State Tax Refund 2019

The Wheres My Refund. Your refund isnt taxable if the box there is checked.

Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos

Tax Reform Impact What You Should Know For 2019 Turbotax Tax Tips Videos

Your 2019 tax refund is for overpayment of taxes in 2019 The IRS began accepting 2019 tax returns on January 27 2020.

State tax refund 2019. If your mailing address is 1234 Main Street the numbers are 1234. State Refund Status 2019. See Refund amount requested to learn how to locate this amount.

Remember state refunds arent taxable even if you did itemize if you opted to deduct state and local sales tax instead of state income tax. March 29 2019 In Rev. You can use online tools to check your refund status amount and more.

Refunds Internal Revenue Service. However if you chose the state tax deduction but did not itemize you would not report it. Enter the amount of the New York State refund you requested.

There you can find out if your refund is being processed. You would need to report it on your 2019 tax return. Before you check your state income tax refund please make sure your state tax return has been accepted by the State.

Thus only 2K of the 5K of state tax refund is taxable. All they need is internet access and three pieces of information. The first refunds in the nation were processed and issues within three weeks although most were received within 10-14 days of acceptance.

Please check your refund status at Wheres My Refund. On the first page you will see if your state income tax return got accepted by the state tax agency or department or not. When your return is complete you will see the date your refund was issued.

Up to 3 weeks. State and local estimated tax payments made during 2020 including any part of a prior year refund that you chose to have credited to your 2019 state or local income taxes. Possible Reasons for a.

State Tax Refund Status. It says in process which it has been since the first week of August. The majority of these refunds are issued before the end of May.

Get information about tax refunds and updates on the status of your e-file or paper tax return. Identify the return you wish to check the refund status for. Tool gives taxpayers access to their tax return and refund status anytime.

For more information click. Here is how to find out. The Department issues 825 million in individual income tax refunds per calendar year.

How to Check on Your State Tax Refund. Each state uses a slightly different system to let taxpayers check their tax refund status. IRS Tax Tip 2018-35 March 7 2018.

To compute the taxable state tax in 2019 you first take the 8K of re taxes from the 10K leaving only 2K. I believe this is because I itemized my deductions and reached the 10000 limit on state and local tax deductions entirely through local property taxes which were 14000 or so. Besides if you also itemize on Schedule A your 2018 state tax refund will be taxable to you in 2019.

2019-11 issued Friday the IRS addressed how the long-standing tax benefit rule interacts with the new 10000 limit on deductions of state and local taxes to determine the portion of any state or local tax refund that must be included on the taxpayers federal income tax return. Tax Day is less than a month away and if you havent filed your taxes yet nows the time to do it. Here is a complete list of links to check the tax return status in your state.

Numbers in your mailing address. To see if your state tax return was received you can check with your states revenue or taxation website. Look at line 5a of your 2019 Schedule A.

Or you can get further contact information to confirm that your return was received. Choose the form you filed from the drop-down menu. In general though there are two pieces of information that you will need in order to check on your refund.

The first important information is your Social Security number SSN. Youll note that some states do not have a personal income tax therefor no refund is necessary. State Tax Refund Not Taxable in 2020 but Taxable in 2019 On my 2020 taxes my 2019 state tax refund of 2614 received in 2020 is not considered taxable by TurboTax.

While the 2020 tax filing season is underway if your 2019 return has yet to be processed still youre not alone. Enter your Social Security number. If your total itemized deductions are greater than your standard deduction AND you dont deduct Sales Taxes.

Their Social Security number. COVID-19 Mail Processing Delays Its taking us longer to process mailed documents including. The Golden State Stimulus is not an income tax refund.

Select the tax year for the refund status you want to check. Your exact refund amount. If not you can.

How long it normally takes to receive a refund. This service only allows you to check your income tax refund status. If you do not have a SSN most states allow you to use a few different types of ID.

The exact whole dollar amount of their refund. The anticipated time frame for refund processing is 30-45 days. Check Refund Status can only be used for tax returns filed after December 31st 2007.

