Sba Loan Database

Instead a bank or financial institution provides the loan and the SBA guarantees it up to a certain amount. Whether lenders request standard terms or customized language in their loan documentation we have the ability to create a systematic and dependable.

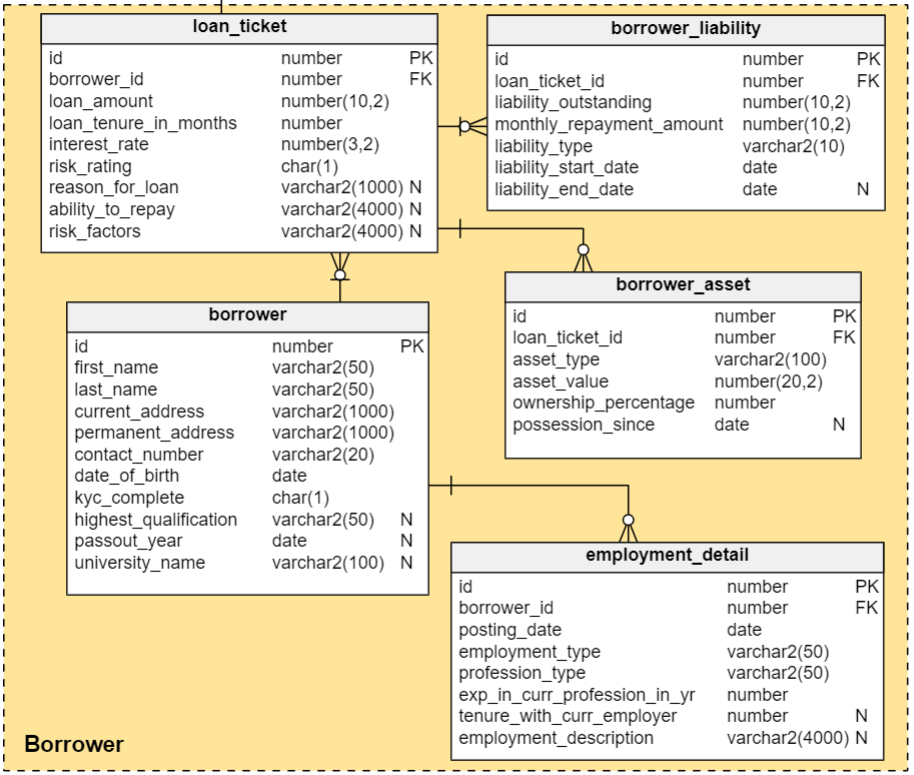

A Peer To Peer Lending Platform Data Model Vertabelo Database Modeler

A Peer To Peer Lending Platform Data Model Vertabelo Database Modeler

Each item in a folder or.

Sba loan database. We provide individuals who are facing SBA loan default with solutions. The agency doesnt lend money directly to small business owners. Meaning if you default on the loan the SBA.

The SBA 7a loan is the most popular of these commercial loans. When you get an SBA loan you get money from a standard lending institutionusually a bank. The SBA lends small businesses money.

November 10 2020 Reflects charge off rates as a percent of the UPB amounts at the end of the fiscal year for the major loan programs and aggregate totals for the small direct and guarantied programs. It consists of a series of links for the current loan that will save the data on the current screen and take you to the item that you selected. How Does an SBA 7a Loan Work.

SBA Disaster Loan Data FY2014. Thats not how it really works. Official SBA Loan Data.

The government backs a number of loans that small US-based businesses can get from a bank credit union or other lending institution. So how does the SBA help put money in your hands. SBA Loan Documentation Services LLC provides a holistic and sequenced approach to the preparation of loan documentation under the SBAs 7a program.

SBA Disaster Loan Data for FY2014 provides verified loss and approved loan amount totals for both home and business disaster loans segmented by city county zip code and state. The maximum loan amount for a standard 7 a loan is 5 million. Small Business Administration 7a 504 Detailed Loan Data since 1990 15 million entries.

People often assume that the SBA lends this money directly to businesses but thats not quite how it works. We have 1243429 SBA 7a Loans since 1990 and 109124 SBA 504 Loans. The loans must be approved by the SBA.

