Prequalify Mortgage Loan

Going through the process will help the lender determine if you have the necessary criteria in terms of income credit and debt. The prequalification that you receive from a lender may differ from this estimate based on the lenders requirements for loan approval.

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg) Pre Qualified Vs Pre Approved What S The Difference

Pre Qualified Vs Pre Approved What S The Difference

You could prequalify for one of our many loan options and you can feel confident in your home financing decisions with step-by-step guidance from an experienced Chase Home Lending Advisor.

Prequalify mortgage loan. For a 10000 loan with a 36-month term and a 1499 APR your required monthly payment would be 34660 plus a one-time origination fee of 199. Take the first step and get prequalified. Mortgage pre-qualification is an important first step for anyone who is considering buying a home and is unsure if they are financially ready.

When youre applying for a mortgage loan however there are some distinctions between the two. Getting a mortgage prequalification is an informal evaluation that helps you determine how much home you can afford. You will need to contact a mortgage lender to prequalify for a home loan.

Mortgage pre-qualification is a written statement from a lender stating the loan amount you would qualify for according to that lenders guidelines. Smart homebuyers do their homework before they start shopping. When you prequalify for a home loan youre getting an estimate of what you might be able to borrow based on information you provide about your finances as well as a credit check.

Each company is a separate legal entity operated and managed through its own management and governance structure as required by its state of incorporation. Getting pre-qualified for a mortgage is an informal way for you to get an idea of how much you can afford to spend on a home purchase. Your lender will also be able to help you understand how taxes and insurance will affect monthly mortgage payments in your local area.

It can be an eye-opening step to not only deem if you are ready to. Find out how to get prequalified and get a customized list of the best lenders. A mortgage pre-approval is a written statement from a lender that signifies a home-buyers qualification for a specific home loan.

The following example illustrates repayment terms. Mortgage pre-qualification does not guarantee that you will get a mortgage. Mortgage prequalification is an informal evaluation of your creditworthiness and how much home you can afford.

For starters prequalification includes a simple check of your finances and credit history to give you an estimate of how much you can borrow if you qualify for the loanthere is no guarantee based on a prequalification alone. And theres no cost commitment or credit check. Quicken Loans LLC doing business as Rocket Mortgage Rocket Homes Real Estate LLC and RockLoans Marketplace LLC are separate operating subsidiaries of Rocket Companies Inc.

A mortgage prequalification is something you work through with a lender or bank. Skip to main content Affected by the coronavirus pandemic. Find a local lender in minutes who can help you get pre-qualified for a mortgage.

Income credit score and debt are just some of the factors that go into the pre-approval process. Prequalifying for your mortgage can save you time help inform your decision. The determination and loan amount are based on your self-reported income and credit information.

Find out how much home you can afford. Learn how much mortgage you qualify for by prequalifying for a home loan with US. Thats why we put together this loan prequalification.

Getting prequalified means knowing roughly how much you can borrow using financial data you provide. Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals. Learn more about mortgage basic prequalification and see if you prequalify for a mortgage loan with US.

Calculate your loan prequalification and more When figuring out how to qualify for a home loan it helps to determine your ability to qualify. Prequalification indicates whether you meet the minimum requirements for a loan and. Mortgage pre-qualification can show youre a serious and credible buyer.

Pre Approval And Pre Qualify For A Mortgage Loan

Pre Approval And Pre Qualify For A Mortgage Loan

Online Mortgage Pre Approval Process Checklist Qualifications Mortgage Prequalification Vs Preapproval

Online Mortgage Pre Approval Process Checklist Qualifications Mortgage Prequalification Vs Preapproval

Pre Qualified Vs Pre Approved Mortgage Pre Qualify Loan

Pre Qualified Vs Pre Approved Mortgage Pre Qualify Loan

Mortgage Prequalification Versus Preapproval Wells Fargo

Mortgage Prequalification Versus Preapproval Wells Fargo

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg) 5 Things You Need To Be Pre Approved For A Mortgage

