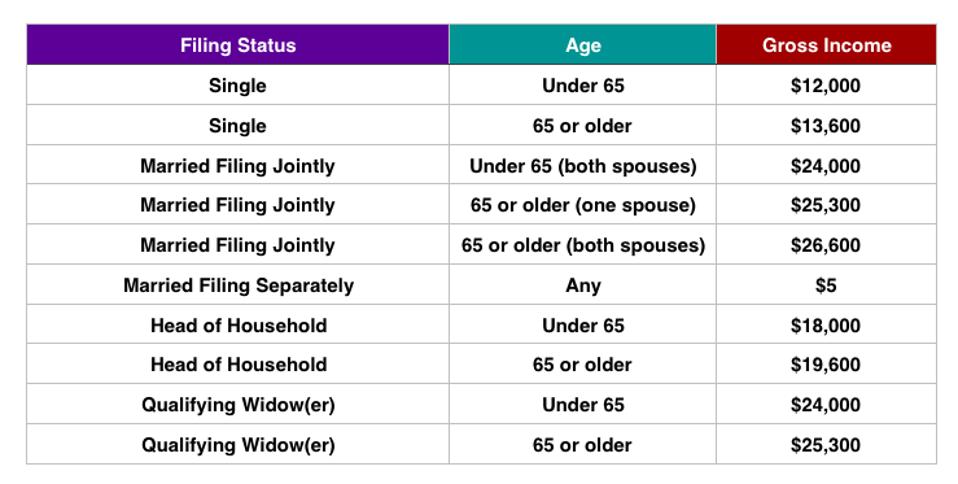

When you take it out it wont be taxed but youll need to wait until 595 years of age for it. For example you reach State Pension age. You are required to file a return if your gross income exceeds the amount listed below for your filing status.

You can be 177 and if your income is above the requirement you pay tax. 501 at this link. It falls to your filing status and income amount.

Youll continue paying Class 4 contributions until the end of the tax year in which you reach State Pension age. However people age 70 may see their income taxes decrease or be eliminated entirely because the income they now earn has changed and decreased. If your income meets the filing requirements then you must file from birth to death.

There is no age limitation on paying taxes. But if you have not yet reached the age of 59 ½ years you will be assessed a 10 percent penalty tax. If you are over age 65 that threshold is 10750.

When Can I Stop Filing Income Taxes. How have you been doing your taxes. Some people are entitled to other tax-free allowances as well such as Married.

Income beyond a certain level 142800 in 2021 isnt subject to Social Security tax but Medicare tax applies to all income. Retirement income and earned income over those amounts remain taxable by the state. Income tax requirements are based on the nature and amount of.

There are several financial metrics that determine such but the main factor is that you have a modest gross income. One estate I heard of did not settle for almost a decade because of multiple hidden holdings that to. Hello Age is not a factor in tax liability.

Individuals 65 and older can defer their property tax increase but the age of 70 by itself does not exclude an indiviual from taxation. If part of your income comes from Social Security you do not need to include this in the gross amount. As long as you are at least 65 years old and your income from sources other than Social Security is not high then the tax credit for the elderly or disabled can reduce your tax bill on a dollar-for-dollar basis.

The income limits are in IRS Pub. Usually a year or so after death depending how complicated your estate is. You only pay Income Tax if your taxable income -.

When you have a traditional IRA you may withdraw your funds at any time without justifying it. You stop paying Class 4 contributions at the end of the tax year in which you reach State Pension age.

/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png) States That Do Not Tax Earned Income

