Bernie Sanders Taxes 13

His proposal also creates four new brackets. With 31825 withheld from his Senate pay that gave the senator a refund of 4172 that year.

Sanders Takes Aim At Corporate America With New Tax Plan Thehill

Sanders Takes Aim At Corporate America With New Tax Plan Thehill

Sanders had about 393000 in book income last year and he and his wife reported giving.

Bernie sanders taxes 13. Bernie Sanders Takes A Swipe At Nike And Phil Knight By Alexander Cole April 02 2021 1317. We are glad he paid only 13 but we find the mind-numbing hypocrisy. And estate values above 1 billion at 77.

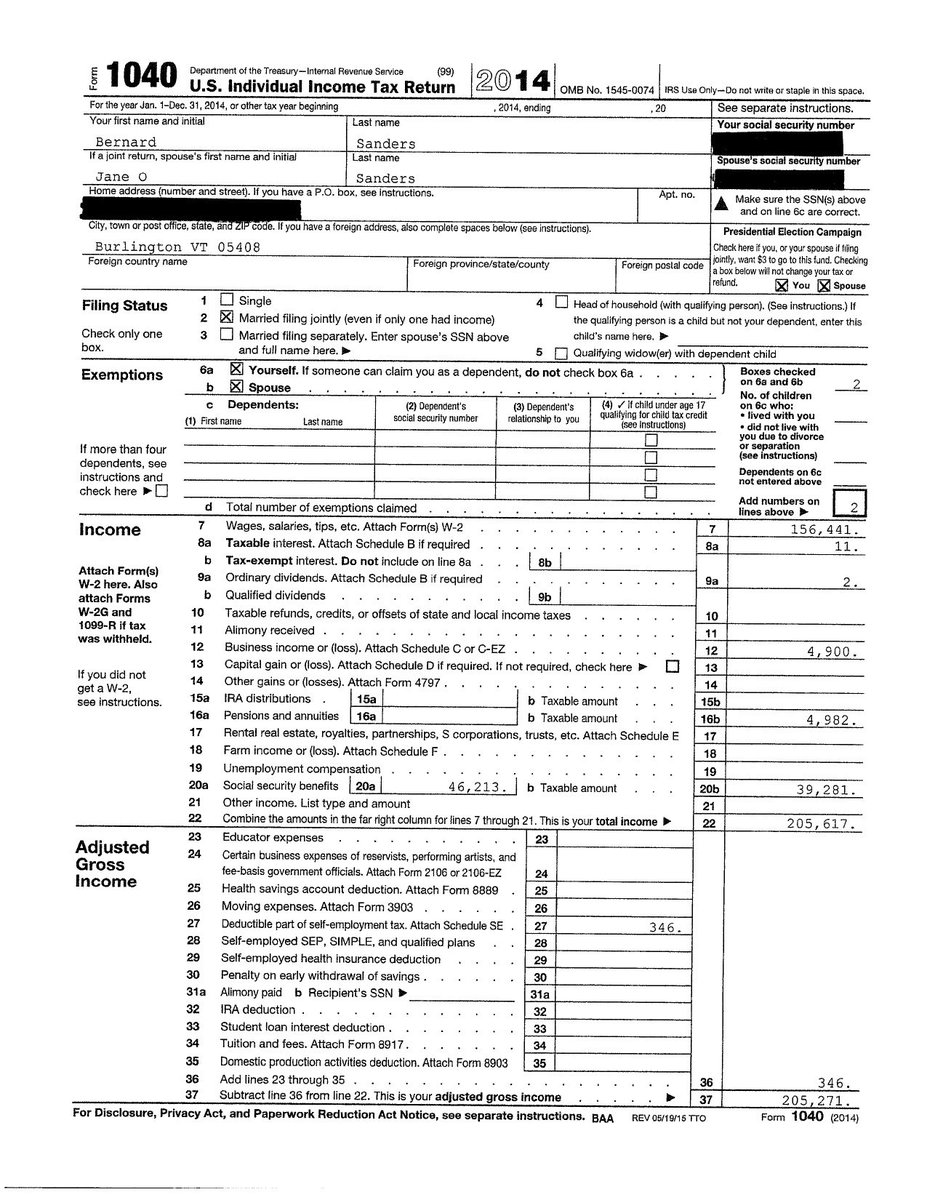

Senator from Vermont and his wife Jane had income of 205271 according to the tax return. In 2018 Sanders adjusted gross income was 561293. Updated 1040 AM ET Wed April 21 2021.

The couple had an adjusted gross income of 561293 in 2018 according to their most recent tax return. The Sanders household took in more than 205000 in 2014 and paid the feds nearly 28000 in taxes an effective rate of about 20 percent based on Sanders taxable income of 141000. In 2016 and 2017 when Sanders also earned significant income from his books his effective tax rate was 35 percent and 30 percent respectively.

Bernie wants Nike to pay more taxes. Plus the senator would levy a new 62 tax on single people with investment income above 200000 and. Taxes of 27653 on adjusted gross income of 205271 amount to an effective tax rate of about 13.

