Quarterly Tax Payment Dates

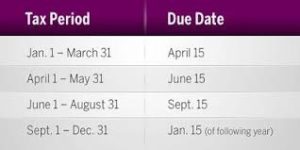

1st payment April 15 2021 2nd payment June 15 2021 3rd payment. The calendar quarters and your due dates are.

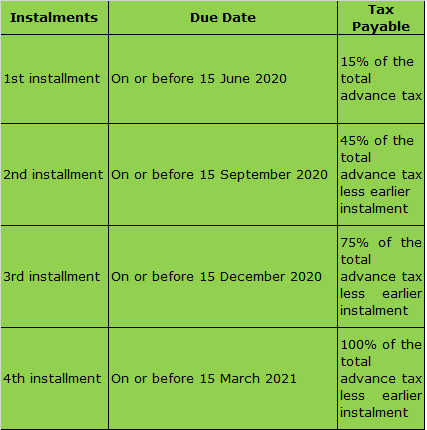

Advance Tax All About The First Instalment To Be Paid By June 15

Advance Tax All About The First Instalment To Be Paid By June 15

You can pay all of your estimated tax by April 15 2021 or in four equal amounts by the dates shown below.

Quarterly tax payment dates. When a due date falls on a weekend or legal. What are the quarterly due dates for my personal income tax estimated payments. 3rd quarter payment deadline.

Monday April 15 2019 Q2. It does not affect estimated quarterly tax payments that are still due on April 15 2021 for business owners and those who file as independent workers because they have no tax withheld by an employer. We may be compensated by advertising and affiliate programs.

April 15 is the deadline to make your first-quarter 2021 estimated tax payment using Form 1040-ES. You do not have to make the payment due on January 18 2022 if you file your 2021 tax return by January 31 2022 and pay the entire balance due with your return. 1st Quarter - April 15th 2nd Quarter - June 15th.

Second payments of both ring fence tax and other Corporation Tax. The final quarterly estimated tax deadline is on January 18 2022. Contributions to traditional and Roth IRAs for the 2020 tax year must be made by April 15 2021.

Due Dates for 2019 Estimated Quarterly Tax Payments. 2nd quarter payment deadline. The quarterly due dates for personal income tax estimated payments are as follows.

2nd QPD 25 25th June. Monday June 17 2019 Q3. The last instalment would have been 28.

First payments of both ring fence tax and other Corporation Tax. 1st quarter payment deadline. Monday September 16 2019 Q4.

Quarterly Estimated Taxes Due Dates Calculation and Late Payment Penalty July 31 2019 July 6 2019 by Pinyo Bhulipongsanon Advertiser Disclosure. Wednesday January 15 2020. Estimated tax payments are typically due on.