States That Do Not Tax Earned Income

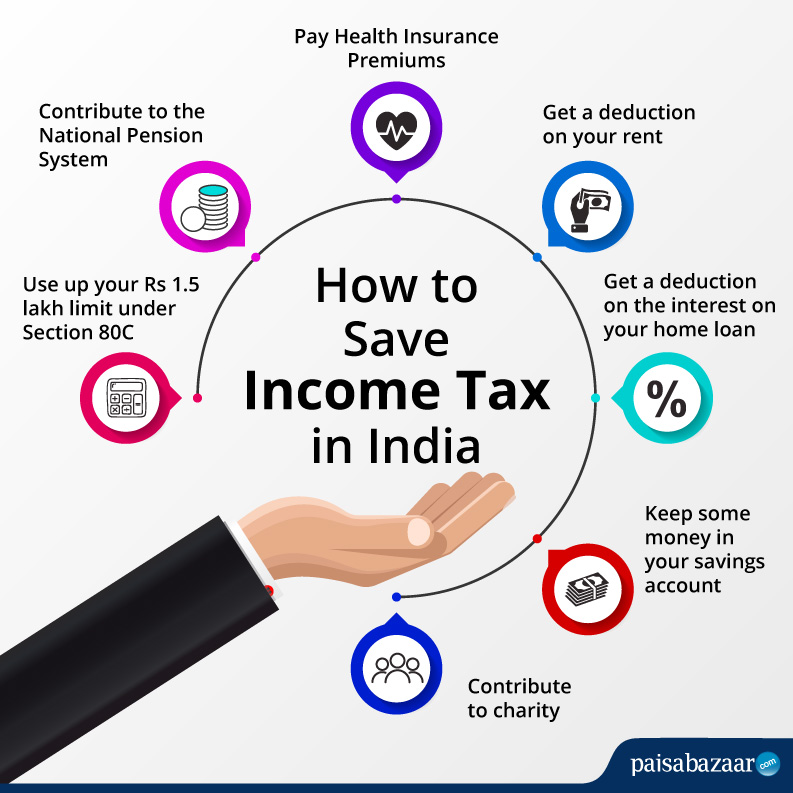

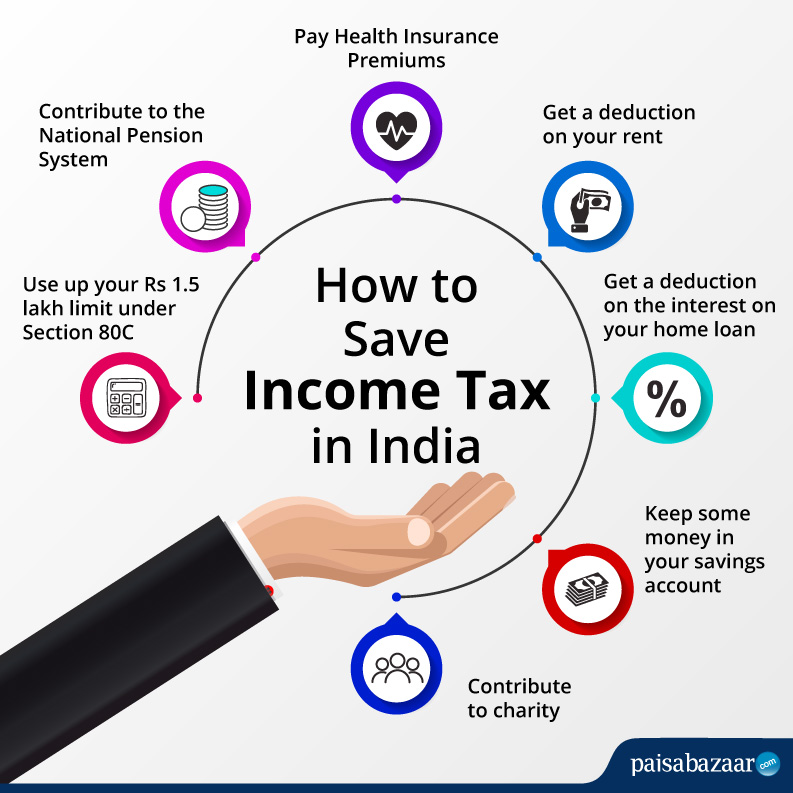

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

Do You Need To File A Tax Return In 2019

Do You Need To File A Tax Return In 2019

When Can Seniors Stop Filing Taxes Audicus

When Can Seniors Stop Filing Taxes Audicus

What Age Can You Stop Filing Income Taxes

What Age Can You Stop Filing Income Taxes

At What Age Can You Stop Filing Income Taxes

At What Age Can You Stop Filing Income Taxes

Publication 554 2020 Tax Guide For Seniors Internal Revenue Service

Publication 554 2020 Tax Guide For Seniors Internal Revenue Service

Petition Stop Paying Income Tax On Pensions Change Org

Petition Stop Paying Income Tax On Pensions Change Org

At What Age Can You Stop Filing Income Taxes

At What Age Can You Stop Filing Income Taxes

Can You Stop Paying Federal Income Taxes At Age 70

Can You Stop Paying Federal Income Taxes At Age 70

What Age Do You Stop Paying Taxes On Social Security Personal Finance Advice

What Age Do You Stop Paying Taxes On Social Security Personal Finance Advice

Do I Have To File Taxes The Answer Depends On Income Age Filing Status Bankrate Com

Do I Have To File Taxes The Answer Depends On Income Age Filing Status Bankrate Com

At What Age Do You Stop Paying Property Taxes Property Walls

At What Age Do You Stop Paying Property Taxes Property Walls

Comments

Post a Comment