Fha Income Guidelines

Commission income showing a decrease from one year to the next requires. FHAs debt-to-income ratio requirements are flexible and allow lenders more flexibility on DTI ratios than conventional mortgages.

This eliminates the need for mortgagees and other stakeholders in FHA.

Fha income guidelines. If the poverty guideline is above the very low-income limit. 400 San Ramon CA 94583 All CMG Financial Guidelines will follow FHAGinnie Mae Guidelines the HUD Handbook in addition to. CMG FHA 40001 Guidelines CMG Financial a Division of CMG Mortgage Inc.

HUD Part-Time Income Guidelines allow part-time and other income to be used as qualified income on FHA loans. 3160 Crow Canyon Rd. The important aspect of your income is actually how much debt you have compared to your bring home income.

You can see why its important that your credit history is. FHA Loan Rules For Primary Income HUD 40001 has sections for hourly income salary and part-time income. The Debt-to-Income DTI ratio is what rings the bell what you look up the guidelines for an FHA loan.

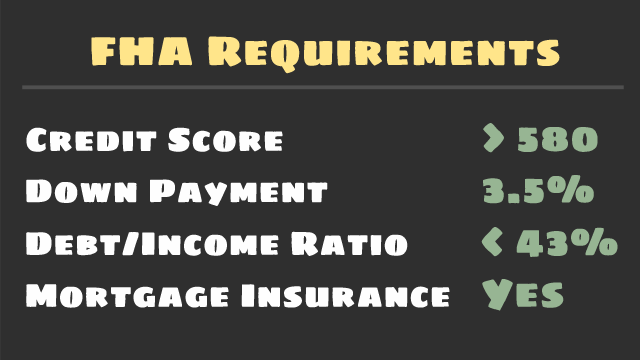

Like most down payments the source of your down payment funds including gift funds requires proper sourcing. The DIT ratio must be less than 43. FHA Loan rules require the income to be stable and reliable which the GI Bill housing payments may be for the duration of the time they are paid.

Responsibility for Servicing Actions 18. The section that includes these guidelines states that the lender is responsible for examining earnings from the home loan applicants primary employment and defines it. FHA-insured loans are suitable for low-to-median income first time home buyers.

To qualify with commission income the borrower must provide copies of signed tax returns for the last two years and the most recent pay stub. FHA loans require two years of stable employment with the same employer or in the same industry. NMLS 1820 Corporate Headquarters.

FHA mortgage insurance provides lenders with protection against loss as the result of homeowners defaulting on their mortgage loans. FHA Loans and the 35 Down Payment April 16 2021 - FHA loan rules require a minimum credit score of 580 or better for 35 down payments. If your credit score is below 580 the down payment requirement is 10.

They are then compared to the appropriate poverty guideline and if the poverty guideline is higher that value is chosen. Commission income must be averaged over the previous two years. The Federal Housing Administrations FHA Single Family Housing Policy Handbook 40001 SF Handbook is a consolidated consistent and comprehensive source of FHA Single Family Housing policy.

13 Borrowers income in a uniform manner that does not discriminate because of the 14 actual or perceived race color religion sex national origin familial status handicap 15 marital status sexual orientation gender identity source of income of the Borrower 16 or location of the Property. The FHA guidelines state that your mortgage payment not exceed 29 of. Employment and Income Requirements.

The remaining 48 states and the District of Columbia use the same poverty guidelines. Hundreds of FHA Handbooks Mortgagee Letters Housing Notices and other policy documents have been consolidated into this single source. The Federal Housing Administration FHA provides mortgage insurance on loans made by FHA- approved lenders throughout the US.

If the income will not be received for at least three years it. With respect to the FHAs self-employment income policy ML 2020-24 requires mortgagees relying on self-employment income to verify the existence of the borrowers business within 10 calendar days. FHA Credit Requirements for 2021 FHA Loan applicants must have a minimum FICO score of 580 to qualify for the low down payment advantage which is currently at 35.

