How To Tell If A Stock Is Good

One is by evaluation of the stocks intrinsic value. After a while youll see the same stocks run again and again.

/using-price-to-earnings-356427-FINAL2-b2131aeaca004b6aa094e5fd986becab.png) Using The P E Ratio To Value A Stock

Using The P E Ratio To Value A Stock

Logically if the current stock price is below this value then it is likely to be a good buy.

/using-price-to-earnings-356427-FINAL2-b2131aeaca004b6aa094e5fd986becab.png)

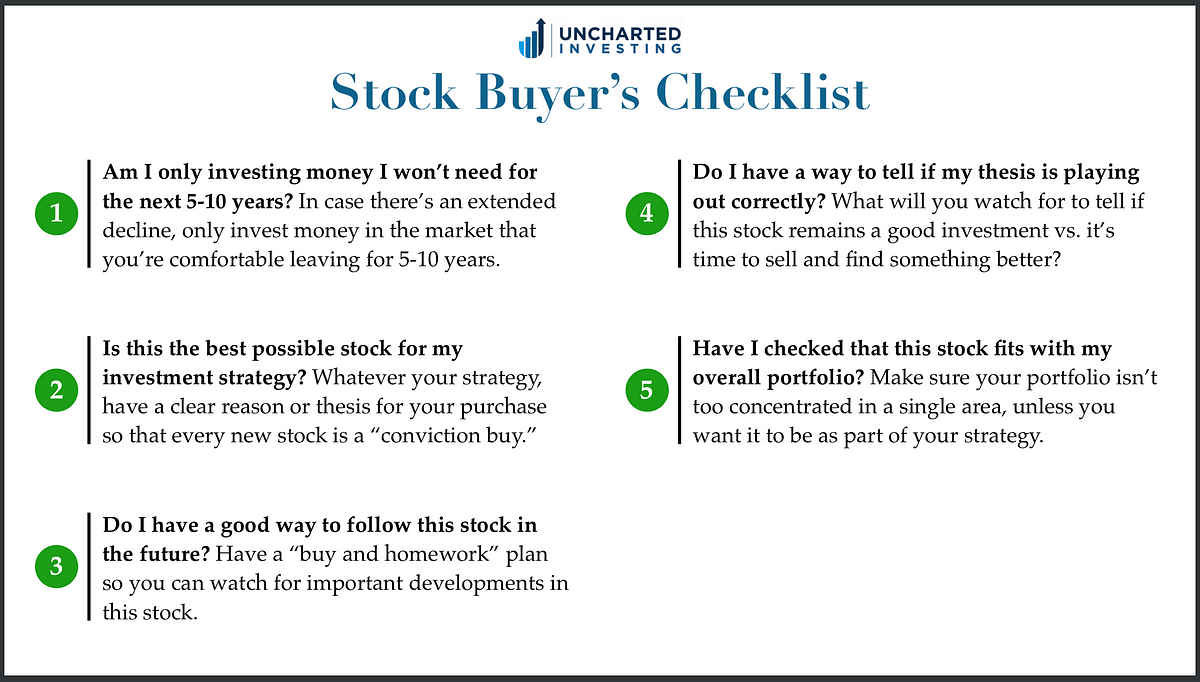

How to tell if a stock is good. Take the price per share and divide it by earnings per share. If so its a pretty good indication that the company is doing something right. Using discount rate can help you tell if a stock is a good or bad buy and if its worth the price it is trading at today.

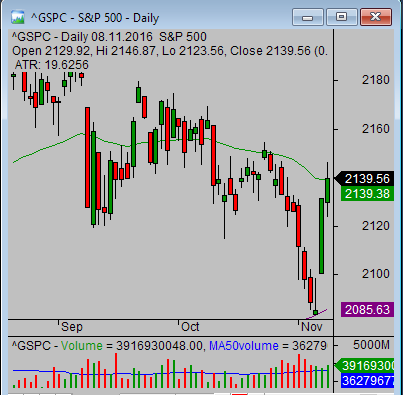

Buy the dip is one of the biggest memes on Financial Twitter fintwit. Always check the volume and the public float as soon as you find a stock with breaking news. Its good to find a rhythm that works for you.

