Indexed Whole Life Insurance

Texas Life Solutions specializes in term life insurance whole life insurance mortgage protection insurance and max funded indexed universal life for all of Texas including Texas and New Mexico. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

Term Life Vs Whole Life Insurance Understanding The Difference Clark Howard

Term Life Vs Whole Life Insurance Understanding The Difference Clark Howard

Whole Life Insurance Its the age-old Tortoise vs.

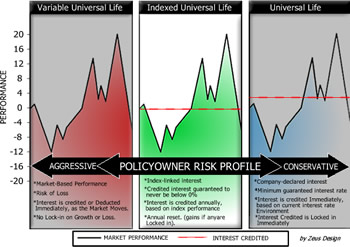

Indexed whole life insurance. Just like any life insurance rates are cheaper when you are young. It lacks the higher investment risk of other permanent life insurance plans but could still have greater returns than traditional whole life. Indexed universal life insurance is a type of permanent life insurance a life insurance policy that stays in effect for your whole life as long as the premiums are paid as opposed to a term life insurance policy which expires after a set amount of time.

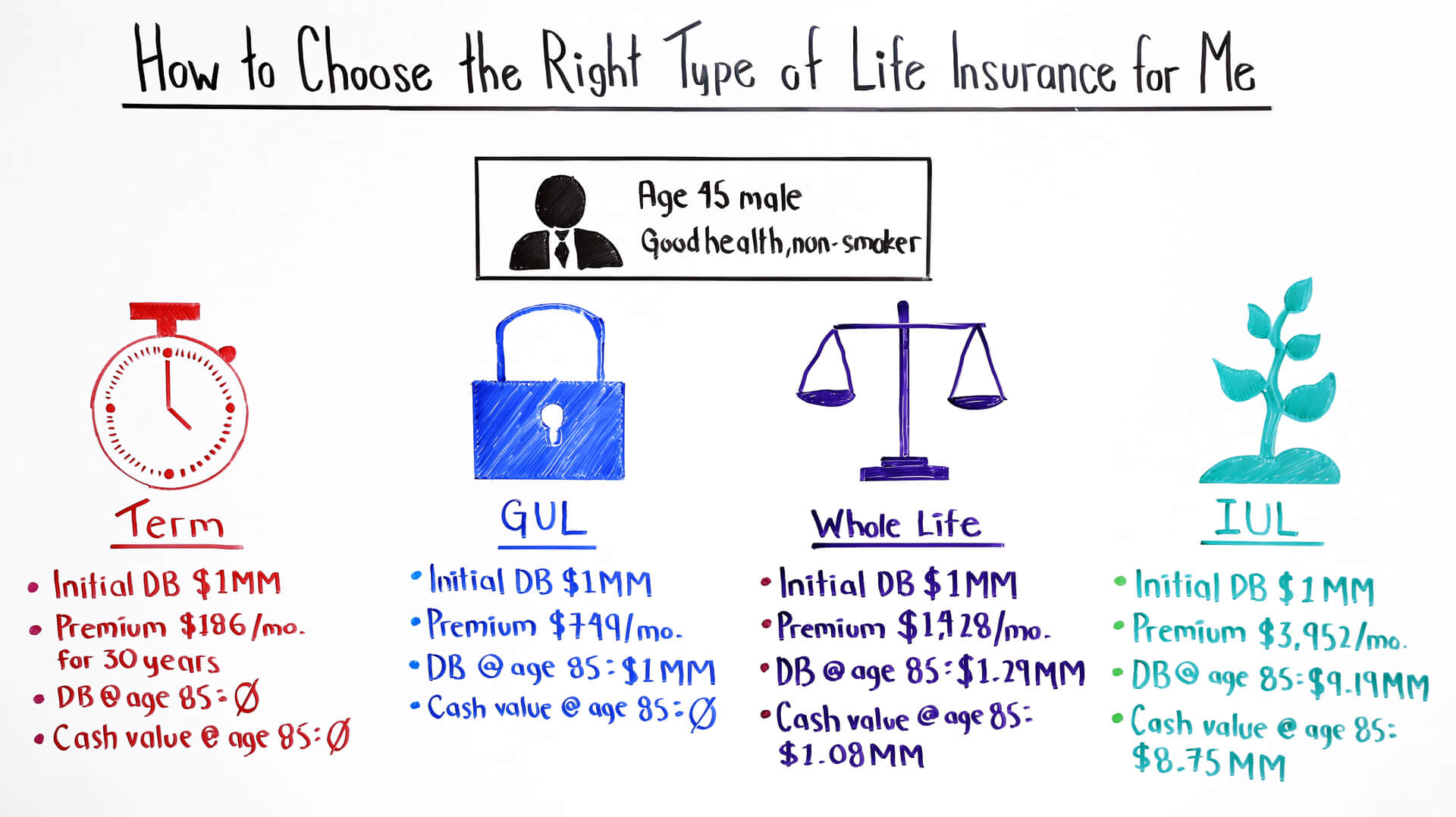

Whole Life vs Indexed Universal Life When shopping for a life insurance policy consumers have a large number of choices. From term life insurance that can be purchased for a few dollars per month to whole life insurance that covers you until the day you pass on there is. But there are many varieties of life insurance including indexed universal life IUL insurance.

Most Indexed Universal Life IUL insurance policies track the SP 500 Index on its way up without realizing any losses from market downturns SP Index Fact 1. Understanding the differences between IUL vs. The healthier you are the cheaper the policy.

