Stock Dividend Example

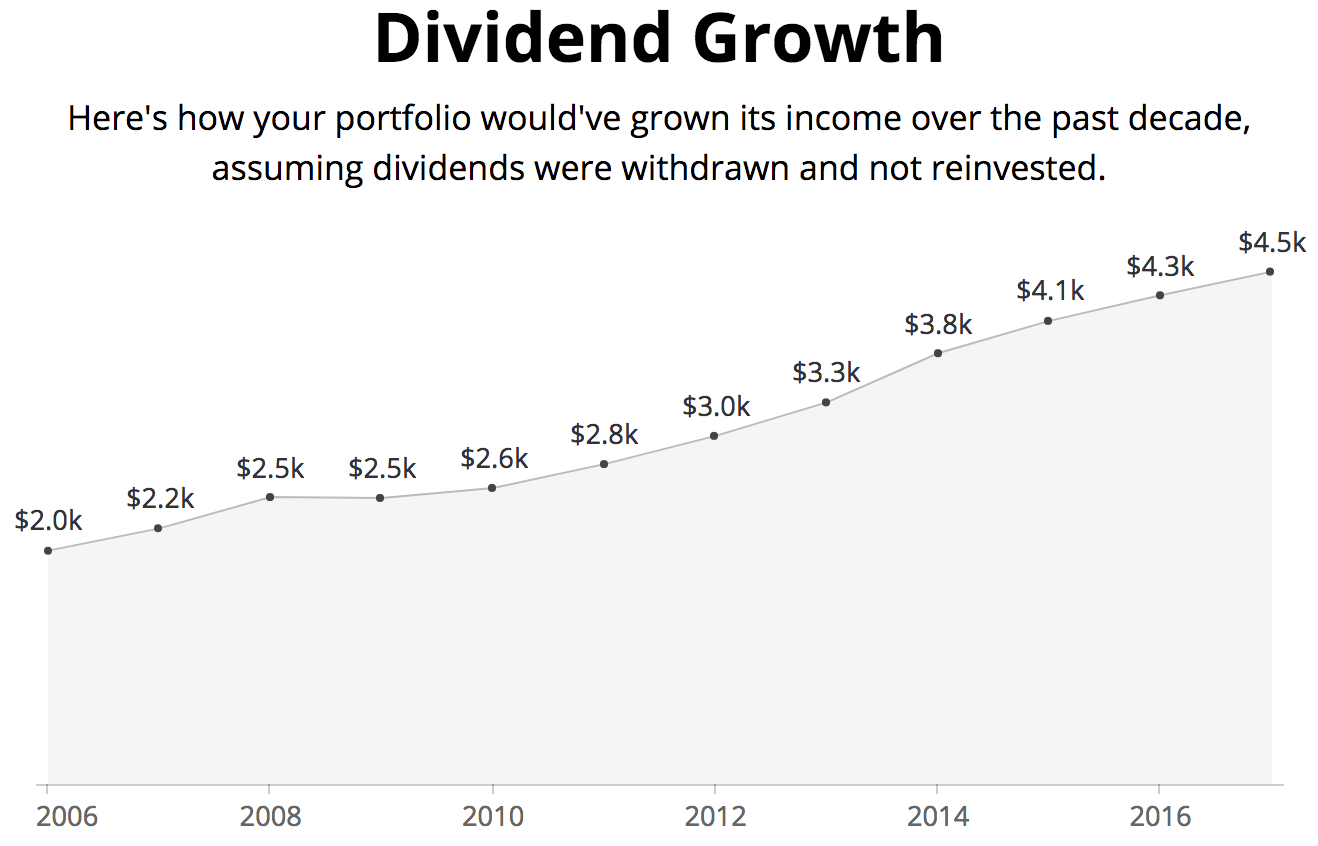

The stock dividend is to distribute to the shareholders on January 12 2021. 100000 shares x 10 10000 increase in.

Stock Dividend Example Accounting What Is Stock Dividends

Stock Dividend Example Accounting What Is Stock Dividends

Please note the following.