We wont bore you with the exact math but these rates are based on three factors. Vetted Biz has reviewed and analyzed the SBA 7a loan approvals from the fiscal years 2010-2020. For instance the SBA guarantee might be 85 of a certain type of loan.

Due to program rules SBA loan rates can only go so high. Details on the SBA Data Leak Small business owners seeking SBA Economic Injury Disaster Loans in March may have had their personal information exposed to other applicants due to. Paid-in-Full and Charge-Off Data.

The records were obtained through SBAs official website. The SBA will guarantee this type of loan for up to 85 for loans smaller than 150000 and 75 for loans greater than 150000. Access your SBA Economic Injury Disaster Loan Portal Account to review your application and track your loan status.

SBA Disaster Loan Data FY2015. What is an SBA loan. In fact the SBA sets very specific interest ranges.

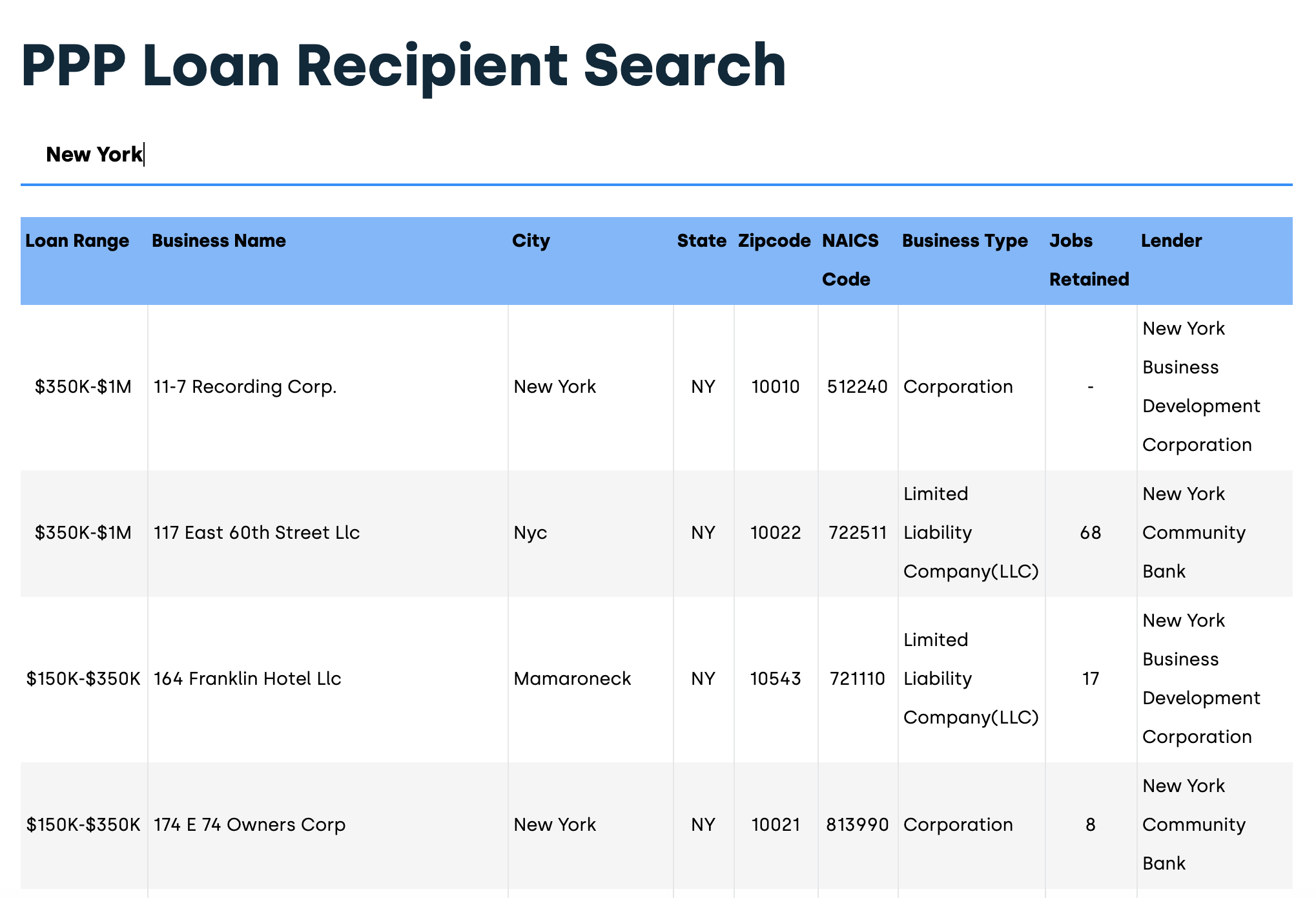

The data release also includes overall statistics regarding dollars lent per state loan. Todays release includes loan-level data including business names addresses NAICS codes zip codes business type demographic data non-profit information name of lender jobs supported and loan amount - accounting for nearly 75 of the loan dollars approved. Small Business Administration SBA Loan Program Performance- Charge Off Rates as a Percent of Unpaid Principal Balance UPB Amount by Program Metadata Updated.

If youre a member of a financial institution authorized by the SBA to issue 7 a loans use this page to access SBA forms get program updates and more. Interest rates are negotiated between the lenders and borrowers but. Our SBA centric loan documentation software provides consistent and reliable documentation.

Log in to CAFS. Access your SBA Economic Injury Disaster Loan Portal Account to review your application and track your loan status. The SBA helps small businesses get loans The SBA works with lenders to provide loans to small businesses.

For instance we help you understand different SBA loan problems and teach you about SBA offer in compromise. Were approved for the SBA 7a loan. Your personal credit rating can also affect your rate.

Instead it sets guidelines for loans made by its partnering lenders community development organizations and. For all loans below 150000 SBA is releasing information except for business names and addresses. Folders and subfolders are used when multiple entries are possible ie borrower guarantor and principal.

