How Do You Refinance Your Mortgage

To refinance a guaranteed loan you must have had the mortgage for at least 12 months. There are two main reasons youd consider doing a refinance.

/155421401-56a2eea15f9b58b7d0cfc939.jpg) Is Refinancing Your Mortgage Really A Good Decision

Is Refinancing Your Mortgage Really A Good Decision

For example you may be able to save on fees for the title search surveys and inspection.

How do you refinance your mortgage. Lower interest rate and payment. Its ideal for your debt obligations to be no more than 36 of your monthly earnings though some lenders will. Youll typically need at least 20 equity in your property to refinance too meaning youve made enough headway on your mortgage to own a portion of the home.

You can do this with your current mortgage provider or a new one. Lenders will also look at your debt-to-income ratio DTI or your total monthly debt payments compared with your income. Refinancing your mortgage means renegotiating your existing mortgage loan agreement.

If youre refinancing your mortgage while youre in the middle of an exiting mortgage term youre likely to be hit with a prepayment penalty - more on that below. Keep in mind there are fees associated with refinancing so you. Here are some of the top ones to think about.

Using A Cash-Out Refinance For Home Improvements When you opt for a cash-out refinance you refinance your mortgage for more than you owe and take the difference in cash. Refinancing your mortgage to pay it off early only makes sense if you can get a lower interest rate. There are several reasons homeowners choose to refinance their mortgage loans.

A mortgage refinance lets you end your current mortgage and start a new one. Refinancing is the process of obtaining a new mortgage in an effort to reduce monthly payments lower your interest rates take cash out of your home for large purchases or change mortgage companies. Refinance to lower your mortgage rate.

Refinance To Remodel. Doing so lets you apply for a new rate. If you plan to refinance you may want to start with your current lender.

To lower your existing mortgage rate or to access the equity youve built in your home as cash. Your new monthly payments length of loan and interest rate. That lender may want to keep your business and may be willing to reduce or eliminate some of the typical refinancing fees.

Before you embark on the process though you need to. Refinancing works by acquiring a new mortgage loan which is used to pay off and close the original loan. Talk to your current lender.

Most people refinance when they have equity on their home which is the difference between the amount owed to the mortgage company and the worth of the home. If you can refinance your balance into a 20-year mortgage at 325 your monthly payment would rise by less than 50 per month and youd pay off your loan eight years sooner. Lets say the original balance on the mortgage was 450000 but the borrower refinanced and cashed out an additional 50000.

For direct loans there is no waiting period for refinancing. If your credit has improved or market rates have dropped since you got your first loan you may be able to save money on interest with a lower rate and monthly payment. You might do this to consolidate debts or you could use the equity in your property to increase your mortgage loan amount for large expenses.

The USDA offers three options for refinancing. You can choose to do this with your current lender or another one. Refinancing your mortgage can under the right circumstances be a financial boon for adding extra savings to your wallet.

This is more likely to happen if your current mortgage. They may be able to. Refinance your mortgage.

Or your lender may not charge an application fee or origination fee. For a 30-year fixed-rate mortgage on a 100000 home refinancing from 9 to 55 can cut the term in half to 15 years with only a slight change in the monthly payment from 805 to 817. By refinancing at the end of your current mortgage term you may be able to avoid prepayment charges.

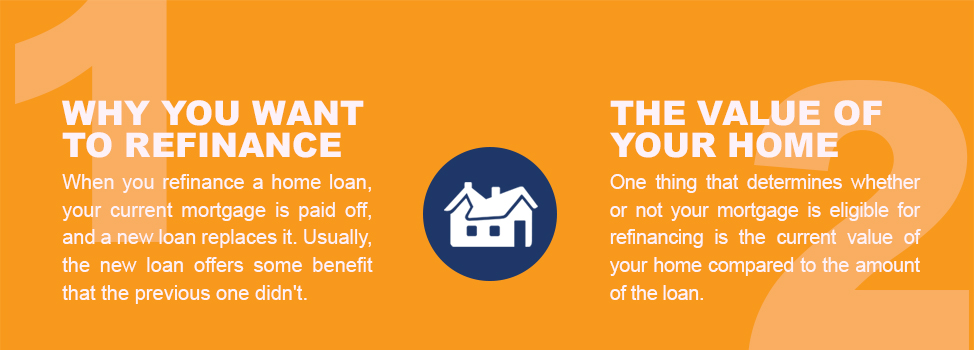

Should You Refinance Your Mortgage Yes Or No Diamond Cu

Should You Refinance Your Mortgage Yes Or No Diamond Cu

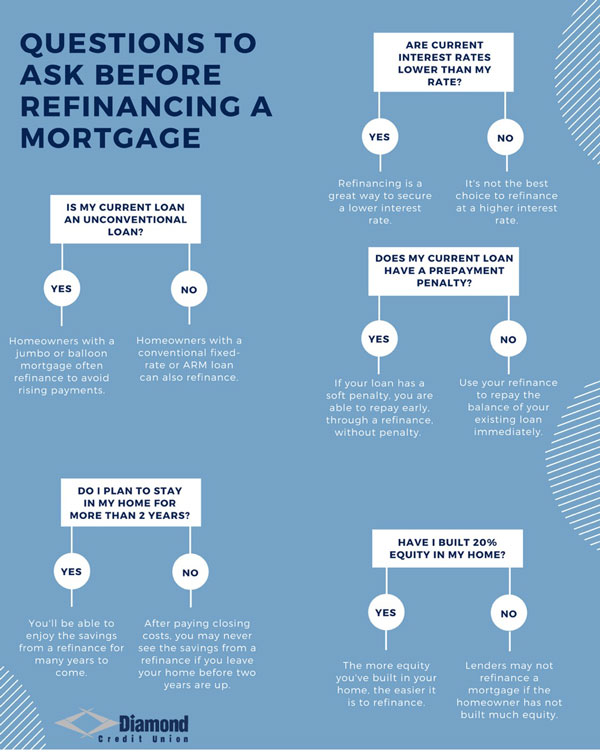

Mortgage Refinance Guide When How To Refinance Mint

Mortgage Refinance Guide When How To Refinance Mint

Should I Refinance My Mortgage When To Refinance Mint

Should I Refinance My Mortgage When To Refinance Mint

Mortgage Refinance Guide When How To Refinance Mint

Mortgage Refinance Guide When How To Refinance Mint

How To Refinance Your Mortgage Loan When Rates Are Low Mint

How To Refinance Your Mortgage Loan When Rates Are Low Mint

Mortgage Refinance 101 What It Is And When You Should Do It Moving Com

Mortgage Refinance 101 What It Is And When You Should Do It Moving Com

/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg) 7 Bad Reasons To Refinance Your Mortgage

7 Bad Reasons To Refinance Your Mortgage

13 Things To Consider When Refinancing Your Mortgage Mid Penn Bank

13 Things To Consider When Refinancing Your Mortgage Mid Penn Bank

How And Why To Refinance Your Mortgage Global Integrity Finance

How And Why To Refinance Your Mortgage Global Integrity Finance

The Pros And Cons Of Refinancing Central Bank

The Pros And Cons Of Refinancing Central Bank

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

What Does It Mean To Refinance Your Mortgage Rismedia

What Does It Mean To Refinance Your Mortgage Rismedia

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Comments

Post a Comment