5 Things You Need To Be Pre Approved For A Mortgage

Mortgage Pre Qualification Vs Pre Approval Understanding The Difference

Mortgage Pre Qualification Vs Pre Approval Understanding The Difference

Pre Approval Vs Pre Qualification What S The Difference Blue Spot

Pre Approval Vs Pre Qualification What S The Difference Blue Spot

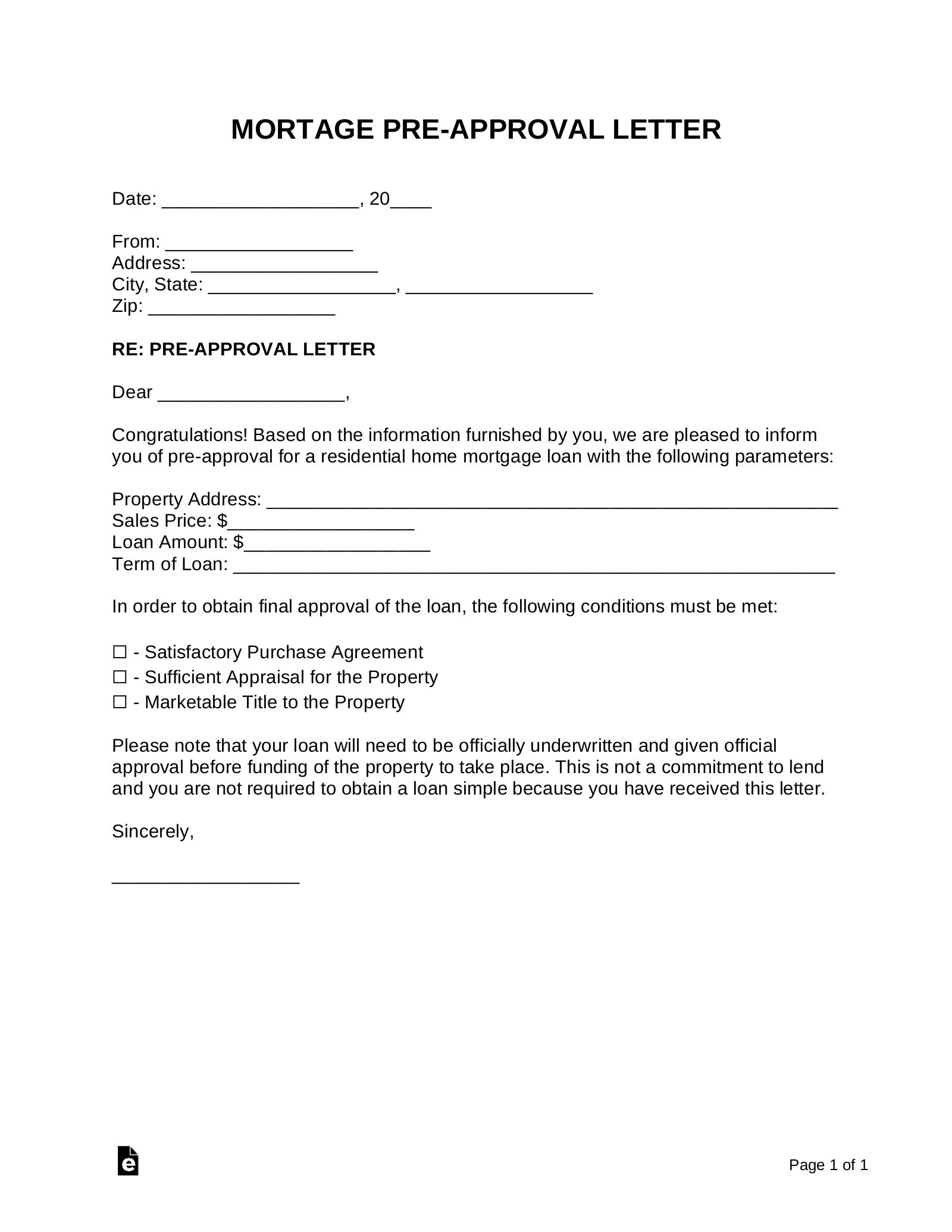

Mortgage Pre Approval Letter Sample Eforms

Mortgage Pre Approval Letter Sample Eforms

Image Result For Sample Mortgage Pre Approval Letter Preapproved Mortgage Mortgage Mortgage Banking

Image Result For Sample Mortgage Pre Approval Letter Preapproved Mortgage Mortgage Mortgage Banking

Mortgage Pre Qualification Vs Mortgage Pre Approval The Truth About Mortgage

Mortgage Pre Qualification Vs Mortgage Pre Approval The Truth About Mortgage

How To Get Pre Approved For A Mortgage Mintlife Blog

How To Get Pre Approved For A Mortgage Mintlife Blog

Mortgage Pre Qualification Letter Template Extraordinary Home Ers For Tx Plus Preferred Information Loan To Vincegray2014

Mortgage Pre Qualification Letter Template Extraordinary Home Ers For Tx Plus Preferred Information Loan To Vincegray2014

Pre Qualified Vs Pre Approved Ally

Pre Qualified Vs Pre Approved Ally

Sofi Mortgage Review Online Pre Qualification Traditional Lending

Sofi Mortgage Review Online Pre Qualification Traditional Lending

Comments

Post a Comment