Stock dividend example. Most cash dividends are paid on a quarterly basis but stock dividends are generally paid at infrequent intervals. A company usually issues a stock dividend when it does not have the. Most states require that corporations capitalize in retained earnings a portion usually the par value of a large stock dividend.

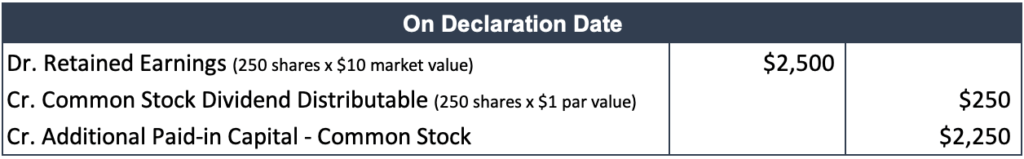

Show the accounting entries. Each organizations board of directors determines the actual dividend amount that the firm will pay out. Example Large Issue 90 Degree Corp has declares and issues a 40 stock dividend.

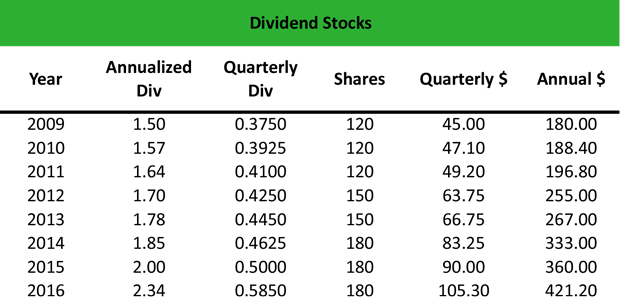

Example of Stock Dividend Accounting Davidson Motors declares a stock dividend to its shareholders of 10000 shares. Stock stock dividends are paid out to shareholders by issuing new shares in the company. For this example were going to look at Coca-Cola stock symbol KO.

A Practical Example of Stock Dividends Company ABC has 1 million shares of common stock. Additional paid in capital due to Stock Dividends 50 1 x 10000 x 20 98000. Its common stock has a par value of 1 per share and a market price of 5 per share.

Stock dividends are very similar to stock splits. On the date of declaration the stock sells at 50share. So if Green Guitar Inc.

Altria Group Inc. MO is another stock that has good history of paying dividends consistently with a dividend yield of 729 It has a quarterly payout of 086 and paid a dividend of 240. Those who will buy shares on August 18 2017 will NOT be eligible to receive cash or stock dividend on August 31 2017.

A company has 200000 outstanding shares of common stock of 10 par value. For example assume a company paid 250000 in dividends in the most recent quarter. A stock dividend is the issuance by a corporation of its common stock to shareholders without any consideration For example when a company declares a 15 stock dividend this means that every shareholder receives an additional 15 shares for every 100 shares he already owns.

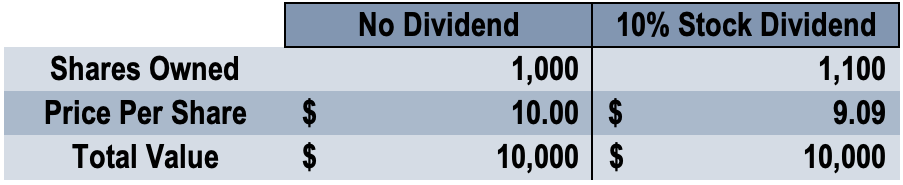

Determine the market capitalization of ABC Company. It declares a 10 stock dividend. An Example of Stock Dividends For example if a company were to issue a 5 stock dividend it would increase the number of shares held by shareholders by 5 one share for every 20 owned.

Record the declaration and payment of the stock dividend using journal entries. Retained Earnings reduces by 150000 100000 50000. Were going to start off in January 2002 with a person saving 25 a week in a savings account that earns a 1 return well just figure annual interest at the end of year to keep things simple.

Common Stock Dividend Determine the amount of dividend paid by the company for the period. 10 x 100000 shares 1000000 market capitalization 2. The market price per share of common stock was 15 on the date of declaration.