He paid a 26 percent effective tax rate on that adjusted gross income. Big corporations steering clear of party conventions Jewish prime. Senator Sanders proposes lowering the estate exemption to 35 million per decedent so 7 million for married couples.

High federal taxes forced Jen Ellis the creator of US. Democratic presidential candidate Bernie Sanders and his wife paid 27653 in federal income taxes in 2014 an effective federal tax rate of 135 percent according to their tax return released on Friday by his campaign. Bernie Breadlines Sanders who wants some of us to pay 90 of our income in taxes only paid 13 federal income tax.

Bernie Sanders I Vt proposed tax plan would raise taxes by 136 trillion over the next decade and reduce the economys size by 95 percent according to an. Opinion by Bernie Sanders for CNN Business Perspectives. Yes we will Sanders said at the CNN town hall last weekend.

The deductions left Sanders and his wife paying 27653 in federal income taxes in 2014 on a joint income of 205271 an effective federal tax rate of 135 percent. WASHINGTON Reuters - US. We will raise taxes.

In 2016 and 2017 Sanders reported earning 106 million and 113 million in adjusted gross income and paid at a 35 and 30 effective rate respectively. Today Senator Bernie Sanders I-VT introduced a plan to make the estate tax more progressive in hopes that this wealth transfer tax will raise as much as 315 billion over ten years and as much as 22 trillion from the estates of current billionaires after their passing. Sanders says the bill is aimed at the fortunes of the top 05.

Estate values between 50 million - 1 billion at 55 percent. Sanders supports repeal of some of the tax deductions that he says benefit hedge funds and corporations and would raise taxes on capital gains and the wealthiest one percent of Americans. That means they likely earned more than 95 percent of Americans according to the most recent data available from the US.

He would use some of the added revenues to lower the taxes of the middle and lower classes. 26K Views 5 1. Estate values between 10 - 50 million at 50 percent.

It would exempt the first 35 million of an individuals estate from the estate tax 7 million for married couples. However as Sanders has admitted his plan also includes tax increases on the middle class. Bernie Sanders paid 135 percent federal tax rate in 2014.

Bernie Sanders paid 134 federal income tax on over 200k income last year. Democratic presidential candidate Bernie Sanders and his wife paid 27653 in federal income taxes in 2014 an effective federal tax. Currently the payroll tax is only applied to wages up to 132900.

Estate values between 35 - 10 million are taxed at 45 percent. How to raise trillions without hiking taxes on working Americans. Bernie Sanders meme-famous mittens to stop selling recycled wool products.

Additionally Sanders would tax capital gains and dividends for households with income over 250000 and create a 22 percent income-based health care premium.

Bernie Sanders To Propose An Estate Tax On Wealthy Up To 77 Time

Bernie Sanders To Propose An Estate Tax On Wealthy Up To 77 Time

/cdn.vox-cdn.com/uploads/chorus_asset/file/6461621/graphic.0.png) Study Most Taxpayers Would Save A Lot Of Money Under President Sanders Vox

Study Most Taxpayers Would Save A Lot Of Money Under President Sanders Vox

Bernie Sanders Released His Tax Returns He S Part Of The 1 The New York Times

Bernie Sanders Released His Tax Returns He S Part Of The 1 The New York Times

How Much Billionaires Could Lose Under Sanders And Warren Wealth Taxes

How Much Billionaires Could Lose Under Sanders And Warren Wealth Taxes

How Danish Is Bernie Sanders S Tax Plan Tax Foundation

How Danish Is Bernie Sanders S Tax Plan Tax Foundation

.png) How Danish Is Bernie Sanders S Tax Plan Tax Foundation

How Danish Is Bernie Sanders S Tax Plan Tax Foundation

Joe Thorndike On Twitter Note To Berniesanders This Is Not A Tax Return It S Part Of A Tax Return Https T Co Gghcpnuqah Https T Co 16t9hqje5v

Joe Thorndike On Twitter Note To Berniesanders This Is Not A Tax Return It S Part Of A Tax Return Https T Co Gghcpnuqah Https T Co 16t9hqje5v

How Scandinavian Countries Pay For Their Government Spending

How Scandinavian Countries Pay For Their Government Spending

/cdn.vox-cdn.com/uploads/chorus_image/image/62973907/1126201872.jpg.0.jpg) Bernie Sanders Estate Tax Increase For The 99 8 Percent Act Explained Vox

Bernie Sanders Estate Tax Increase For The 99 8 Percent Act Explained Vox

Chart Visualizing Bernie Sanders Proposed Tax Reform Statista

Bernie Sanders Released His Tax Returns He S Part Of The 1 The New York Times

Bernie Sanders Released His Tax Returns He S Part Of The 1 The New York Times

Bernie Sanders Proposes 8 Tax On Extreme Wealth To Help Middle Class Curb Power Of The Rich Marketwatch

Bernie Sanders Proposes 8 Tax On Extreme Wealth To Help Middle Class Curb Power Of The Rich Marketwatch

Comments

Post a Comment