Rural Development Loan Interest Rate

With a Rural Development Loan you can finance up to 100 of the homes value. Contact us for details and current interest rates applicable for your project.

Usda Loans Your Guide To The Usda S Rural Development Home Loan

Usda Loans Your Guide To The Usda S Rural Development Home Loan

Even better news for current USDA Rural Development borrowers looking to lower their rate the USDA offers a streamline refinancing option known as the USDA Rural Refinance Pilot program.

Rural development loan interest rate. The lender would add 2916 to your monthly mortgage payment in order for you to have the 350 at the end of twelve months to pay the USDA. Interest rate View the monthly interest rate for QRIDA First Start and Sustainability Loans drawn down from the first day of each month. Effective April 1 2021 the current interest rate for Single Family Housing Direct Home Loans is 250 for low and very low-income borrowers.

Guaranteed Rates purpose is to give their customers a low low rate on their mortgages with transparent and fair fees leveraging technology to streamline and simplify the loan process and providing unmatched service and expert advice to help their clients find the perfect mortgage. 525 FD 01 Year. It can be a good option if youre buying your first home or having trouble saving for a down payment.

Right now the USDA charges 035 of the loan amount per year. FD 05 Years. Once the loan is approved the interest rate is fixed for the entire term of the loan and is determined by the median household income of the service area and population of the community.

Interest paid Annually pa FD 01 Month. If there are additional state-specific requirements they will be listed above. Effective April 15 2021 900 am.

Insured electric loans approved on or after this date are either municipal rate loans or hardship rate loans. A 200000 loan would require a 15 down payment with a monthly principal and interest payment of 88475 for 360 months based on 338 annual percentage rate APR. This ratio means that 29 of your pre-tax income can go to interest insurance principle taxes and HOA dues.

1356 RELRA amended the Rural Electrification Act of 1936 7 USC. There are no pre-payment penalties. Fixed interest rates based on the need for the project and the median household income of the area to be served.

FD 04 Years. FD 02 Years. There are no other additional requirements at the national level.

Department of Agriculture Rural Development has announced a decrease in the home mortgage interest rate for its Direct Homeownership Loan program. There are several other great features of the Rural Development Loan. FHA mortgage insurance premiums include a 175 upfront mortgage insurance premium and 085 in.

There are times where the home actually appraises for more and in these cases you can finance in some of your closing costs. Income limits vary between different locations so it is important to work with a mortgage lender that in familiar with your location. Are there additional requirements.

901 et seq RE Act to establish a new interest rate structure for insured electric loans. 400 FD 03 Months. On November 1 1993 the Rural Electrification Loan Restructuring Act Pub.

USDA mortgage insurance rates are lower than those for conventional or FHA loans. 500 FD 06 Months. Current Interest Rate 307.

Current interest rates drawn down from 1 April 2021. Effective September 1 2016 the interest rate will be reduced to 2875 percent for home mortgages. In many cases this is the same as the purchase price but not always.

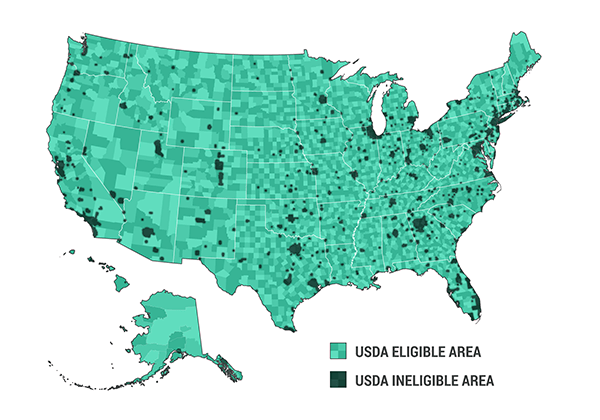

Department of Agriculture Rural Development USDA recently announced that the interest rate of Single-Family Housing Direct 502 loans will fall to 3 percent effective November 1 2019. Interest rates are set by Rural Development contact us for details and current rates. The Rural Development loan is a 100 financed home loan insured by the United States Department of Agriculture to promote homeownership in less-dense communities.

The Fixed Rate Plus Loan includes downpayment and closing costs assistance as a second mortgage at 0 with no payments equal to 3 of the first mortgage loan. If youve received a United States Department of Agriculture USDA loan in the past you know how beneficial this program can be for homebuyers. For example if you have a loan amount of 100000 you would owe 350 per year.

Its one of the few loans other than the VA loan that doesnt require you to have cash upfront for the down payment. FD 03 Years. The remaining 41 can be used for your loan payment and all of your other bills.

Homeownership opportunities are available under this program with no down. Contact us for details and current interest rates applicable for your project. Assumes 4500 in closing costs.

This is the lowest interest rate ever offered by the Agency. 350 FD 02 Months. Up to 40-year payback period based on the useful life of the facilities financed.

Electric Programs Hardship Loan Rate. What is the loan term and rate. 391 lignes Monthly Principal Interest Payment.

Details Interest paid on Maturity pa Interest paid Monthly pa Interest paid Annually pa. If applicable borrows can enjoy interest rates as low as 1. Monthly payments do not include amounts for taxes and insurance premiums so the actual monthly payment may be greater.

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements

Different Types Of Mortgage Loans

Different Types Of Mortgage Loans

Kentucky Usda Rural Development Loans Louisville Kentucky Mortgage Loans

Kentucky Usda Rural Development Loans Louisville Kentucky Mortgage Loans

Https Www Rd Usda Gov Files Ia Hp Rhsdirianews 03 2017 Pdf

Usda Loans Usda Loan Requirements Rates For 2021

Usda Loans Usda Loan Requirements Rates For 2021

Usda Mortgage Loans Rates Requirements Programs Interest Com

Usda Mortgage Loans Rates Requirements Programs Interest Com

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements

Https Www Rd Usda Gov Files Rd Rhs Cfrelendingpostawardfaq Pdf

Usda Loans Usda Loan Requirements Rates For 2021

Usda Loans Usda Loan Requirements Rates For 2021

Agriculture Loan Interest Rates Types Eligibility Criteria

Agriculture Loan Interest Rates Types Eligibility Criteria

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements

Ky Rural Development Loan Kentucky Usda Mortgage Lender For Rural Housing Loans

Ky Rural Development Loan Kentucky Usda Mortgage Lender For Rural Housing Loans

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Usda Rural Development Rural Housing Loan In Kentucky

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Usda Rural Development Rural Housing Loan In Kentucky

Comments

Post a Comment