How To Get 1099 From Lyft

You may not be receiving a Form 1099 if. Go to the Tax Information tab.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Uber and Lyft send out 1099 forms every year by January 31.

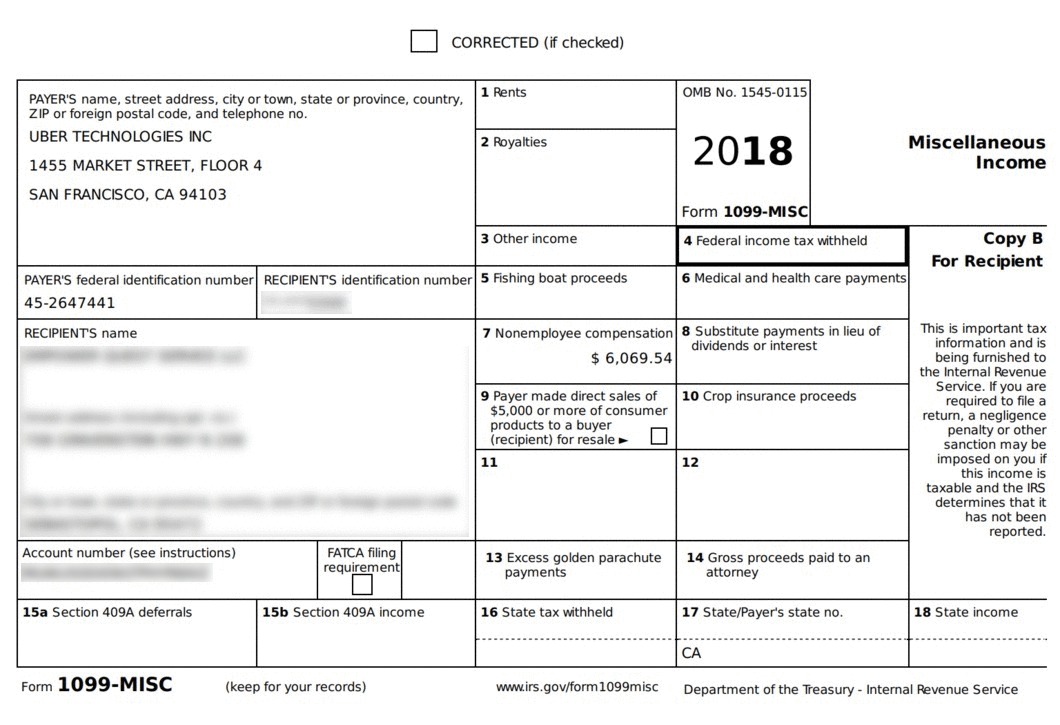

How to get 1099 from lyft. Form 1099-MISC summarizes your non-driver compensation. Additionally how do I get my tax summary from LYFT. Please view the TurboTax FAQs below for more information.

Lyft will send 1099-MISC forms to drivers who earned at least 600 through non-driving activities like referrals and other bonuses in 2018. Use them to calculate your gross income and then keep them for your records. Even if you dont receive the 1099-NEC youll likely still have to file taxes.

If you didnt receive one or both 1099s report the income from your Driver Dashboard and take a screenshot or print out the page for your records. 1099 requirements Here are the requirements to get a 1099 for the 2020 tax year. This is correct and in line with the law.

If youre eligible for a 1099-K or 1099-MISC form they can be downloaded from the Tax Information tab of your Driver Dashboard. Also question is how do I get my 1099 from LYFT. If you do not receive a paper form you still need to report the income.

As a Lyft driver you should go through the year assuming that youre going to have to pay self-employment tax next season. How To Get Lyft Tax 1099 Forms__Try Cash App using my code and well each get 5. If your earning was less than 20000 you can.

TurboTax import your income documents from Lyft. Drivers who earned at least 600 from non-driving activities like referral bonuses incentives mentoring in the past year. If you made more than 599 through those payments Lyft should send you a Form 1009-K that summarizes those earnings.

HOW DO I GET MY 1099S FROM UBER LYFT. Forms 1099 are not returned with your tax return. You will just need to indicate that your a Lyft Driver.

Go to the Tax Information tab. When using TurboTax Online you may be able to import your Lyft income 1099-NEC 1099-K and expenses platform fees service fees third-party fees Express Pay fees Express Drive rental fees and tolls info after youve identified yourself as an Lyft driver. Your Annual Summary and any 1099 forms you qualified for requirements below are available in your Driver Dashboard.

If youve earned less than 20K with Lyft in 2018 youll have all. Youll likely still have to file your taxes even if you dont receive a 1099. If you have not received your 1099 form from Uber or Lyft you may need to reach out to Uber and Lyft to get those forms.

If you did not make enough to. Some drivers qualify to get a 1099-K or 1099-NEC from Lyft. If you qualify to receive a 1099 the easiest way to access your document is to download it directly from your partner dashboard.

What else can I do to reduce my tax bill. After you select importing from Lyft well ask you to enter your phone number. If so you can log in to the Lyft account dashboard and get your Lyft 1099 Tax form.

Form 1099-NEC Form 1099-K Lyft platform fees Service fees Third party fees Express Pay fees Express Drive rental fees Tolls Your mileage wont be imported. How to find Lyft fedral 1099-k 1099-Misc and summary - YouTube. IRS Form 1099-K summarizes the income you earned through payment card and third-party transactions.

It is only the requirements for Lyft to send a paper 1099 form to you. We have instructions on how to. How to find Lyft fedral 1099-k 1099-Misc and summary.

You will need to contact both companies for your missing forms. The IRS knows you made that income all electronic payments are tracked and you will likely get. Customers must use a card to pay on each ride that you provide.

How do I get my 1099 from Uber. Please note Lyft only issues Form 1099 to drivers who earned more than 20000 during the calendar year January 1 to December 31. Under the Documents header select Download to download your Annual Summary or tax forms.

To view or download using a computer. You can import your Lyft income and most of your expenses including. If you dont see a 1099 form in your Dashboard you can use your Annual Summary to file your taxes.

Weve put together a list of the 6 fastest ways to get in touch with Uber here and the six best ways to contact Lyft customer support here. If youre eligible for a 1099-K or 1099-MISC form they can be downloaded from the Tax Information tab of your Driver Dashboard.

Lyft S Us Tax Site For Drivers Lyft

Lyft S Us Tax Site For Drivers Lyft

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Uberlyftdrivers Com

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Uberlyftdrivers Com

How Do Uber And Lyft Drivers Count Income Get It Back Tax Credits For People Who Work

How Do Uber And Lyft Drivers Count Income Get It Back Tax Credits For People Who Work

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Turbotax Self Employed Explained How To File Rideshare Taxes Advice Experiences Uber Drivers Forum For Customer Service Tips Experience

Uber Or Lyft Taxes What To Do Without A 1099 Form Rideshare Dashboard

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

How Do Uber And Lyft Drivers Count Income Get It Back Tax Credits For People Who Work

How Do Uber And Lyft Drivers Count Income Get It Back Tax Credits For People Who Work

Turbotax For Lyft Drivers Tips For Deductions Filing

Turbotax For Lyft Drivers Tips For Deductions Filing

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Get Your Employment Or Income Verification At Lyft

How To Get Your Employment Or Income Verification At Lyft

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Uber And Lyft Taxes 2016 1099 Forms Are Now Available Rideshare Dashboard

Comments

Post a Comment