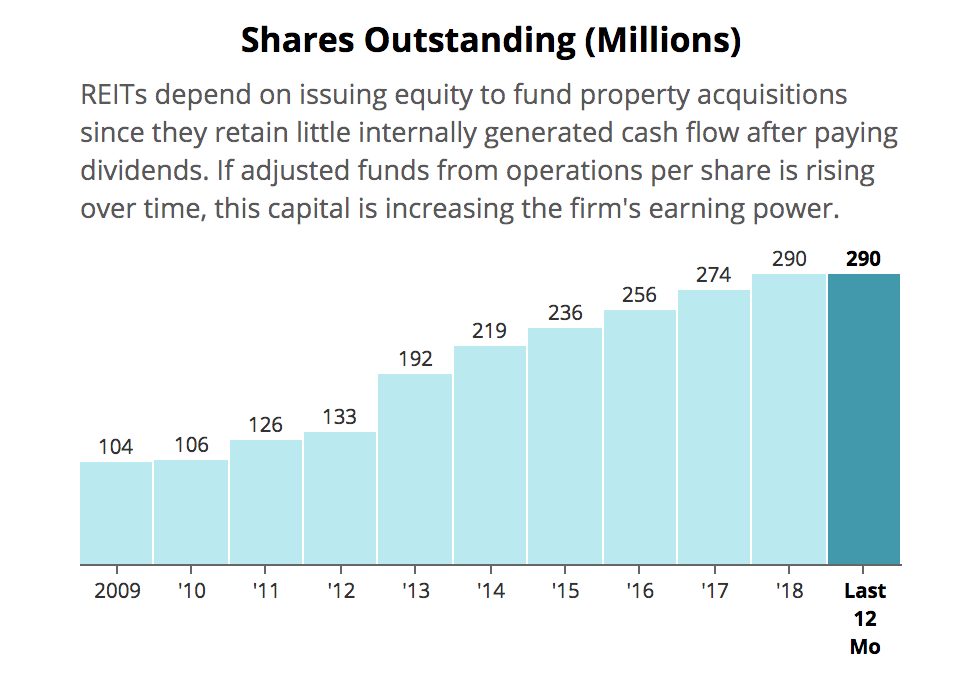

In the above example the cum-dividend date is August 17 2017. Stock dividends may be issued when a company does not have cash reserves to pay investors or needs to conserve cash for reinvesting but still wants to maintain the appearance of paying dividends. Determine the increase in shares outstanding due to a 10 stock dividend.

Determine the amount of outstanding shares of stock that the company had over this same period. A stock dividend is the latter of these two kinds of dividends. The stock currently trades at 100 per share giving the business a market capitalization of 100 million.

Thats a fine example. Determine the new total shares. Had 1000 shares of 1 outstanding stock and issued a 300 share stock dividend it would be considered a large stock dividend.

Small stock dividend example For example on December 18 2020 the company ABC declares a 10 stock dividend on its 500000 shares of common stock. And if you had held the stock for five years the current dividend would make for a yield of 642 based on what you had paid for them back in April 2016. For example a shareholder who owns 100 shares of stock will own 125 shares after a 25 stock dividend essentially the same result as a 5 for 4 stock split.

Hence it is called the ex-dividend date. For example historically the total annual return which includes dividends of the SP 500 has been on average about two percentage points higher. Stock Dividend Example If a company declares a 10 stock dividend then every shareholder will receive an additional 10 shares for every 100 shares they own when dividends are paid.

Example of a Stock Dividend 1. The company has five investors who each own 200000 shares. The fair value of the stock is 500 and its par value is 100.

For example if an employee is due a salary of 80000 per year based on the number of shares the investor already owns. These are paid out pro-rata ProratedIn accounting and finance prorated means adjusted for a specific time period.