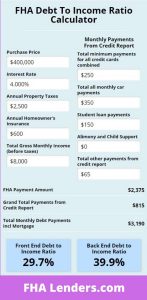

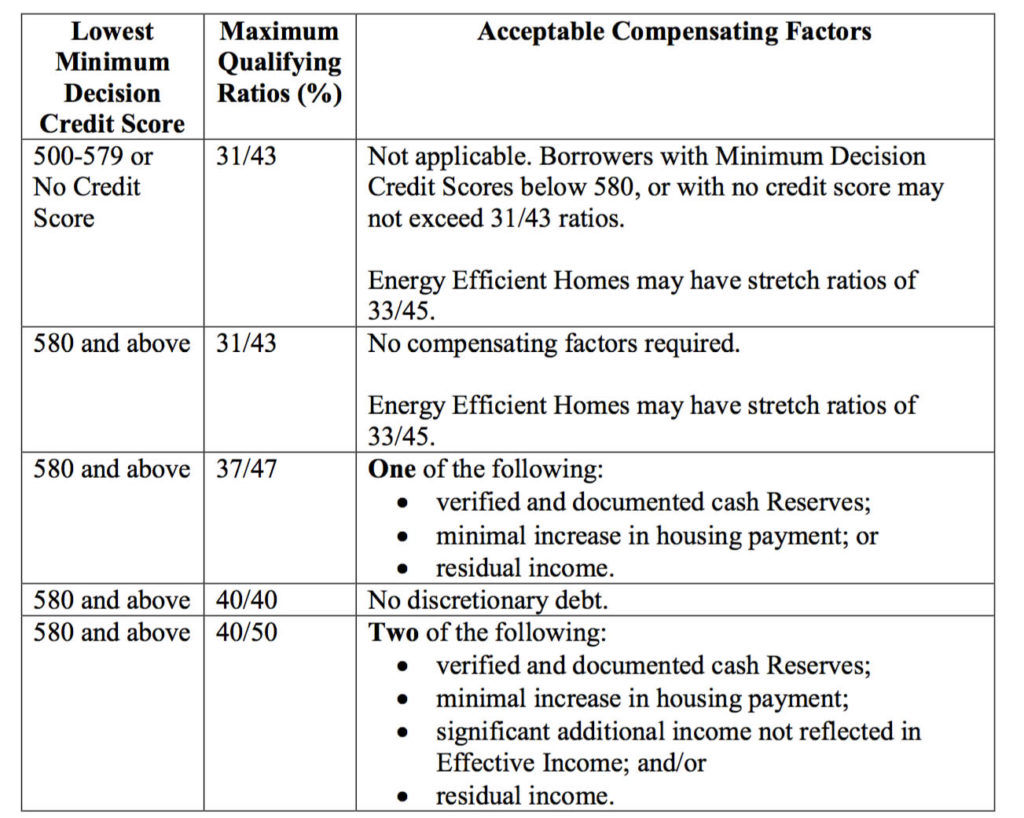

Make sure you provide a letter with any down payment gift that explains the amount. There are two debt-to-income ratios that are evaluated when you apply for a FHA loan. Weve published a thorough guide for an FHA debt-to-income ratio for the first-time homebuyers like you to figure out what this is all about to how to do it the right way for quick loan approval.

HUD 40001 says those funds must be likely to continue in order to count as verifiable income. FHA loans actually do not have a minimum income requirement nor are do they have any maximum limits on income. Income received from government assistance programs is acceptable for qualifying as long as the paying agency provides documentation indicating that the income is expected to continue for at least three years.

What kind of proof. FHA loan rules do not require you to list any such payments but they cannot be counted toward your monthly income unless you declare the income and furnish proof of it. The extremely low-income limits therefore are first calculated as 3050ths 60 percent of the Section 8 very low-income limits.

HUD 40001 explains how the lender must document your income in this area. The DIT ratio must be less than 43. However if the borrowers has part-time overtime income bonus income commission income the borrower needs to have had that income for the past two years.

These are called your debt-to-income ratios.