You make loan repayments directly to them. Requests for existing records must be in writing handwritten or typed and submitted via mail fax or electronically. Requests may be sent to SBA program or field offices or to the FOIPA OfficeRequester Service Center 409 Third St.

The money from the SBA 7a loan. In total 588053 small businesses in the US. The tree allows you to navigate to specific sections of the loan and contains links to specific data already entered for the current loan.

They guarantee part of your loan. The 7a loan provides financial assistance for entrepreneurs starting a new business or acquiring operating or expanding an existing business. Your interest rate will depend on those factors and the type of SBA loan you get.

In the latest data installment the SBA has broken out the 7a and 504 loans separately.

Here S How To Lookup All Ppp Loan Data And Ppp Loan Recipients

Here S How To Lookup All Ppp Loan Data And Ppp Loan Recipients

Sba Releases Raw Ppp Recipients Data Here S Who Got The Money Youtube

Sba Releases Raw Ppp Recipients Data Here S Who Got The Money Youtube

Search The Database Virginia Paycheck Protection Program Loan Recipients Wavy Com

Search The Database Virginia Paycheck Protection Program Loan Recipients Wavy Com

A Simple Database From Pkdd 99 Download Scientific Diagram

A Simple Database From Pkdd 99 Download Scientific Diagram

Schema Of The Loan Database Download Scientific Diagram

Schema Of The Loan Database Download Scientific Diagram

Loan Details Released For Paycheck Protection Program

Loan Details Released For Paycheck Protection Program

Sba Loan Email List Sba Business Leads Dmdatabases

Sba Loan Email List Sba Business Leads Dmdatabases

The Pkdd1999 Financial Database Where The Classification Target Download Scientific Diagram

The Pkdd1999 Financial Database Where The Classification Target Download Scientific Diagram

Sba Releases Data On Delaware S Largest Ppp Borrowers Dbt

Sba Releases Data On Delaware S Largest Ppp Borrowers Dbt

Ppp Loans And The Sba Database Bridgeworth Wealth Management

Ppp Loans And The Sba Database Bridgeworth Wealth Management

An Example Database The Last Column Of Loan Relation Contains Class Download Scientific Diagram

An Example Database The Last Column Of Loan Relation Contains Class Download Scientific Diagram

Where Did 380b In Ppp Money Go Cnn

Where Did 380b In Ppp Money Go Cnn

Searchable Database Of Sba Ppp Loan Recipients That Received More Than 150 000 Triangle Business Journal

Searchable Database Of Sba Ppp Loan Recipients That Received More Than 150 000 Triangle Business Journal

Comments

Post a Comment