Stock Splits And Stock Dividends Principlesofaccounting Com

Stock Splits And Stock Dividends Principlesofaccounting Com

Small Stock Dividends Explanation And Examples Play Accounting

Small Stock Dividends Explanation And Examples Play Accounting

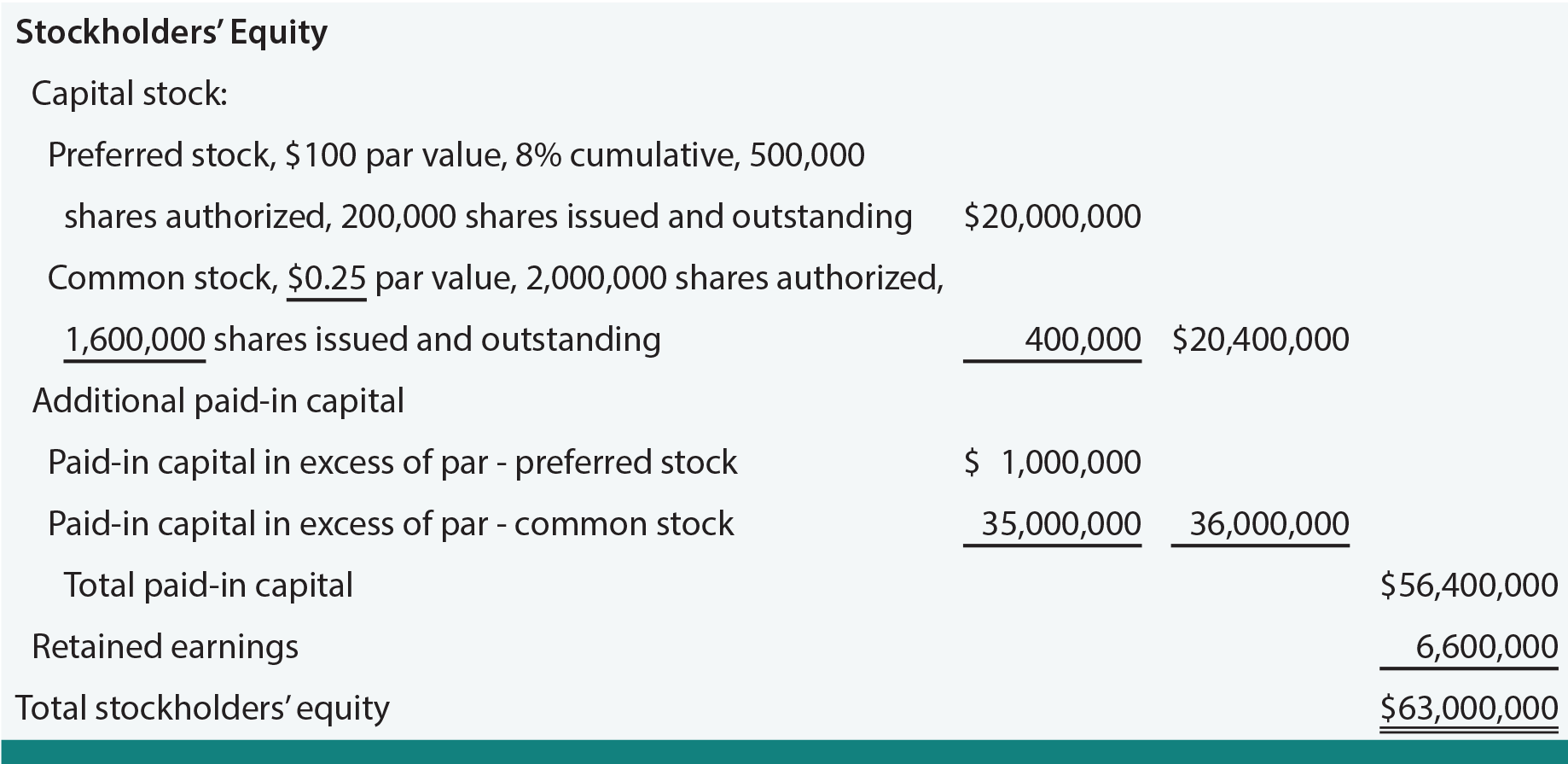

Stock Dividends Meaning Example Benefits Impact On Wealth Eps

Stock Dividends Meaning Example Benefits Impact On Wealth Eps

Stock Dividend Example Accounting What Is Stock Dividends

Stock Dividend Example Accounting What Is Stock Dividends

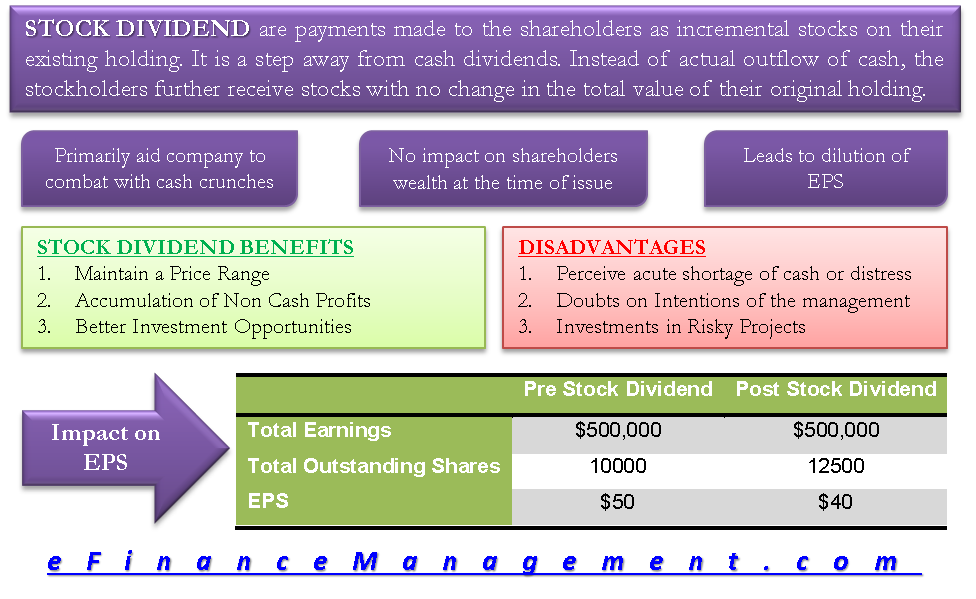

5 Reasons To Be A Dividend Growth Investor Intelligent Income By Simply Safe Dividends

5 Reasons To Be A Dividend Growth Investor Intelligent Income By Simply Safe Dividends

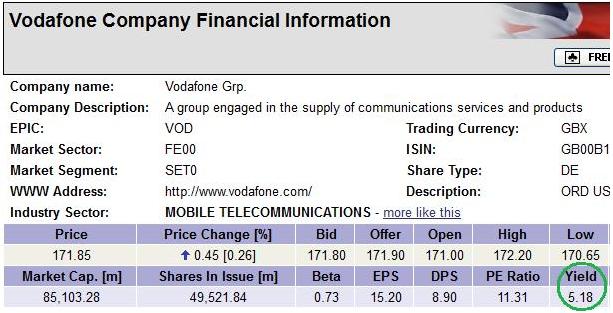

Stock Dividends Explained Sharesexplained Comshares Explained

Stock Dividends Explained Sharesexplained Comshares Explained

High Dividend Stocks Intelligent Income By Simply Safe Dividends

High Dividend Stocks Intelligent Income By Simply Safe Dividends

Stock Dividend Example Accounting What Is Stock Dividends

Stock Dividend Example Accounting What Is Stock Dividends

Cash Dividends Bonus Stocks Stock Dividends Rights Issues And Net Download Scientific Diagram

Cash Dividends Bonus Stocks Stock Dividends Rights Issues And Net Download Scientific Diagram

/dotdash_Final_Ex_Dividend_Date_vs_Date_of_Record_Whats_the_Difference_Oct_2020-01-6453b1e5c23146779ab4da7df074e8ab.jpg) Comparing Ex Dividend Date Vs Date Of Record

Comparing Ex Dividend Date Vs Date Of Record

Stock Dividend Definition Example Journal Entries

Stock Dividend Definition Example Journal Entries

Stock Dividend Definition Example Journal Entries

Stock Dividend Definition Example Journal Entries

What Are Dividend Stocks Definition Meaning Example

What Are Dividend Stocks Definition Meaning Example

Dividend Definition Examples And Types Of Dividends Paid

Dividend Definition Examples And Types Of Dividends Paid

Comments

Post a Comment