NO State Income Tax.

Tens Of Thousands Of Illinois Taxpayers Who Submitted Returns Early Still Waiting For Refunds Cbs Chicago

Tens Of Thousands Of Illinois Taxpayers Who Submitted Returns Early Still Waiting For Refunds Cbs Chicago

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

2019 Income Tax Refund Dates Brown Brown And Associates Cpa Tax Services For Clarksville Nashville And Springfield Tn

Online Refund Status State Income Tax

Online Refund Status State Income Tax

2020 Illinois Tax Filing Season Began Monday January 27 The Crusader Newspaper Group

2020 Illinois Tax Filing Season Began Monday January 27 The Crusader Newspaper Group

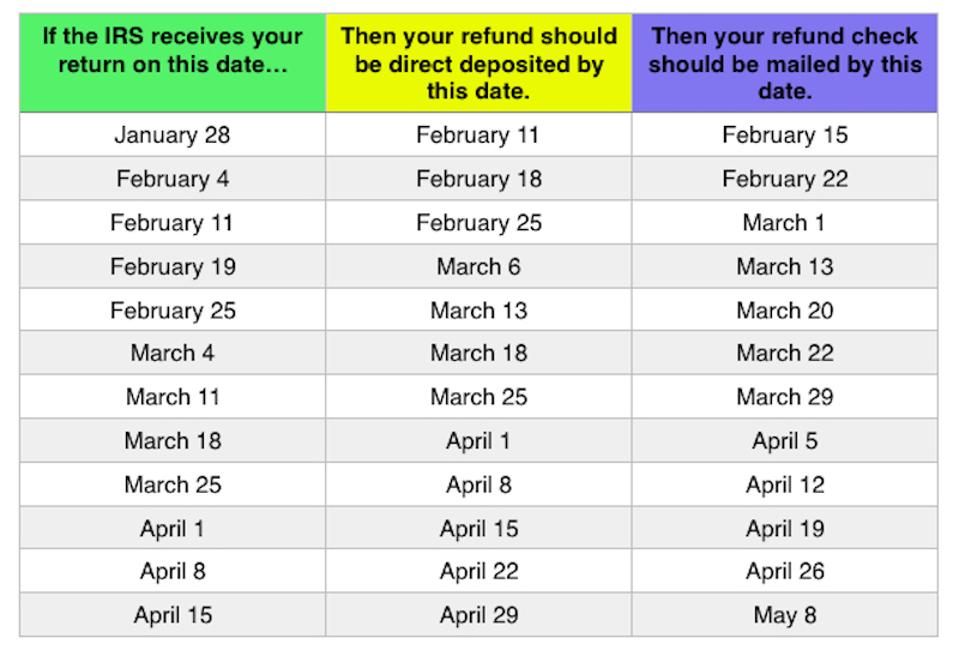

The 2019 Irs Tax Refund Schedule What To Expect The Conservative Income Investor

The 2019 Irs Tax Refund Schedule What To Expect The Conservative Income Investor

/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png) Are Tax Refunds Taxable Unfortunately Yes Sometimes

Are Tax Refunds Taxable Unfortunately Yes Sometimes

1040 State Taxes On Wks Carry Schedulea

1040 State Taxes On Wks Carry Schedulea

2020 Tax Refund Schedule When Will I Get My Money Back The Motley Fool

2020 Tax Refund Schedule When Will I Get My Money Back The Motley Fool

How Much The Average Tax Refund Is In Every State

2019 Tax Refund Chart Can Help You Guess When You Ll Receive Your Money

2019 Tax Refund Chart Can Help You Guess When You Ll Receive Your Money

A State Tax Refund Might Be Coming Your Way Fredericksburg Today

A State Tax Refund Might Be Coming Your Way Fredericksburg Today

Where S My State Tax Refund Updated For 2020 Smartasset

Where S My State Tax Refund Updated For 2020 Smartasset

Comments

Post a Comment