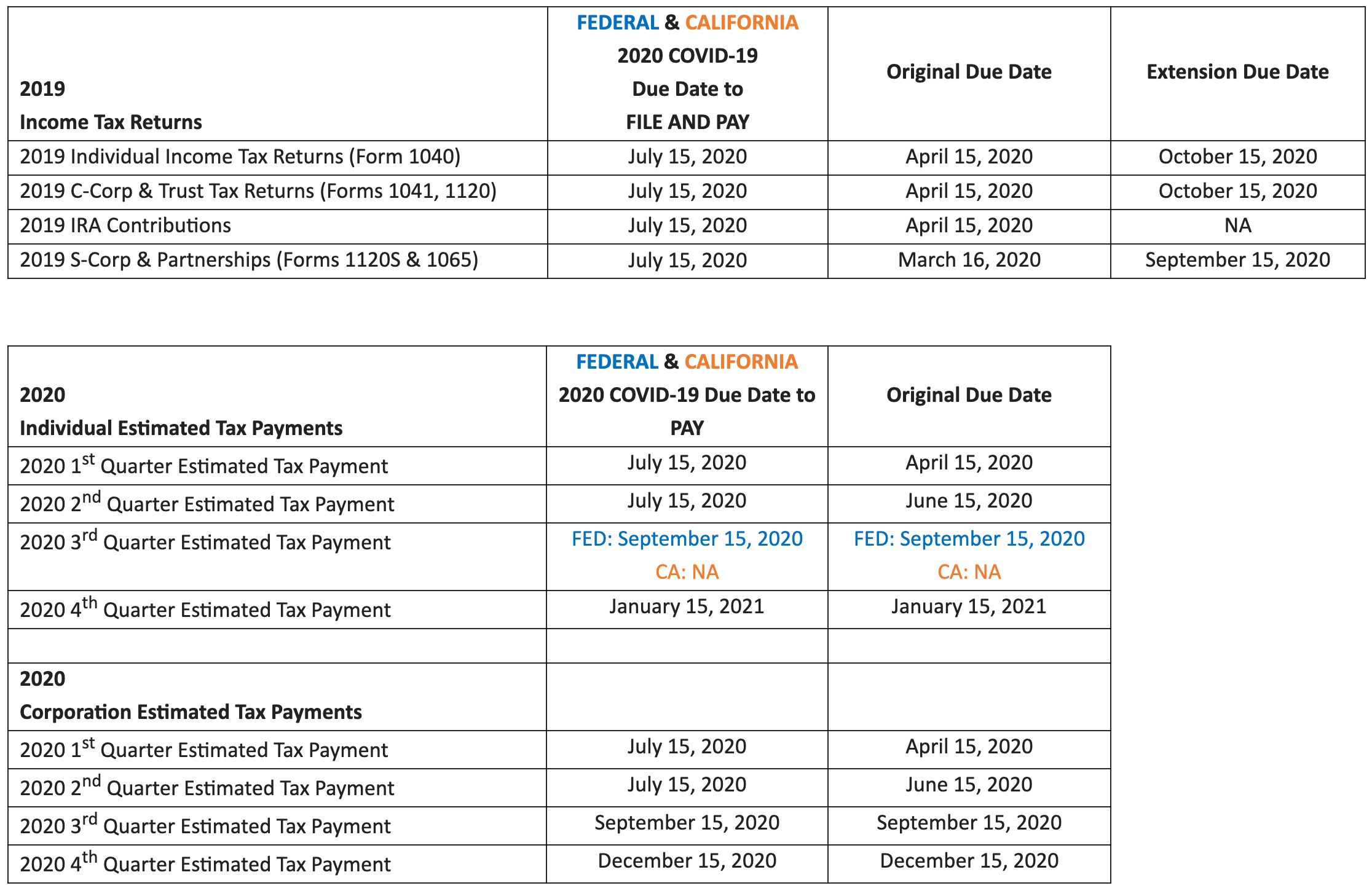

While the deadlines to file and pay certain taxes have been extended to May 17 the first quarter estimated tax payments for individuals are still due on April 15. The IRS expects you to make your quarterly payments promptly before those dates. Due by July 15.

How do I make federal quarterly estimated payments. For 2021 use Estimated Tax for Individuals Form 540-ES when paying by mail. If you are a quarterly remitter including an eligible new small employer your remittance due date is the 15th of the month after the calendar quarter in which you pay or give remuneration.

Due by April 15. 2 Deadlines in Calendar Year 2021 for 2020 Returns. Instalment payment dates for an accounting period 1 January 2020 to 14 January 2020.

The last instalment is due before the accounting period start date. 7 Zeilen The federal tax filing deadline for individuals has been extended to May 17 2021. For your 2021taxes the quarterly estimated tax deadlines are in April June September and January.

To pay your estimated tax visit payment options. What are the filing dates for federal quarterly estimated tax payments. Get details on the new tax deadlines and on coronavirus tax relief and Economic Impact Payments.

3rd QPD 30 25th September. Estimated tax payments are made once a quarter. Estimated taxes are paid on a quarterly basis with payment deadlines being April 15 June 15 September 15 and January 15 of the following year.

Employees Tax Pay As You Earn - PAYE By the 10th day of the following month. Due dates for quarterly remitters. If you miss it youll want to pay the quarterly tax payment as soon as you can.

Payment Payment due date. Quarterly Payment Dates QPDs 1st QPD 10 25th March. In general you are expected to pay estimated taxes if you expect to owe 1000 or more annually for your taxes.

How To Calculate And Pay Quarterly Estimated Taxes

How To Calculate And Pay Quarterly Estimated Taxes

Mark Your Calendar Tax Deadlines Every Business Owner Should Remember Globe Mybusiness Academy

Mark Your Calendar Tax Deadlines Every Business Owner Should Remember Globe Mybusiness Academy

Due Dates For E Filing Of Tds Tcs Return Ay 2021 22 Fy 2020 21

Due Dates For E Filing Of Tds Tcs Return Ay 2021 22 Fy 2020 21

How To Pay Quarterly Taxes Online Or By Mail Shared Economy Tax

How To Pay Quarterly Taxes Online Or By Mail Shared Economy Tax

2017 Important Tax Dates Free Printable Mazuma Business Accounting

2017 Important Tax Dates Free Printable Mazuma Business Accounting

Estimated Tax Payments Remember To Pay Timely Caramagno Associates Ltd Chicago Cpa Firm

Estimated Tax Payments Remember To Pay Timely Caramagno Associates Ltd Chicago Cpa Firm

2020 California Sales Tax Due Date

2020 California Sales Tax Due Date

How To Calculate Estimated Taxes For 2021 Benzinga

How To Calculate Estimated Taxes For 2021 Benzinga

How To Reduce Estimated Tax Penalties With Ira Distributions Financial Planning

How To Reduce Estimated Tax Penalties With Ira Distributions Financial Planning

Estimated Tax Payment Deadlines Have Changed But You Still Have Calculation Options Don T Mess With Taxes

/income-tax-deadlines-2021-75aaceca6a8f47eabc8a17a9185f24ac.png) Federal Income Tax Deadlines In 2021

Federal Income Tax Deadlines In 2021

Tax Season What To Expect Now That Tax Day Is July 15th Thomas Doll

Tax Season What To Expect Now That Tax Day Is July 15th Thomas Doll

How To Pay Quarterly Income Tax 14 Steps With Pictures

How To Pay Quarterly Income Tax 14 Steps With Pictures

Comments

Post a Comment