Getting A Preapproval Letter

What to do now Decide when to get a preapproval letter. Every lender is different.

/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg) Pre Qualified Vs Pre Approved What S The Difference

Pre Qualified Vs Pre Approved What S The Difference

Getting preapproved for a mortgage is a crucial first step in the home-buying process.

Getting a preapproval letter. Once you are pre-approved you will get a pre-approval letter stating the amount a lender thinks you will be able to borrow. A mortgage preapproval is a letter from a lender indicating that you are tentatively approved for a loan. No property appraisal or title review has yet been performed.

Whats included in a preapproval letter. A pre-approval letter can be acquired through your lender indicating that your finances have been approved and you will be allowed to borrow up to a certain amount of money as long as you meet and maintain the lenders requirements. To help smooth the homebuying process we recommend getting a mortgage pre-approval as the first step to take.

Some sellers might even require buyers to submit a pre-approval letter with their offers though having a pre-approval letter does not guarantee that your offer will be accepted by a seller. This is extremely important when determining your budget. A mortgage preapproval tells sellers you can back up your offer.

Being pre-approved for a mortgage is necessary In todays marketplace sellers expect to see a pre-approval letter. Documents Required for a Pre-Approval Letter. Thats much different from a few years ago when getting approved for a mortgage was much easier.

A pre-approval letter is your own peace of mind. When to Get a Pre-Approval Mortgage pre-approval letters are typically valid for 60 to 90 days. Once you get Verified Approval well give you a Verified Approval Letter.

When the pre-approval expires youll have to update your paper work to get a new one. It gives you an idea of how much you can borrow which will help narrow down your search to houses in your price range. It typically includes a maximum loan.

To issue a preapproval letter lenders are looking for evidence that youre capable of repaying a mortgage. There are a few reasons the preapproval letter is important. Follow up with the.

If the loan file gets a thumbs up from the underwriter your loan officer can issue a pre-approval letter. A preapproval letter provides documentation of exactly how much mortgage you have been approved to borrow. When you get preapproved you get a beautiful document called a preapproval letter also known as your PAL.

Getting a mortgage is often referred to as the mortgage process with an emphasis on the process part. The preapproval letter usually includes an estimate of your loan amount interest rate and monthly mortgage payment. To get a preapproval letter you need documents verifying your income employment assets and debts.

A preapproval letter can make a big difference for homebuyers. When you get preapproved you usually get a preapproval letter. Heres how to get one.

Its not a one-and-done type of event as much as we all want it to be but getting preapproved can set you up for success. All mortgage pre-approval letters have an expiration date. Although a preapproval puts.

Lenders put an expiration date on these letters because your finances and credit profile could. Many things can change after you get pre-approved such as your income credit history or even the interest rate. Find out what you need to do and what.

Getting a pre-approval is an important step in the homebuying process. As you can see a pre-approval letter is more meaningful because an underwriter has researched and verified your credit and capacity to repay a loan. And this documented evidence shows both Realtors and sellers that you are serious in your pursuit of a property.

Lenders typically check your credit before issuing a preapproval letter and. Find out what the lenders preapproval process is. You can show this to your real estate agent and the sellers as proof that you can obtain a large enough mortgage to.

A mortgage preapproval is a letter from a lender saying that its tentatively willing to lend you a certain amount for a house. The Mortgage Preapproval Letter. Every lender is different but in general youll need to provide bank account.

First real estate agents typically. A pre-approval letter also helps you prove to real estate agents and sellers that youre a credible buyer and able to act fast when you find the home you want to buy. Because of this your pre-approval normally lasts for 60 to 90 days.