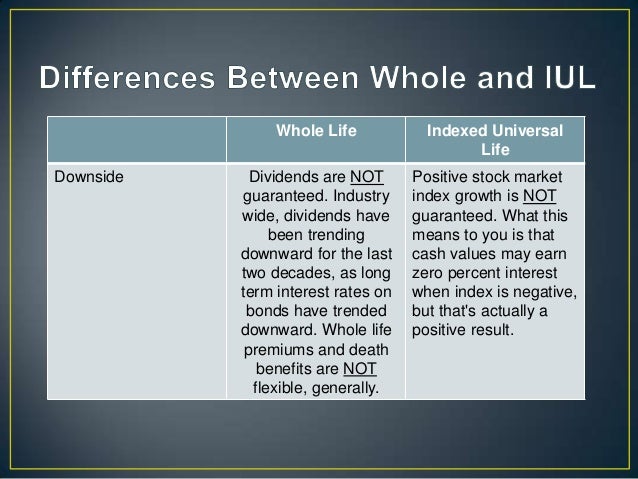

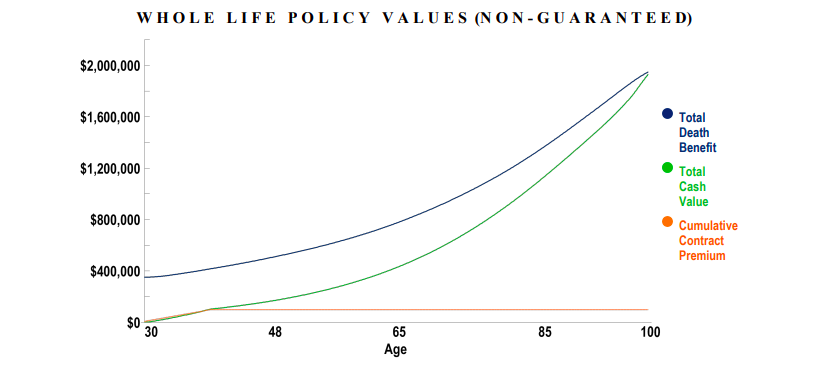

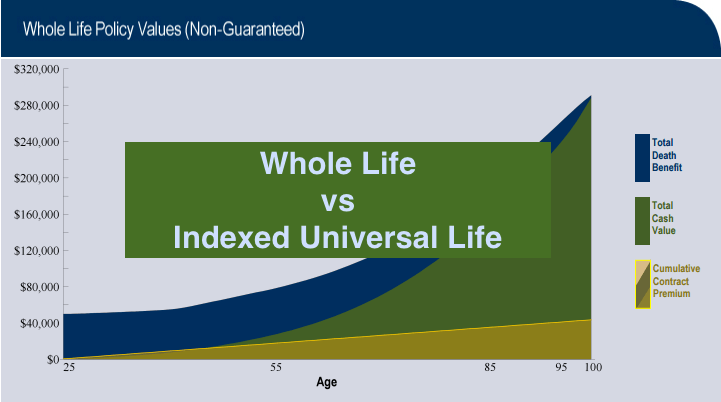

Whole life insurance and indexed universal life insurance IUL are two types of permanent policies you might consider if youre interested in lifetime coverage. What is indexed whole life insurance. Policyholders have been questioning for decades if they should choose slow-but-steady growth of Whole Life or roll the dice for the chance of faster gains.

Whole life insurance and indexed universal life insurance IUL are. Indexed whole life insurance gains cash value based on an investment index chosen by your insurance company. This allows the cash value of your policy to grow when certain stock market indexes.

In contrast index universal life does follow the stock market as it is indexed to specific sector indices such as the SP 500 or NASDAQ 100. In contrast indexed universal life insurance policies are more like retirement-income vehicles. The market has experienced annual gains more than three times as often as it sustained annual losses.

Indexed policies offer a. Guarantees vs No Guarantees. Policyholders have been questioning for decades if they should choose slow-but-steady growth of Whole Life or roll the dice for the chance of faster gains.

Also health plays a significant part in cost. An indexed universal life insurance policy gives the policyholder the opportunity to allocate cash value amounts to either a fixed account or an equity index account. When you buy permanent life insurance you have a few options.

Indexed Universal Life vs. Indexed whole life is best for those who want a policy with tax-deferred investment growth and investments with a lower potential for volatility. Indexed Universal Life vs.

Whole life insurance is like a stripped-down version of indexed universal life insurance. The older you get the more you will pay. Life insurance can provide a measure of financial protection against the worst-case scenario.

The policy has a cash value component that acts as a forced savings vehicle but at a fixed rate of return set by the insurer not based upon the performance of an index. In exchange for paying premiums life insurance provides beneficiaries with a large payment upon the insureds death. Here are the factors that affect your Indexed Universal life insurance premium.

But consumers havent been. Its a way to protect your family after you pass especially if that happens when they still depend on you financially. Whole life insurance is a non correlated asset which means that it is does not follow the movement of the stock market.

While both policies can offer the opportunity to accumulate cash value while leaving behind a death benefit for your loved ones they arent exactly the same. Whole life insurance can help you. Whole life insurance is designed to be exactly thatlife insurance.

Whole Life Insurance Its the age-old Tortoise vs. Indexed Whole Life Insurance Apr 2021. But consumers havent been the only ones asking questions.

Often these policies are whole life insurance policies meaning they are good for as long as insured individual is alive and will be paid upon that individuals death. An indexed life insurance policy is helpful for those who want to make sure the relative value of the benefit and premium never change. Two popular choices are whole life insurance and indexed universal life IUL.