2021 Fha Debt To Income Ratio Requirements Calculator Fha Lenders

2021 Fha Debt To Income Ratio Requirements Calculator Fha Lenders

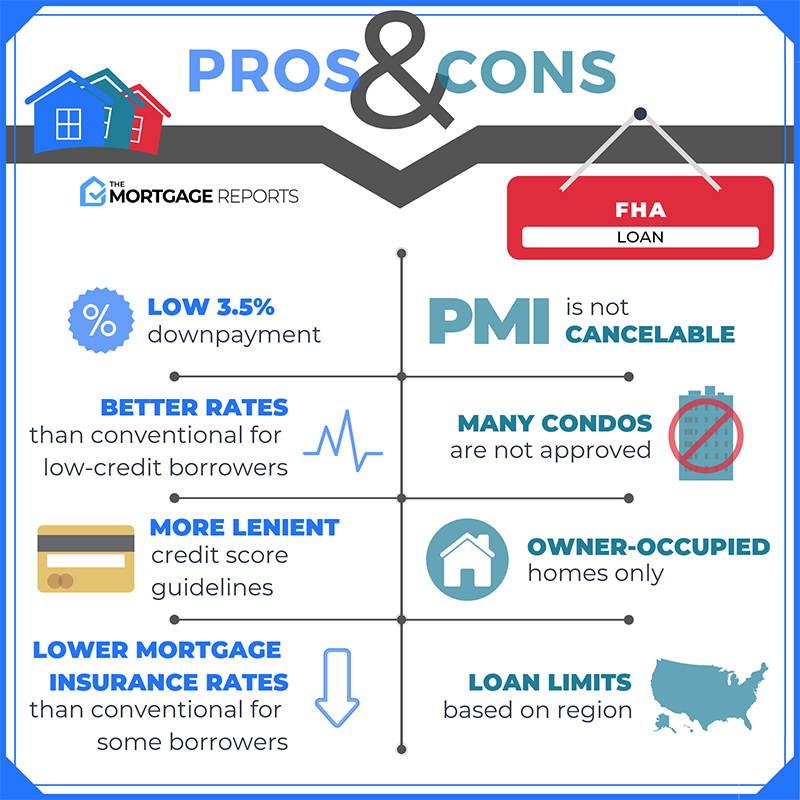

Fha Loans 2021 Loan Requirements Guidelines How To Qualify

Fha Loans 2021 Loan Requirements Guidelines How To Qualify

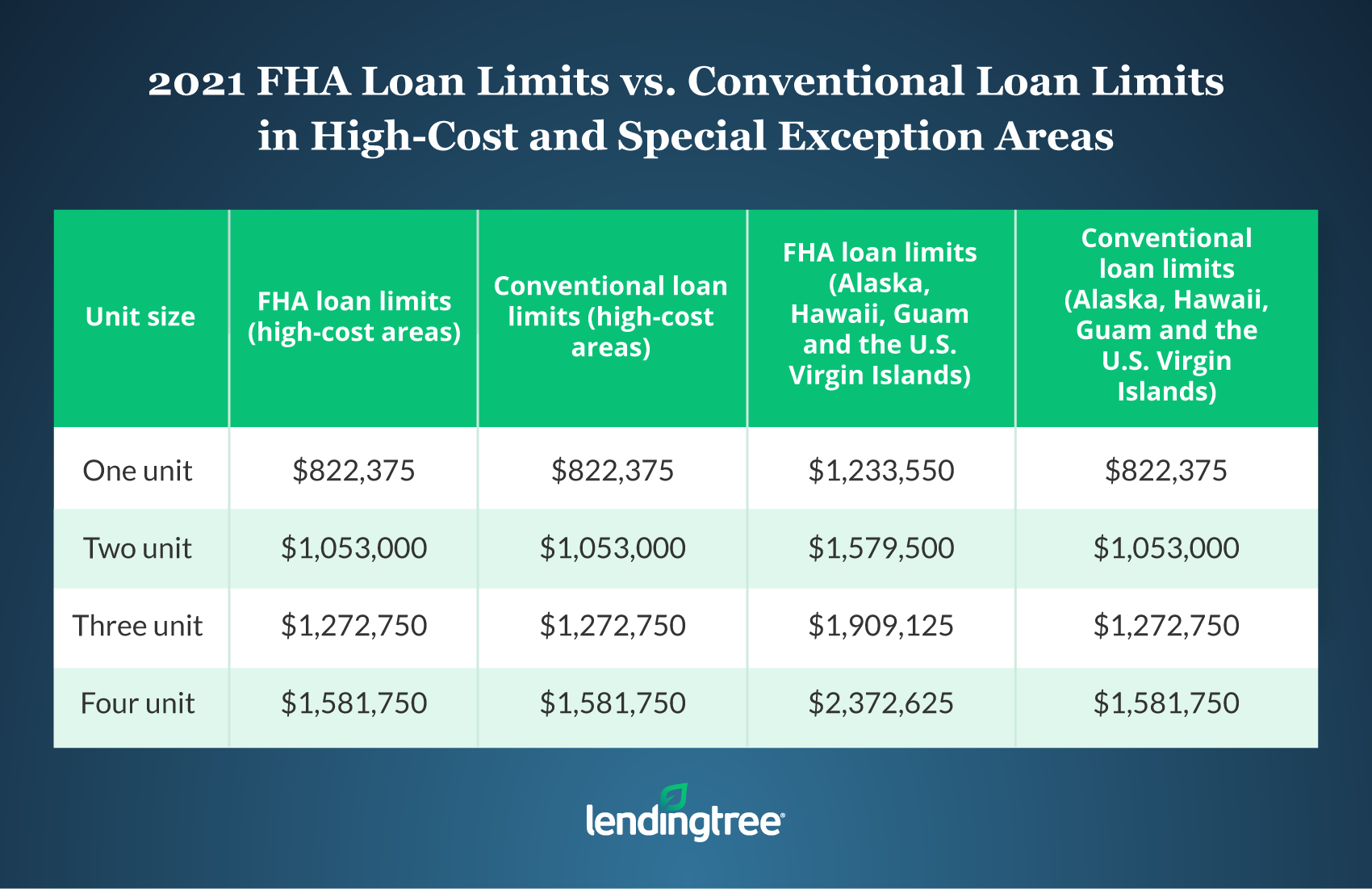

Fha Loan Limits In 2021 Lendingtree

Fha Loan Limits In 2021 Lendingtree

Fha Loan Guide Requirements Rates And Benefits 2021

Fha Loan Guide Requirements Rates And Benefits 2021

Fha Debt To Income Dti Ratio Requirements 2019

Fha Vs Conventional Choosing Which Loan Is Best For You

Fha Vs Conventional Choosing Which Loan Is Best For You

2021 Fha Qualifying Guidelines Fha Mortgage Source

Fha Criteria For 2012 Borrowers Can Expect More Of The Same

Are There Income Requirements For An Fha Mortgage

Are There Income Requirements For An Fha Mortgage

Income Requirements For An Fha Loan Part Two Fha News And Views

Income Requirements For An Fha Loan Part Two Fha News And Views

Fha Vs Conventional Which Low Down Payment Loan Is Best

Fha Vs Conventional Which Low Down Payment Loan Is Best

Fha Requirements Debt Guidelines

Fha Requirements Debt Guidelines

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Comments

Post a Comment