Pre Approval Letter Sample How To Get One

Pre Approval Letter Sample How To Get One

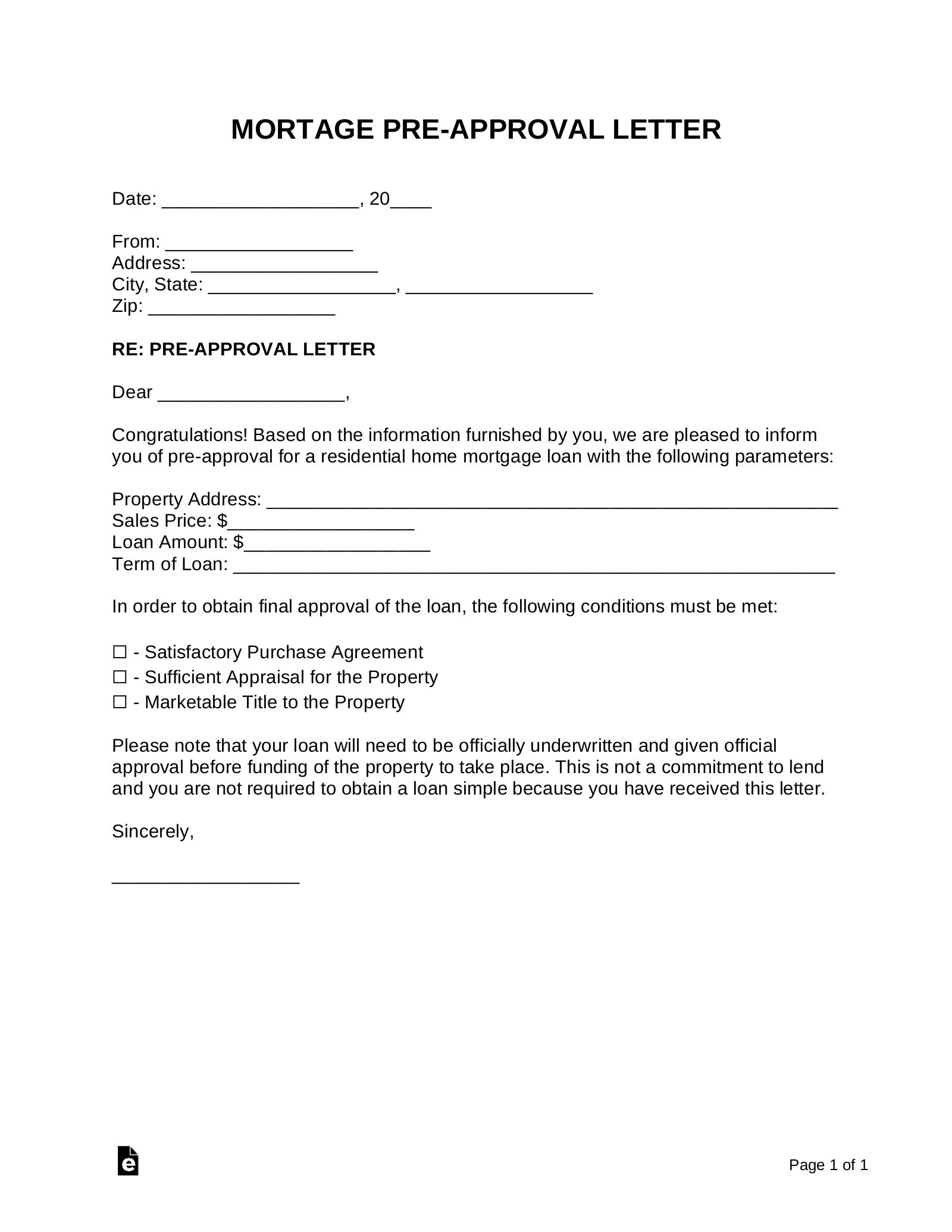

Mortgage Pre Approval Letter Sample Eforms

Mortgage Pre Approval Letter Sample Eforms

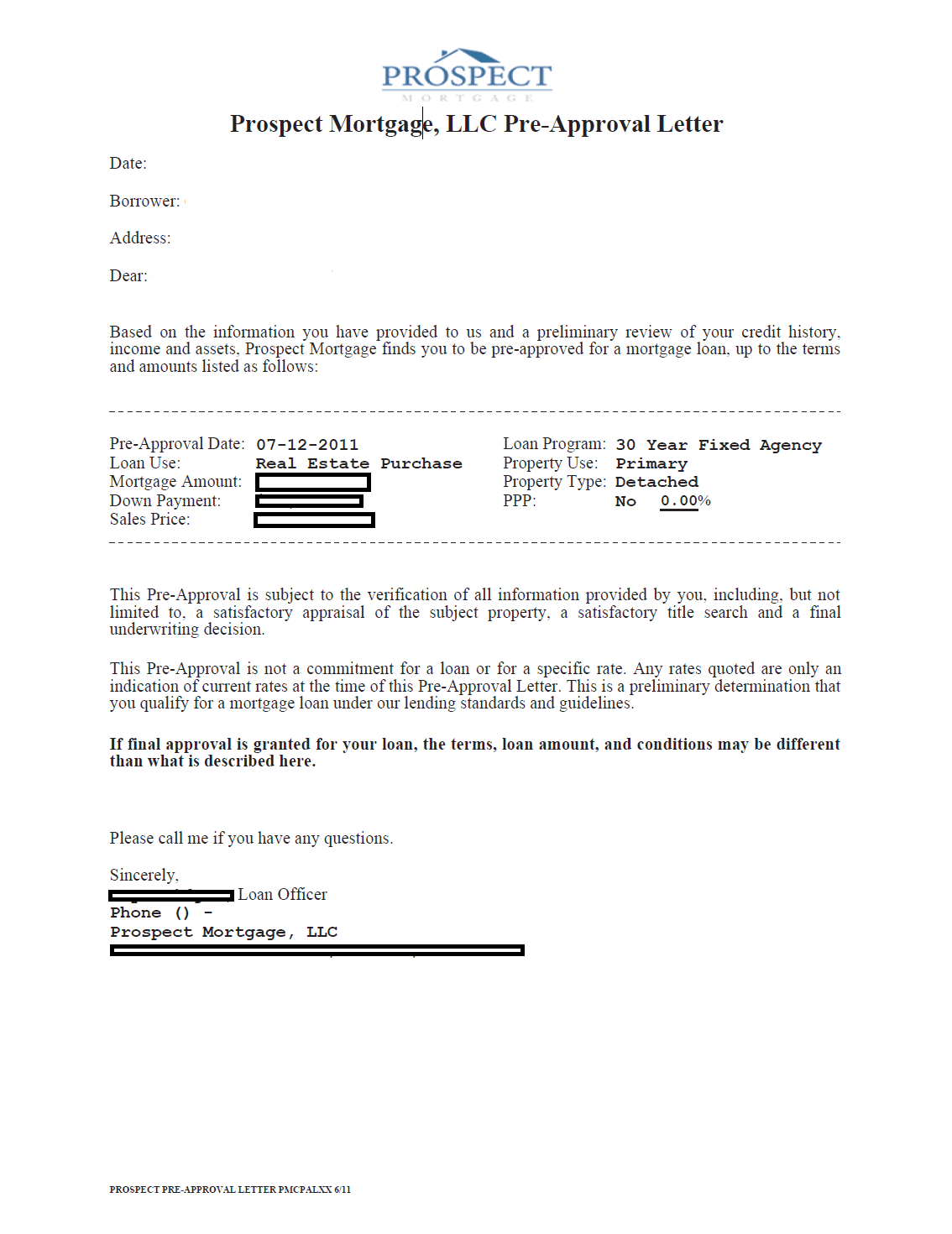

Preapproval James Campbell Los Angeles Real Estate Agent

Preapproval James Campbell Los Angeles Real Estate Agent

Pre Approval Letter For Mortgage Sample

Pre Approval Letter For Mortgage Sample

Mortgage Preapproval Use These Tips To Get Preapproved Ffccu

Mortgage Preapproval Use These Tips To Get Preapproved Ffccu

4 Reasons To Get A Mortgage Pre Approval Moving Com

4 Reasons To Get A Mortgage Pre Approval Moving Com

Image Result For Sample Mortgage Pre Approval Letter Preapproved Mortgage Mortgage Mortgage Banking

Image Result For Sample Mortgage Pre Approval Letter Preapproved Mortgage Mortgage Mortgage Banking

Redondo Mortgage Center How To Get Preapproved For A Mortgage

Redondo Mortgage Center How To Get Preapproved For A Mortgage

The Importance Of The Pre Approval Letter In A Chicago Real Estate Closing Chicago Real Estate Closing Blog

The Importance Of The Pre Approval Letter In A Chicago Real Estate Closing Chicago Real Estate Closing Blog

Essay Contests Undergraduate Program Department Of History Printing Services Writing Editing Translating Mobofree

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg) 5 Things You Need To Be Pre Approved For A Mortgage

5 Things You Need To Be Pre Approved For A Mortgage

The Upside Of Having A Mortgage Pre Approval

The Upside Of Having A Mortgage Pre Approval

How And Why To Get Pre Approved For A Mortgage

How And Why To Get Pre Approved For A Mortgage

How To Get Pre Approved For A Mortgage Freddie Mac

How To Get Pre Approved For A Mortgage Freddie Mac

Comments

Post a Comment