Whole Life Insurance Vs Indexed Universal Life Which Is Better Youtube

Whole Life Insurance Vs Indexed Universal Life Which Is Better Youtube

Whole Life Vs Indexed Universal Life Insurance Whole Life Insurance

Equity Indexed Universal Life Insurance Compare Policy Rates And Benefits

Equity Indexed Universal Life Insurance Compare Policy Rates And Benefits

What Is Universal Life Insurance Ramseysolutions Com

What Is Universal Life Insurance Ramseysolutions Com

What Is The Difference Between Whole Life And Indexed Universal Life

What Is The Difference Between Whole Life And Indexed Universal Life

Indexed Universal Life Insurance 2021 Definitive Guide

Indexed Universal Life Insurance 2021 Definitive Guide

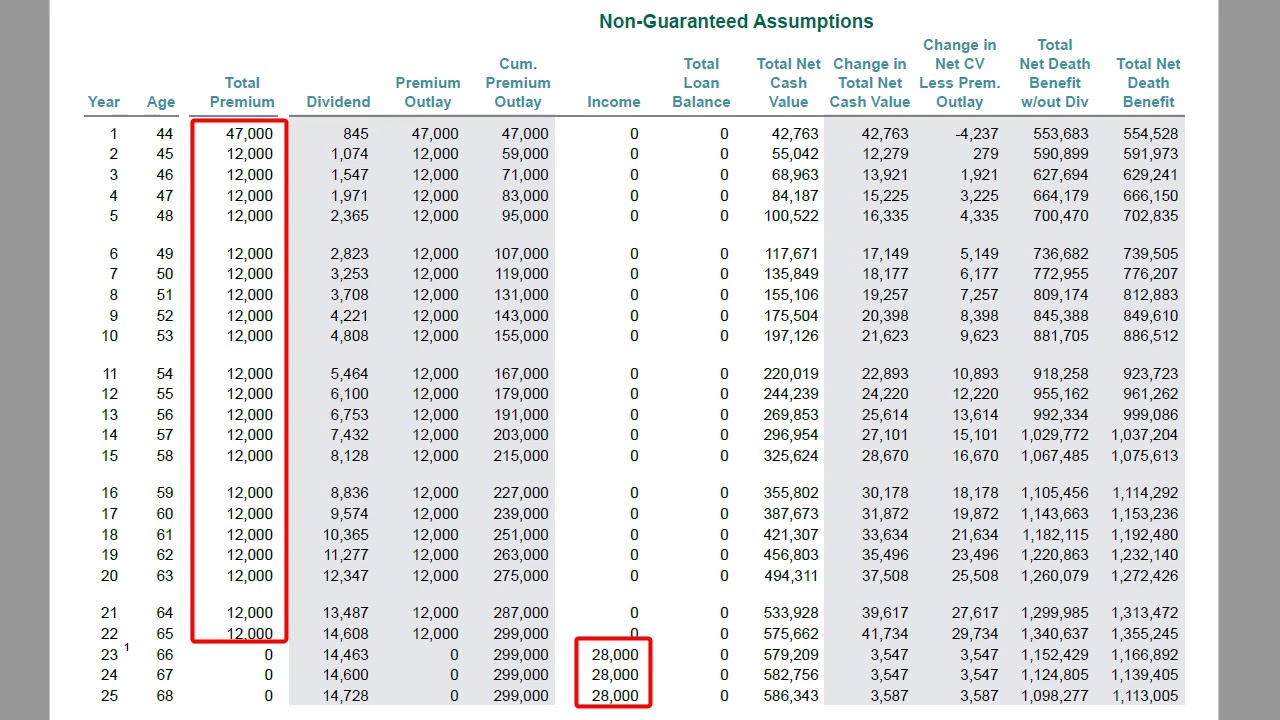

Limited Pay Whole Life Insurance What Is It See The Numbers

Limited Pay Whole Life Insurance What Is It See The Numbers

Episode 106 How To Choose The Right Type Of Life Insurance For

Episode 106 How To Choose The Right Type Of Life Insurance For

Whole Life Vs Indexed Universal Life Insurance Which Is Best

Whole Life Vs Indexed Universal Life Insurance Which Is Best

Whole Life Vs Indexed Universal Life What Insurance Agents And Financial Advisors Really Think Infinite Wealth Consultants