There are two ways one can predict stock price. Stock picking can seem confusing but using fundamental analysis and ratios can help you find long-term investing opportunities. These income investments in.

Put in a lot of screen time. 7 of the Best Tech Dividend Stocks. The current stock price is higher than its fair value meaning that the stock is overvalued.

Both things impact the pace of a stocks movement. Ratio analysis isnt only for individual stock pickers as this. Its fitting to use its PE to help determine if its cheap or not.

For example Toronto-Dominion Bank stock would be considered a value stock. Its good to get to know them over time. The current stock price is equal to its fair value.

If the stock pays a dividend you might want to use the dividend-adjusted PEG ratio formula. The stock price is where its supposed to be and you would be able to buy the stock for its intrinsic value fair value. As such traders and investors are always looking for.

Its fitting to use its PE to help determine. In this case the lower the number the better with anything at one or below considered a good deal. 7 Ways to Tell if a Stock Is a Good Price The price-earnings ratio is one of the simplest and most common valuation metrics.

PE ratio earnings growth dividend yield The absolute upper threshold that most people want to consider is a ratio of two. Second is by trying to guess stocks future PE and. You would currently pay a premium for what its truly worth.

Even small regular improvement over a long period can be a positive. Whether your an investor or a day trader knowing how to tell if a stock is bottoming out is a great way to find good entries in stocks. Other valuation techniques include looking to a companys dividend growth and comparing a stocks.

How to Evaluate Stock Performance Consider Total Returns Over the Right Period. Wayne Duggan April 22 2021. A stocks performance needs to be placed in the right context to.

To evaluate a stock review its performance against a benchmark. Net income divided by shareholder equity The return on equity will tell you how efficient a company is being with shareholder equity says Admans. Telecom stocks are a good source of dividend yield.

After all we wouldnt take on big. Users like Ramp Capital are famous for their relentless bullishness in the face of corrections in the broad market. Put It in Perspective.

How To Sell Stocks Want Long Term Profits Take Many Gains This Way

How To Sell Stocks Want Long Term Profits Take Many Gains This Way

When Should You Buy A Stock Investor S Handbook

When Should You Buy A Stock Investor S Handbook

Best Time S Of Day Week And Month To Trade Stocks

How To Read Stocks Charts Basics And What To Look For Thestreet

How To Read Stocks Charts Basics And What To Look For Thestreet

How To Tell If A Stock Is Good Or Bad Covered Call Basics

How To Tell If A Stock Is Good Or Bad Covered Call Basics

How Do You Know If A Stock Is Good Stocks Walls

/GettyImages-932632502-d3c8d3de9b8f45c98718004d0da75eaa.jpg) When To Buy A Stock And When To Sell A Stock 5 Tips

When To Buy A Stock And When To Sell A Stock 5 Tips

Ways To Identify Bullish And Bearish Stocks Simple Stock Trading

Ways To Identify Bullish And Bearish Stocks Simple Stock Trading

How To Figure Out If A Stock Is Worth Buying Youtube

How To Figure Out If A Stock Is Worth Buying Youtube

Investing 101 How To Read A Stock Chart For Beginners

Investing 101 How To Read A Stock Chart For Beginners

Ways To Identify Bullish And Bearish Stocks Simple Stock Trading

Ways To Identify Bullish And Bearish Stocks Simple Stock Trading

How To Define Overvalued Stocks Quora

How Do You Know If A Stock Is Good Stocks Walls

Is Hormel A Good Dividend Stock The Motley Fool

Is Hormel A Good Dividend Stock The Motley Fool

Comments

Post a Comment