Should You Exchange Your Life Insurance Policy For A New One

Should You Exchange Your Life Insurance Policy For A New One

Term Insurance Whole Life Universal Life Index Universal Life Scott Zimmerman

Term Insurance Whole Life Universal Life Index Universal Life Scott Zimmerman

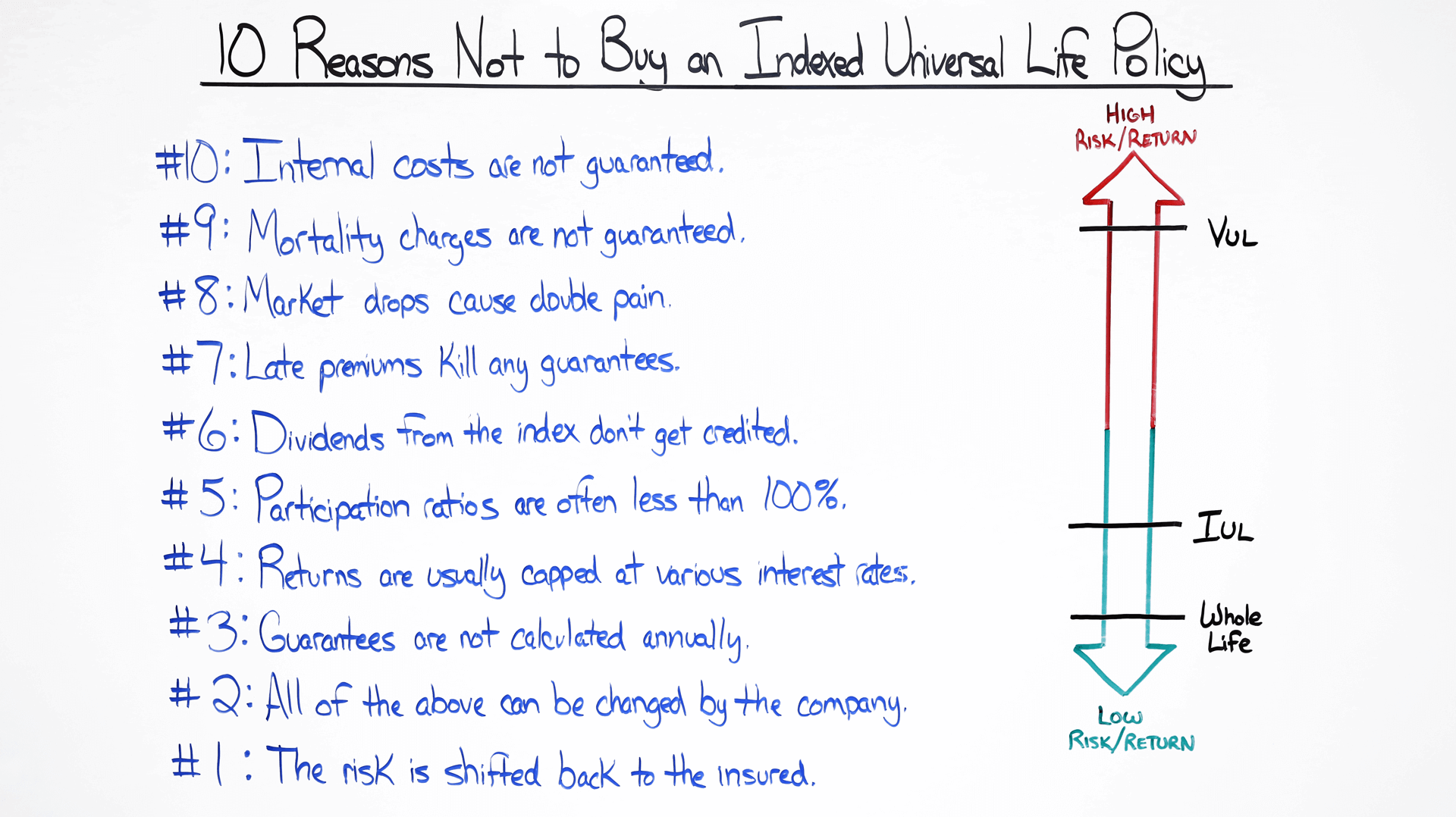

Episode 29 10 Reasons Not To Buy An Indexed Universal Life Poli

Episode 29 10 Reasons Not To Buy An Indexed Universal Life Poli

Whole Life Vs Indexed Universal Life Iul Real Numbers Explained

Whole Life Vs Indexed Universal Life Iul Real Numbers Explained

Comments

Post a Comment